Kepler Trust report: Monks Investment Trust

Monks offers a highly active approach to investing in global equities.

26th July 2019 09:53

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Monks offers a highly active approach to investing in global equities.

William Sobczak is an analyst at Kepler Trust Intelligence.

Summary

Monks (LSE:MNKS) aims to deliver long-term capital growth through a well-diversified, actively managed, global equity portfolio.

Rigorous, bottom-up analysis is at the heart of the investment process, with the managers, Charles Plowden, Spencer Adair and Malcolm MacColl, looking to identify growth companies with above-average earnings growth. The team takes a long-term view on their holdings as this ensures that the fundamental attributes of a company are given ample time to drive returns. The investment company has an annual turnover of just 17%, according to the May factsheet.

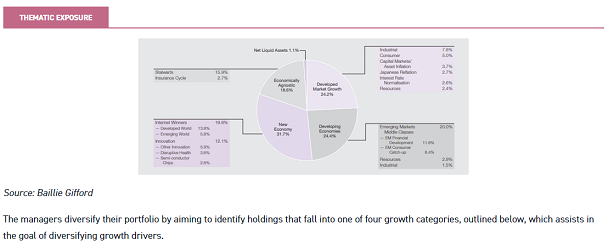

Diversification is a key characteristic of the trust, and the managers split holdings into four categories depending on the anticipated growth. Holdings are also divided into three broad holding sizes that allow the managers to embrace the potential for asymmetry of returns through positions in stocks with higher risk-return characteristics.

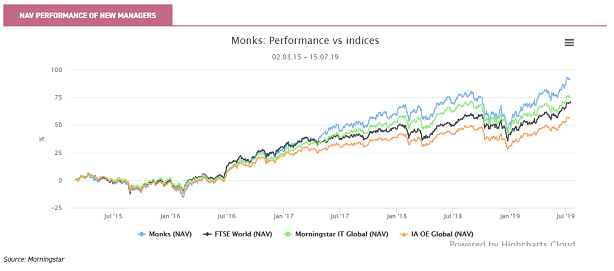

Since the new managers took over the portfolio in March 2015, the trust has performed strongly relative to both its peers and the benchmark FTSE World. Over the past four years, the trust has delivered NAV total returns of 91.4%. In comparison, the FTSE World, the AIC Global sector and the IA Global sector have delivered 70.1%, 75.3% and 56.6%, respectively.

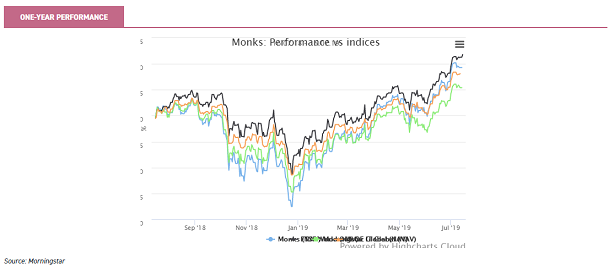

With that said, it has come at the expensive of volatility and, over the same period, the fifth-highest standard deviation, at 17.2%, in the 16-strong peer group. Returns have been even more volatile over the short term. Over the past year, the trust has the second-highest beta, at 1.21, in the AIC Global sector and the third-highest standard deviation, at 20.37.

The final quarter of 2018 saw the trust being hit particularly hard, falling by 13.7% in NAV total returns. In comparison, the FTSE World index lost 10.9%. However, there has since been a rally and from the start of the year the trust has produced NAV total returns of 26.5%, relative to 20.1%, 18.8% and 19.8% returns for the benchmark, AIC peer group and IA peer group, respectively.

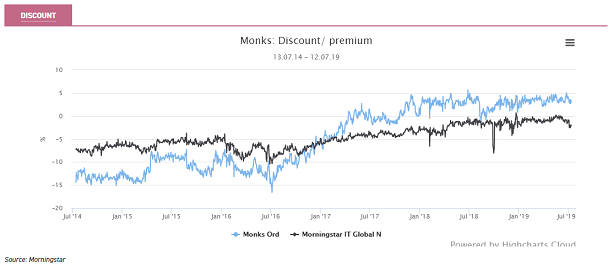

At present Monks is trading at premium of 4% relative to the sector-weighted average discount of 0.2%.

Portfolio

The team at Monks aims to offer long-term capital growth for investors through a differentiated portfolio of global companies. At the helm of the portfolio is Charles Plowden, who is supported by deputy managers Spencer Adair and Malcolm MacColl. Collectively, the team undertakes a rigorous bottom-up investment process, identifying a wide range of growth stocks that they believe will offer above-average earnings growth in the future. The managers take a long-term perspective on their positions, recognising that it takes time for company fundamentals to drive returns. This long-term approach is also sought out in the management of the underlying companies, where they hope the management of market expectations does not take priority over the ultimate growth of the company.

