Moneysupermarket.com reinvention pays off

19th July 2018 12:05

by Graeme Evans from interactive investor

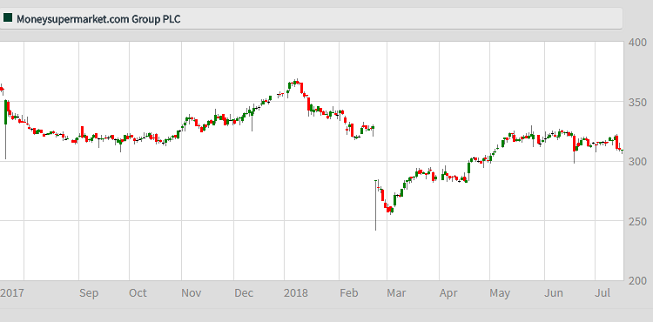

It's now made a full recovery since last February's crash, but some believe there's further upside here, reports Graeme Evans.

Attempts by Moneysupermarket.com to "reinvent" itself appear to be paying off after its half-year results triggered a big share price rise for the FTSE 250-listedprice comparison website.

Having delivered figures slightly ahead of expectations, one City analyst highlighted the potential for the company to beat the record high of 366.5p seen in January.

Contrast this to a year ago, when our own Edmond Jackson concluded it was time to ditch this growth favourite on the basis that it's best days were likely to be over. With additional pressure from intense industry competition, he said the market would be tipped towards demanding a more meaningful dividend yield.

Since then, Moneysupermarket has done a pretty good job in responding to these concerns. Under the leadership of Mark Lewis, who took over from long-time CEO Peter Plumb in April 2017, the company has launched its Reinvent strategy with the aim of re-accelerating core growth and unlocking new opportunities.

The early results show a 5% rise in interim revenues to £173.7 million as Moneysupermarket generated strong growth from helping people save money on their energy bills. Adjusted earnings per share was 4% higher at 8.4p.

Source: interactive investor Past performance is not a guide to future performance

Changes under the new strategy have included making the site easier to use, particularly for those on a mobile phone, while its new technology platform has enabled it to personalise more services for customers.

It also announced today that it has set up a joint venture to develop a comparison tool so consumers can compare and apply for mortgages online. The aim is to disrupt a market that is still largely paper and telephone based.

Liberum analysts believe mortgages will be a key part of potential future growth and a clear area of opportunity for the company.

They added: "There are encouraging early signs that the new strategy, with the focus on personalisation, which should help to lock the consumer more into the Moneysupermarket.com range of products, is starting to work."

However, Liberum remains cautious on the stock for the timebeing, with a 'hold' recommendation and 295p target price. They note that the company faces tough comparisons in home services in the current quarter.

In contrast, Gareth Davies at Numis Securities is sticking to his 390p target price after seeing today's half-year figures come in slightly ahead of expectations.

He said: "All in there was a fear heading into this set of results they could be disappointing. That is not the case, with a good set of numbers that at the very least firmly underpin FY estimates."

Davies said the stock traded on a projected 2018 price earnings multiple of 18.6x, falling to 16.7x in 2019.

With half-year net cash at £24.4 million, alongside generally low capital expenditure and no debt, Moneysupermarket has good potential for income.

The company, which increased its half-year dividend by 4% to 2.95p, currently trades on a projected 2018 yield of 3.5%, with earnings cover of about 1.5 times.

While encouraged by the medium term prospects for the price comparison market and on Moneysupermarket's ability to capitalise, Shore Capital thinks that the current stock valuation is fair rather than cheap.

They added: "The group's growth profile looks relatively modest versus other online stocks following downgrades earlier this year to reflect reduced growth expectations in core markets and additional cost investment."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.