These four US lenders set tone for Lloyds Bank results

There's a huge amount of activity in the US and UK banking sectors currently, and much more to come.

17th July 2019 12:35

by Graeme Evans from interactive investor

There's a huge amount of activity in the US and UK banking sectors currently, and much more to come.

Forecast-beating results by some of Wall Street's biggest banks have given investors respite from ongoing jitters over a looming cut in US interest rates and slowing global growth.

JPMorgan Chase (NYSE:JPM), which is regarded as a bellwether for the US economy, beat profit estimates due to higher net interest income and improved lending at consumer arm Chase. Its boss Jamie Dimon admitted that business sentiment had soured a little due to the China trade war, but overall he is bullish on the US economy due to solid job creation and rising wages.

Goldman Sachs (NYSE:GS) also reported better-than-expected second quarter profits yesterday thanks to an increase in equities trading revenue, while stronger consumer lending helped Citigroup (NYSE:C) beat Wall Street targets in its results on Monday.

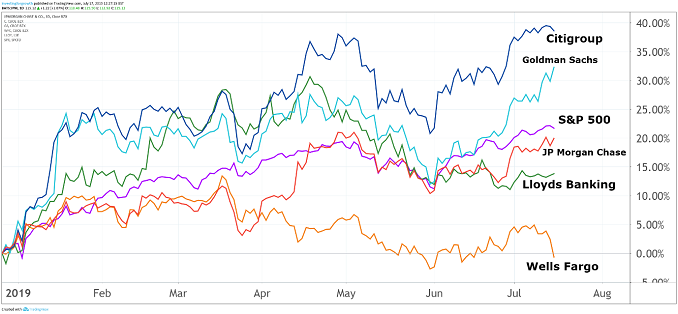

Shares in JP Morgan Chase and Goldman Sachs were both higher last night, having risen by 18% and almost 30% respectively in the year to date. Wells Fargo (NYSE:WFC), which posted higher earnings yesterday, saw shares fall 3% after its results included a more cautious outlook for cost cuts.

The resilient performance on Wall Street sets the tone for the UK banking sector, which kicks off its reporting season on 31 July when Lloyds Banking Group (LSE:LLOY) posts half-year figures. Barclays (LSE:BARC) and The Royal Bank of Scotland (LSE:RBS) follow that same week before HSBC (LSE:HSBA) unveils figures on 5 August.

Source: TradingView Past performance is not a guide to future performance

Focus on 31 July will also be on the US Federal Reserve, with policymakers widely expected to announce a cut in interest rates. JP Morgan said yesterday it forecast as many as three cuts over the coming months.

This will raise fears among followers of banking stocks that the all-important measure of bank profitability - the net interest margin - has peaked. Banks typically make more money from traditional banking when interest rates are higher, which seem less and less likely now.

JP Morgan's net interest margin declined to 2.49% from 2.57% a year earlier, while there were also falls for Citi and Wells Fargo in results this week.

Among the UK-listed banks, this trend will be a particular concern to HSBC investors given the global player's operations in the United States. Its net interest margin fell to 1.59% in first-quarter results, some eight basis points lower than in 2018 and fuelling questions in the City at the time about why the bank had not made more of rises in US interest rates.

Over the past 12 months, US bank stocks have trailed a strongly, underperforming the S&P 500 index by around 14%, with fears over the net interest margin a growing concern. However, this is increasingly being countered by optimism that US rate cuts may help to prolong the current bull market and give a slowing economy a welcome boost.

July's fund manager survey from Bank of America Merrill Lynch (BoAML) suggests that this thinking is gaining traction, with the bank finding that investors have taken on more risk this month by rotating into cyclical plays including banks.

Michael Hartnett, BoAML's chief investment strategist, said yesterday:

"The dovish Fed and trade truce have caused investors to reduce cash and add risk, but their expectations of an earnings recession and debt deflation still dominate sentiment."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.