An old-fashioned business about to set new share price high

This stock has been successfully tipped by overseas investing expert Rodney Hobson before, and there’s still a strong argument to keep buying. He also has a warning about a well-known company.

30th August 2023 09:38

by Rodney Hobson from interactive investor

Two companies in quite different sectors were facing headwinds last year. The outcomes have proved wildly different.

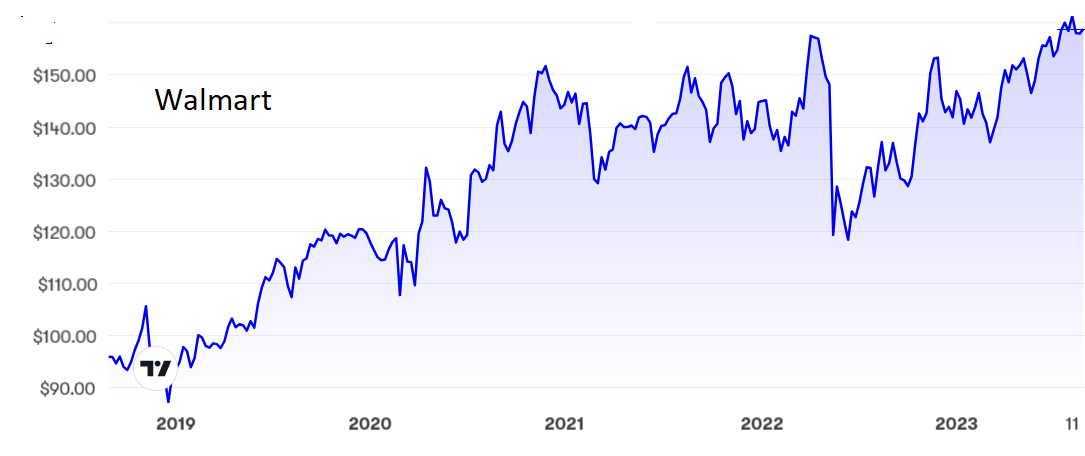

Retail giant Walmart Inc (NYSE:WMT) is doing much better this time round, with last year’s tortoises turning into this year’s hares.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Net sales rose 5.9% to $160 billion in the three months to 31 July, Walmart’s second quarter, which was just a little to the top side of forecasts. Net profits soared 53% to $7.9 billion. The big improvement came in general merchandise, which struggled a year ago as hard-up consumers cut back on non-essential spending during a time of high inflation. However, food sales have also been strong.

The results were good enough to allow Walmart to raise its guidance for the full year to 4-4.5% sales growth with operating profits up 7.5%.

Walmart is now on the brink of removing the longstanding cloud of opioid lawsuits for once and for all. During the current quarter it will pay the remaining $2.8 billion to cover its agreed liabilities for its role as a pharmaceutical retailer in the spread of opioid addiction in the US. It will be well rid of this unwelcome and expensive distraction.

The only piece of bad news in the latest announcement is that Judith McKenna is quitting next month as head of the international division. Although this side accounts for only about a third of sales – the bulk of business is still in the United States – it has been faster growing of late.

At least there is a competent replacement in Kathryn McLay, who has performed well as head of Walmart subsidiary Sam’s Club, a chain of membership-only warehouses owned by Walmart.

The shares are bumping up against their previous peak just above $160, where the price/earnings (PE) ratio is 30.5 and the yield 1.4%.

Source: interactive investor. Past performance is not a guide to future performance.

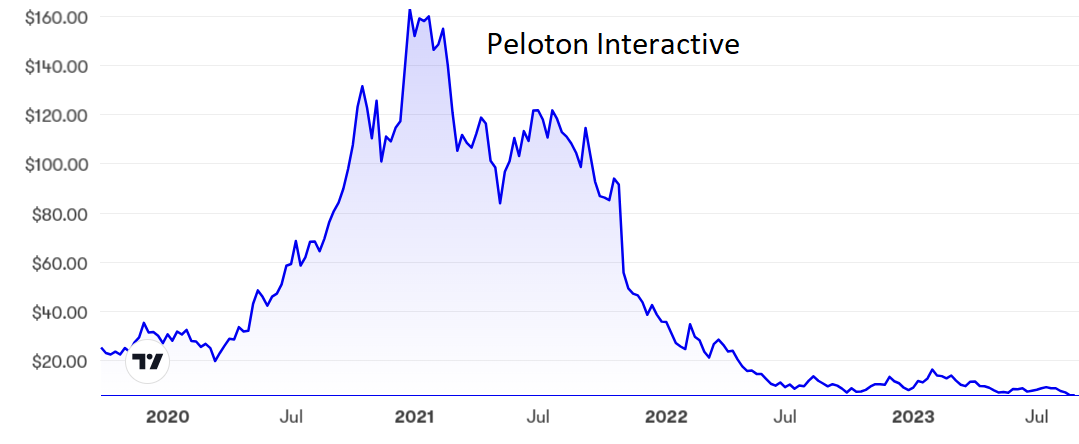

How many brick walls can exercise bicycle maker Peloton Interactive Inc (NASDAQ:PTON) crash into? It continued to lose subscribers in the three months to the end of June, down 5% to 6.5 million, as keep-fit enthusiasts migrate back to gyms where there is a variety of equipment and fitness regimes rather than settle for just one expensive pedal machine or treadmill at home.

Then there is the recall of 2.2 million wonky seats on supposedly upmarket exercise bikes, which has cost substantially more than expected. An extra $40 million has been set aside for costs actually incurred in the latest quarter plus likely future spending as Peloton sorts out the mess. One wonders what sort of grip management has on the business if it can be so far out in its estimates. Companies usually overallow for this type of cost and hopefully claw back the excess later.

- Stockwatch: why I’ve tweaked my rating on microchip star Nvidia

- IPO outlook boosted as Arm prepares for US listing

Peloton reported revenue down 5% to $642 million and net losses almost double at $242 million. Revenue in the current quarter is now set to fall below $600 million. The one straw to clutch is that cashflow was positive, but that is not likely to be repeated in the third or fourth quarters.

The shares topped $160 at the end of 2020 but are now at $6 and remain in freefall. The chief executive says he has never been more optimistic. Investors can be forgiven if they have never felt more pessimistic.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I was cautious about Walmart last year as it struggled to cope with inflation but a reluctant buy rating at $122 in May proved to be right.The fundamentals are admittedly now challenging but it is not too late to buy into what is turning into a real success story. The shares will surely set a new high soon.

I have long warned investors to keep away from Peloton and that advice remains. Three months ago I weakened and suggested that holders might as well stay in and hope for the best. They have got the worst. Sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.