Lloyds Banking and UK bank sector results preview

Despite political and economic concerns, there are three bank shares worth buying at results time.

23rd July 2019 14:44

by Graeme Evans from interactive investor

Despite political and economic concerns, there are three bank shares worth buying at results time.

Placing a value on Britain's bombed-out banking stocks just got harder after Boris Johnson's appointment as prime minister made a no-deal Brexit scenario appear even more likely.

While the crippling political uncertainty is unlikely to lift any time soon, this hasn't stopped banking analyst Jason Napier from taking an optimistic view of the sector with renewed 'buy' recommendations for Lloyds Banking Group (LSE:LLOY), Barclays (LSE:BARC) and The Royal Bank of Scotland Group (LSE:RBS).

Ahead of the industry's upcoming interim results season starting next week, the UBS expert points out that the UK domestic banks are attractively valued at about seven times 2019 earnings per share (EPS) and much more compelling than European counterparts.

Napier said:

"Though we expect concerns around Brexit to remain a significant stumbling block to a near term re-rating we think these banks offer good absolute and excellent relative value compared with most eurozone peers."

He has a price target of 75p for Lloyds, which if achieved would represent the highest level since 2015 for this widely-held stock. Napier is a long-time supporter of the bank, although that faith hasn't been repaid so far after a prolonged period of sideways movement caused by Lloyds being seen as a proxy for the UK economy.

Brexit aside, Lloyds is in rude health after its most recent results showed higher profits, an improved net interest margin and a capital cushion nudging 14%. Its tight control of the business previously enabled a share buyback of £1.75 billion.

When the company reports interim results on July 31, UBS expects to see a slight weakening in underlying profits to £1.9 billion despite a continued robust net interest margin of 2.90%. The interim dividend should increase 5% year-on-year to 1.12p.

Valuing shares at 6.8 times forecast earnings, Napier is confident there's scope for "substantial capital upside and significant capital returns". He added:

"We think Lloyds is an undervalued, strongly capital-generative bank, operating with a cost advantage in a competitive market."

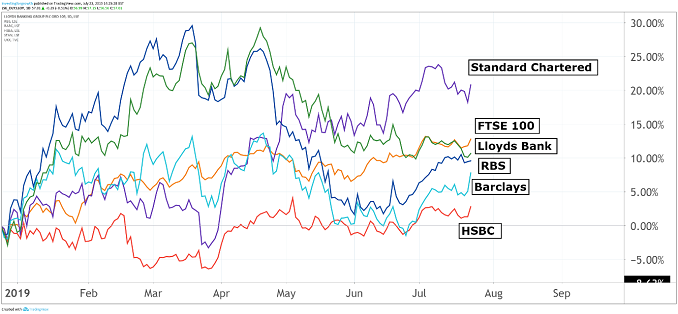

Source: TradingView Past performance is not a guide to future performance

While Lloyds is entirely UK-focused, the investment banking operations at Barclays offer investors an element of Brexit protection. That operation is also under pressure, however, with recent results from Wall Street rivals showing aggregate revenues down 9% year-on-year.

Despite the prospect of another challenging quarter, Napier believes Barclays is well positioned to pick up significant revenues from struggling Deutsche Bank (XETRA:DBK).

He has Barclays trading at 7.2 times 2019 earnings, which is a 17% discount to the European bank average of 8.7x. Shares have now languished below Napier's 200p target price for more than a year, with the company's "jam tomorrow" promise of potential buy-backs so far failing to convince investors.

Napier sees the prospect of a special dividend, but doesn't expect a buy-back when Barclays reports half-year results on August 1.

Royal Bank of Scotland reports a day later, with UBS expecting second quarter profits up 4% on the previous three months at £1.3 billion but down 17% year-on-year. There should be a special dividend of 5p a share alongside an ordinary payment of 2.5p to leave RBS with a capital buffer of around 16.6%.

Napier said: "We see the RBS investment thesis as pretty straightforward and predominantly driven by progress in defending margin in a low rate environment, reducing group costs and returning excess capital via open-market and off-market share buybacks."

- Who joins Lloyds Bank on this list of cheap UK shares to buy?

- These four US lenders set tone for Lloyds Bank results

- The outlook for UK dividend income

Royal Bank of Scotland shares are currently at 228.7p, which compares with UBS’s price target of 285p.

The stock has improved since early June, despite uncertainty over who will replace Ross McEwan as chief executive next year.

McEwan has made RBS a much slimmer entity since he took over in 2013, although the share price is also a third weaker over that period.

While UBS doesn't expect interim results to lead to significant changes to consensus EPS forecasts for the three domestic-focused banks, it sees greater risks to earnings at the international banks HSBC (LSE:HSBA) and Standard Chartered (LSE:STAN).

The pair have traded in a resilient fashion in recent weeks, aided by weaker sterling. However, UBS is worried by the impact of lower capital market volumes in Asia, as well as the imminent cuts in US interest rates and baked-in wage inflation. Longer term, there’s the concern that profitability in Hong Kong will be affected by the arrival of new, well-funded digital players.

Napier said:

"We think that the HSBC investment thesis is more dependent on its capacity to return capital by dividends and share buybacks. This is an area in which a number of European banks have struggled this year."

UBS has a 633p price target on HSBC, based on it trading at 11.3 times forecast EPS with a 6.2% dividend yield. Standard Chartered has traded better than Napier expected in 2019, but he believes strong trading in investment banking and concrete plans to return excess capital to shareholders through buy-backs are required to sustain the stock at current levels.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.