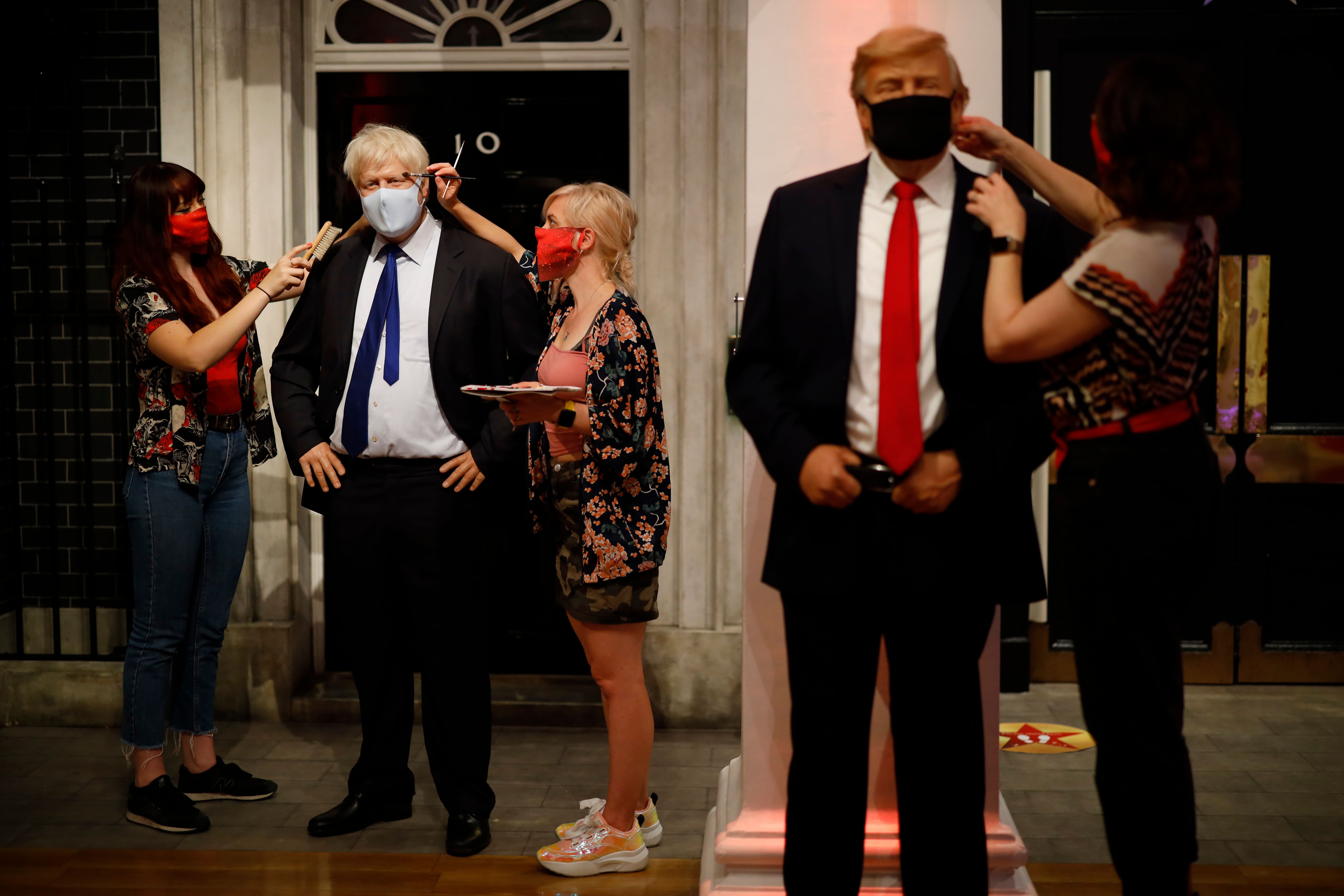

Market snapshot: all eyes on the US election and UK lockdown

It will be an historic week as America goes to the polls, while markets are reacting to a new lockdown.

2nd November 2020 08:15

by Richard Hunter from interactive investor

It will be an historic week as America goes to the polls, while UK markets have their first chance to react to confirmation over the weekend of a new month-long lockdown.

Investors face a litany of concerns this week which will test the collective mettle.

In the UK, it is the first chance for the market to react to the announcement of a further national lockdown.

The impact will be sector wide, with airlines, tourism and travel remaining out for the count, retailers leaning heavily on their ability to transact online, and the banks considering further spikes in bad debt provisions. Ahead of its full-year results tomorrow, Primark owner Associated British Foods (LSE:ABF) has already announced that it expects a hit of £375 million to sales as a result of shuttering its stores.

In addition, the oil price has slumped further and is now down 45% in the year to date on demand concerns following the various announced lockdowns, putting further pressure on the oil majors. More positively, the supermarkets could avoid some of the selling pressure, having already absorbed costs such as store reformatting as a result of the initial lockdown and therefore being better prepared this time round.

The lockdown announcement will also lead to calls for further government support to individuals and businesses which would pile further pressure on the UK’s financial position, while ongoing negotiations between the UK and the EU add further uncertainty to what is already a precarious outlook.

It would appear that the FTSE 100 index, down 26% in the year to date, now has longer to wait for any sign of a positive catalyst to arrest its decline.

In the US, and aside from similar Covid-19 anxiety, the election will, of course, be front and centre. The polls are showing that the outcome remains uncertain, with Biden still ahead. However, from a wider perspective, the possibility of a delayed or contested result would put further pressure on markets which have suffered the recent disappointments of renewed lockdown concerns, the lack of an interim fiscal stimulus and even some quarterly results from big tech which were not enough to keep up with lofty expectations.

- Use our helpful calendar to find out when the America's largest companies are reporting results

- Want to buy and sell international shares? It’s easy to do. Here’s how

In the year to date, the indices have given up some of their previous strength, with the Dow Jones now down 7% and the S&P 500 index up just 1%. While the tech-dominated Nasdaq is still comfortably ahead by 22%, this is some way from its recent highs.

The volatility, which is likely to accompany the news flow this week, will be heightened as investors attempt to assess the extent of the global economic impact following these events.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.