Not too late to buy this US tech giant

Already a great performer, software sales and demand for AI remain strong, reinforcing the investment case for this household name. Analyst Rodney Hobson explains his rationale.

7th May 2025 08:52

by Rodney Hobson from interactive investor

Large American tech companies are scrambling to move production from China to the United States. About time too.

President Donald Trump will no doubt claim this as a vindication of his tariff wars and for once he has a fair point. It is hardly coincidence that the likes of NVIDIA Corp (NASDAQ:NVDA), Microsoft Corp (NASDAQ:MSFT) and International Business Machines Corp (NYSE:IBM) are bringing production back home in the wake of escalating import tariffs on Chinese goods. Whatever pain is caused by rising prices of overseas goods, this boost to the American jobs market is good news for the American economy.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The mystery is why this has taken so long. The idea of “onshoring” production that had been taken offshore to countries with cheaper labour decades previously, came into vogue 10 or more years ago then slipped quietly out of favour. Given global insecurities already apparent irrespective of rising tariffs, the stability and security of home production has to be worth paying more in wages.

After all, IBM had already announced last August that it would close most of its research and development operations in China with the loss of about 1,000 jobs there. That work had to be transferred elsewhere. Surely IBM had thought about where it would be moved to.

Alas, acting belatedly in haste will not come cheap. IBM is to spend $150 billion boosting production in America over the next five years, including $30 billion on bolstering manufacturing of mainframe and quantum computers. This is one of the largest technology companies in the world and it is already a major US employer. One hopes that there will be sufficient skilled labour in the US to take up the slack.

This decision came too late to stop Trump from cancelling 15 government contracts worth $100 million with IBM under a cost-cutting drive. This amount is comparatively small for a company the size of IBM but is an unwelcome warning shot across the bows from a president who is not averse to inflicting considerable damage.

Meanwhile, IBM has produced mixed first-quarter figures. Revenue edged 0.6% higher to $14.5 billion and pre-tax profits jumped 8% to 1.2 billion, but net income fell by a third to just over $1 billion, leaving earnings per share at a disappointing $1.12. Even so, all these figures exceeded expectations, as did free cash flow a tad higher at $2 billion.

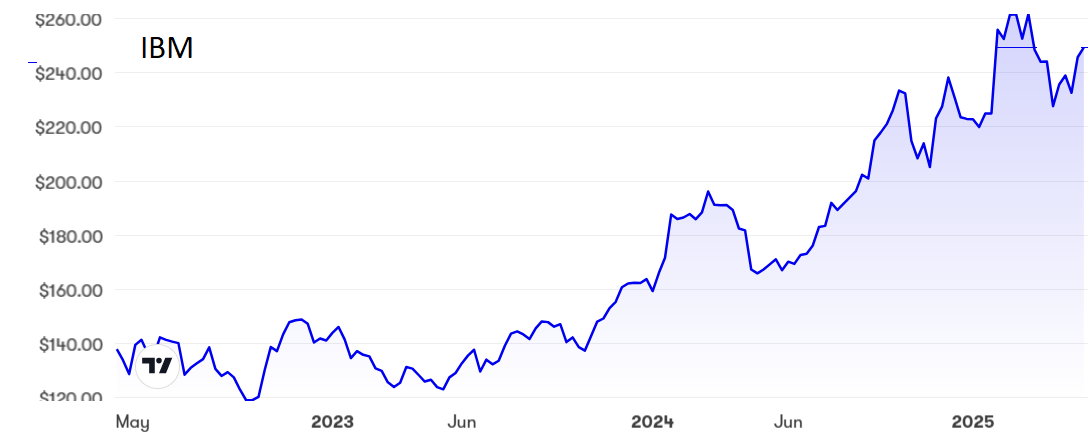

Source: interactive investor. Past performance is not a guide to future performance.

IBM tactfully described the economic environment as fluid, “based on what we know today”, no doubt anxious to avoid provoking Trump further, and it maintained its annual guidance for revenue growth of at least 5% in constant currencies or 3.5-4% when translated into dollars.

That implies a clear pick-up in growth over the next few months, beginning in the current quarter when revenue should be about $2 billion higher than in the first three months.

Software sales remain strong, as does demand for AI. The good news is that these are areas where margins are widening.

- ii view: tariff uncertainty overshadows Apple earnings beat

- ii view: big spending Meta Platforms beats forecasts

- ii view: AI demand supports Microsoft's reassuring sales forecast

As with all American companies, the first quarter may have been distorted by stockpiling in anticipation of tariff increases, a phenomenon that is likely to unravel from now on. Treat all figures for the first half of 2025 with some caution.

One positive note is that IBM is sensibly pursuing expansion in India, already a rising star in technology and a better prospect than China. It is partnering Tata Consultancy Services to develop India's quantum computing industry and deploy India's largest quantum computer.

The shares currently trade at just under $250, where the price/earnings (PE) ratio at over 40 is anticipating stronger growth in profits but the yield is some consolation at 2.7%. The stock has doubled in value over the past two years, with solid dividends on top, but has for the moment peaked at $264.

Hobson’s choice: I recommended putting IBM into an ISA as a long-term investment at $191 in March last year. Those who did so are showing a healthy profit and should hold on. Although the best chance has gone, it is not too late to buy. Although it may be some time before the $264 ceiling is broken, the downside looks restricted to around $240.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.