Mitie undervalued by 70%, but Boohoo bounces back

26th September 2018 12:52

by Graeme Evans from interactive investor

Mitie remains friendless, reports Graeme Evans, but some argue that investors are missing a trick. Seems they're snapping up Boohoo instead.

Turnaround prospect MITIE and the growth story Boohoo are two potential investment plays that have attracted plenty of attention in recent months.

The pair have compelling stories to tell, but in the past year the market has been lukewarm towards both after heavy share price falls of around a third.

Today, investors got more clarity with the release of updated trading figures. They liked what they saw in Boohoo's interim results, with shares up 8%, but Mitie was priced 6% lower even though the half-year performance met expectations.

Source: interactive investor (*) Past performance is not a guide to future performance

It represents further frustration for Mitie and its chief executive Phil Bentley, who is working through a plan to remove complexity and duplication and sharpen the outsourcer’s edge in smart analytics and data-led insight.

His turnaround plan is now into its second year, with Bentley still confident he can deliver operating profit margins of between 4.5% and 5.5% over the medium term.

He said most of Mitie's operating divisions, spanning security, engineering services, cleaning, care & custody and catering, delivered had solid performances so far in 2018. However, average daily net debt is still expected to be about £40 million higher than last year's H1 level of £278 million.

• Nine stocks to buy after Carillion crash

The order book has also fallen from £4.5 billion to £4.2 billion, but analysts at Liberum believe a wide range of work is in the pipeline as Mitie starts to benefit from technology that can improve client service and save money.

They maintained their price target of 240p, which offers a 70% upside on the price after today's latest fall. The target is based on a 2019 price/earnings (PE) multiple of 7.3x, compared with the sector average of around 13.1x.

The team at Liberum said:

"Financial risks should fade, albeit only slowly. There is also scope for more positive news on contract wins."

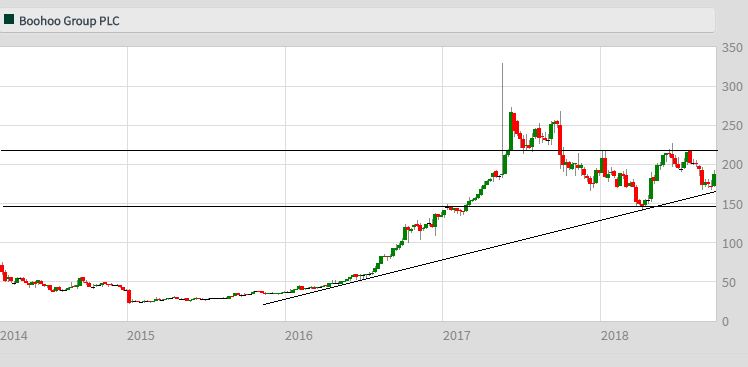

Shares in AIM-listed Boohoo have struggled in recent months, amid concerns about margins and fears that the stock got ahead of itself after a spectacular 2016 and 2017 in which it surged by more than 400%.

• Surging Boohoo sheds tears of joy

• Stockwatch: Five ideas for 2018

The market swung back behind the online fashion retailer today after it increased guidance for the 2019 financial year in the wake of a 50% jump in revenues to £395.3 million for the six months to August 31.

It now expects to grow annual sales by between 38% and 43% this year, up three percentage points on previous forecasts. It also reiterated the company's medium-term target to deliver sales growth of at least 25% a year and an underlying earnings margin of 10%.

Source: interactive investor (*) Past performance is not a guide to future performance

Analysts at joint broker Zeus said the company, which also owns the brands PrettyLittleThing and Nasty Gal, is "well positioned to execute the next stage of its growth".

They pointed to significant investment in distribution capacity, as well as the recent appointment of a new CEO with a wealth of operational experience, and a strong balance sheet with significant net cash.

Trading on a full year PE of 49.3x falling to 40.4x in FY20, Zeus said Boohoo's valuation looked undemanding compared with its peers.

They said:

"We continue to see upside potential in the shares as the group establishes itself as an international business, supported by high levels of investment ensuring it has the infrastructure it needs to execute future growth."

*Horizontal lines on the chart represents previous technical support and resistance. Black diagonal line on Boohoo chart represents uptrend since 2016.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.