Macroeconomic factors do not phase the managers and they pay little attention to the trust’s benchmark, the FTSE World index. This agnostic approach means that the trust has a high active share of 90% and returns can vary significantly in comparison to the peer group.

The portfolio, which includes stocks with a range of different growth profiles, will typically contain more than a hundred holdings. Investments are held in three broad holding sizes: the highest conviction holdings, which will typically be close to 2% each; average sized holdings, which will be around 1% each; and the incubator holdings, which represent 0.5% of the portfolio each. They say this allows the managers to back their judgement in the stocks for which they have greater conviction, and to embrace the asymmetry of returns through 'incubator' positions in higher risk/return stocks.

The focus on growth has led to exposure to some exciting themes that are in many cases linked to secular changes in the global economy and society, as outlined in the graphic below. As can be seen, the portfolio has diversified exposures across different markets and types of opportunity.

Growth stalwart

The stalwarts are comprised of companies that the managers believe have a durable franchise. This means that they will typically deliver robust returns and profitability regardless of the macroeconomic conditions. The team anticipates that these types of company will deliver c. 10% p.a. earnings growth, usually through their competitive advantage due to their dominant local scale, customer loyalty or strong brand.

Prudential is a good example of a growth stalwart and has the highest weighting of any company in the category at 3.3%. The managers’ rational for holding the company is four-fold: more than half of its value comes from its under-appreciated yet fast-growing Asian operations, it trades on a significant discount to fair value, it is hard to disrupt with many years of growth potential ahead, and it is well run. Alongside this, Prudential’s new business profits in Asia have compounded at 18% and 19%, respectively, over the past five and ten years.

Rapid growth

The rapid growth category includes companies that are in the early stages of their business life cycle and have vast growth opportunities. The team anticipates these companies will offer earnings growth between 15-25% p.a. and will attack existing profit pools or create new markets.

A recent addition to the portfolio, and this category, is Schiehallion. This closed-ended fund is a Baillie Gifford managed vehicle dedicated to investing in late-stage, high-growth private businesses. The thesis behind the fund is that companies are staying private for longer given lower capital and regulatory requirements, and the fund seeks to generate attractive returns from this growing and exciting opportunity set. It is a 2.2% holding in the trust.

Cyclical growth

The cyclical category includes companies that are subject to macroeconomic and capital cycles with significant structural growth prospects. As one might anticipate, the earnings will be more volatile than, say, the stalwart category, but the managers anticipate the subset to deliver between 10 and 15% p.a. through a cycle. An example of this type of company is Orica, a provider of explosives and services to the mining industry. The company sits within a consolidated market but has been leveraging the mining capital cycle. There are also considerable supply side barriers to entry, which protects the business from competition.

Latent growth

The final category is comprised of the latent growth companies. These companies have a specific catalyst that will drive above-average earnings in the future. Currently, these companies are trading at historically low levels and are considered out of favour. This is typically due to delivering unspectacular returns in recent periods, but with management having clear reasons to anticipate earnings growth accelerating beyond market expectations over time.

An example of a latent company is IIDA, the Japanese house builder. Currently, the sector in which IIDA resides is extremely out of favour and this has caused it to trade on a subdued valuation. However, the company operates in a particular niche within the market, typically selling their developments to couples who are buying their first house. Rather than being exposed to a decreasing Japanese population, the company is exposed to a growing population aged 20 to 30 that stands to benefit from the reflationary environment.

In common with other Baillie Gifford-managed investment trusts, the managers are able to invest in private companies. Last year the board increased the limit on private company exposure to 5% of the portfolio from 2% and we have also seen the trust invest in The Schiehallion Fund (LSE:MNTN). Alongside this, the trust now has three unquoted companies, including GRAIL Inc, the gene sequencing business, and Ant Financial, the Chinese payment and savings platform.

Looking forward, the managers remain optimistic, recognising that the growth opportunity for many companies is expanding dramatically as new technologies change the way that business is conducted. They say these changes are creating new long-term winners across a wide range of industries and at a rapid pace. The managers believe the trust is well placed to benefit from these changes, without being overexposed to certain risks.

Gearing

The use of gearing is another differentiating factor for the trust. Looking across the AIC Global sector, just half of the constituents choose to utilise it, according to JPMorgan Cazenove. Gearing levels are regularly discussed between the board and the managers, and are adjusted depending on the outlook.

The board, and managers, believe that a gearing level of 10% should be the long-term neutral position for the trust; however, as of 31 May it was just 7% geared.

As of the most recent annual report in April 2019, borrowings were comprised of a £40 million debenture stock repayable in 2023, which has a 6.375% p.a. coupon and is worth 2% of NAV at the current date, as well as short-term bank loans of £103.6 million (converted from USD 22/07/19). The trust also has a short-term loan facility of £5 million with the ability to increase it to £50 million, which has not been utilised.

Performance

Since the new managers took over the portfolio, the trust has performed strongly relative to both its peers and the benchmark FTSE World index. Over the past four years, the trust has delivered NAV total returns of 91.4%. In comparison, the FTSE World, the AIC Global sector and the IA Global sector have delivered 70.1%, 75.3% and 56.6%, respectively. With this said, it has come at the expensive of volatility and, over the same period, the fifth-highest standard deviation, at 17.2%, in the 16-strong peer group.

Returns have been even more volatile over the short term and the past year has been a tale of two halves for the trust. Over one year to 15 July 2019, the trust had the second-highest beta (1.21) and the third-highest standard deviation (20.37). The latter half of 2018 saw the trust being hit particularly hard and, in Q4 alone, it fell by 13.7% in NAV total returns.

In comparison, the FTSE World lost 10.9%. Some of the names that were hit hardest sat in the company’s top 10 holdings, including the likes of Naspers (LSE:NPSN), Amazon (NASDAQ:AMZN) and Prudential (LSE:PRU), all of which fell by more than 20% in share price terms from August to December. Prudential has actually struggled for almost five years now; however, the trust has used this weakness to continue building its position. This illustrates the trust’s long-term approach and willingness to persevere with a company until the fundamental attributes drive the performance.

Since the poor period of performance in the fourth quarter of 2018, the trust has responded emphatically. From the start of 2019, the trust has produced NAV total returns of 26.5%, relative to 20.1%, 18.8% and 19.8% returns from the benchmark, AIC peer group and IA peer group, respectively. Many of the strongest performers have been the companies that were hit hardest last year, including the previously mentioned casualties: Naspers, Amazon and Prudential.

Dividend

Dividends are low on the list of priorities for the managers at Monks and, as stated in the investment objective, capital appreciation is the main goal as opposed to offering income. Currently the trust yields 0.2%, relative to the weighted sector average of 1.3%.

Management

The trust saw a management change in March of 2015 and this has contributed to much of the change in sentiment towards the trust. Now at the helm of the portfolio are Charles Powden, Spencer Adair and Malcolm MacColl, who are responsible for the 'Global Alpha' team. Ideas are shared between teams, but each team is ultimately responsible for the ideas in their portfolios.

Baillie Gifford was founded in 1908 and is now one of the UK’s largest independent active investment management firms. The company has £196.3 billion of funds under management as of September 2018 and the trust’s management team is able to draw on the vast resources of Baillie Gifford. Alongside this, the entire team has shares in the company, meaning that all interests are aligned.

Charles leads the team and was an investment manager in the Baillie Gifford UK equity team for more than 20 years, notably developing specialist UK capabilities, and was latterly head of the team. Since its inception in 2005, Charles has headed up the global alpha strategy, which is currently his sole portfolio management role. He became joint senior partner with overall responsibility for the investment departments in 2006.

Spencer joined Baillie Gifford in 2000 and spent time working in the fixed income, Japanese, European and UK teams, before becoming an investment manager for the global alpha portfolio. He became a partner in 2013.

Malcolm joined Baillie Gifford in 1999 and has spent time in the UK small cap team and North American team. He has been a global alpha investment manager since the product’s inception and became a partner in 2011.

Discount

Currently Monks is trading at premium to NAV of 3.4% relative to the sector-weighted average discount of -0.9%. As can be seen below, the premium developed at the end of 2017, but has previously not been a regular feature of the trust. Now that the trust is trading on a premium – on average through 2019 the trust has traded at 3.4% above par – the board has been issuing shares from treasury. Since the start of 2019, the company has issued 755,000 shares.

Charges

Currently the OCF for the trust is 0.50%. This is attractive relative to the average within the Global sector of 0.72% and the weighted average of 0.55%. The annual management fee is 0.45% on the first £750 million of total assets, 0.33% on the next £1 billion of total assets, and 0.30% on the remaining total assets.

The KID RIY for the trust is 0.88, relative to the sector-wide weighted average of 0.99. With this said, calculation methodologies across companies can vary.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.