The passive investing boom could actually be making markets riskier

The rise of super-affordable index-tracking ETFs and other set-it-and-forget-it funds has been reshaping markets. And, nope, it’s not all for the better.

26th September 2025 09:05

by Stéphane Renevier from Finimize

- Passive investing has now overtaken active funds – and that dominance brings hidden risks

- The big three: diversification breaks down as stocks move in lockstep, fragility rises when passive funds all sell at once, and price discovery erodes as flows outweigh fundamentals

- To offset those risks, consider tilting toward equal-weight, value, or small-cap strategies, and diversifying more broadly across regions and styles.

Index funds and exchange-traded funds (ETFs) now manage more money than old-school stock-pickers – and that’s starting to reshape how markets behave. Those investments’ low fees are great, sure. But a new paper from two heavyweight finance experts warns that too much money crowding into the same benchmarks can distort prices, inflate bubbles, and turn a run-of-the-mill selloff into a rowdy stampede.

What’s going on here?

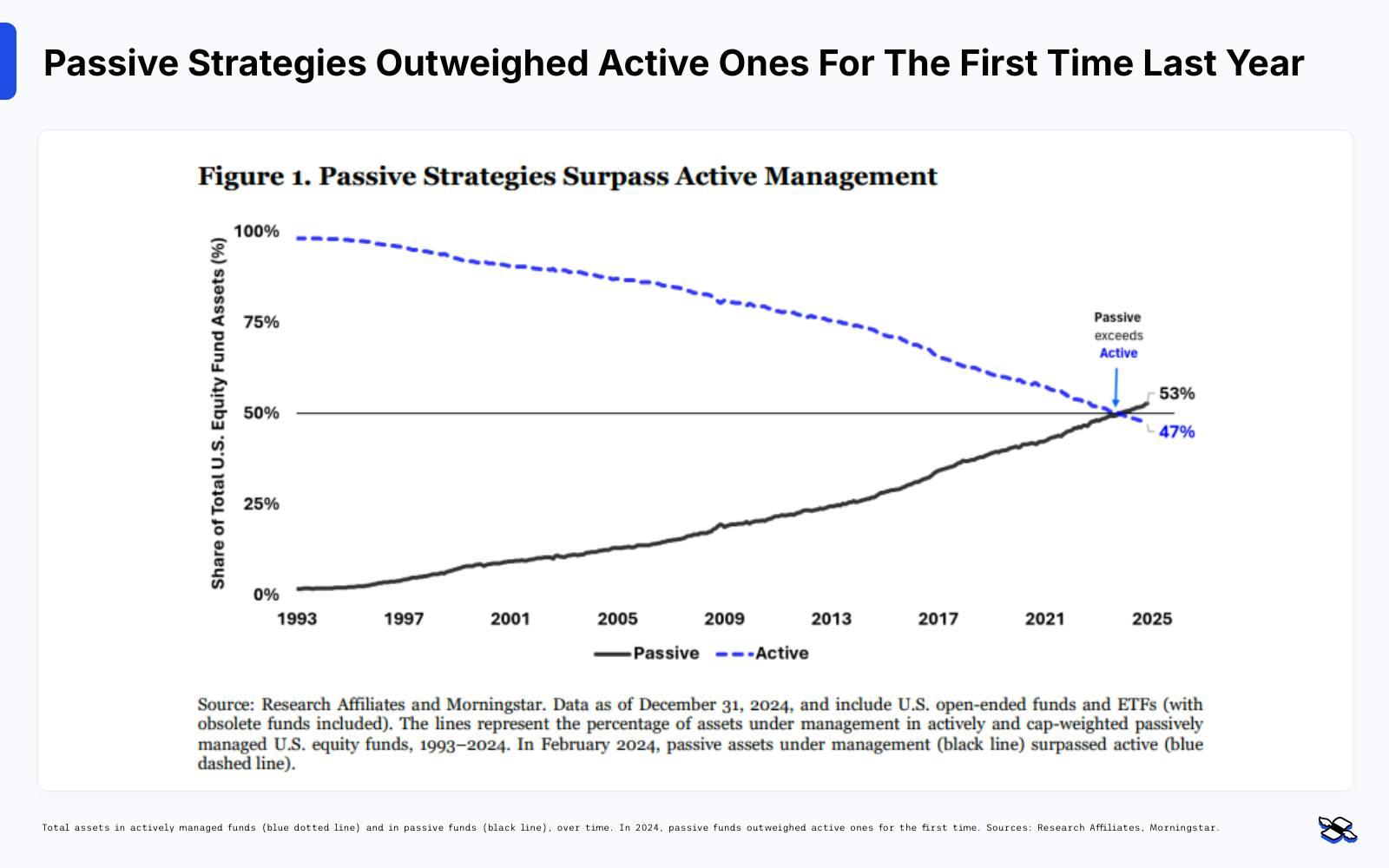

Passive investing hit a milestone last year: for the first time, cap-weighted index funds and ETFs overtook actively managed ones in total assets. And that gap very much reflects where folks want to put their money now. Investors shoveled nearly $2 trillion (£1.5 trillion) into passive products last year, while active funds bled a record $450 billion.

Total assets in actively managed funds (blue dotted line) and in passive funds (black line), over time. In 2024, passive funds outweighed active ones for the first time. Sources: Research Affiliates, Morningstar.

The appeal is obvious. Passive funds are dirt cheap – costing around 0.09% on average, compared to 0.64% for active ones. They’re simpler and they’ve outperformed most active managers for over a decade. Plus, autopilot retirement accounts keep pumping money into them every month, creating a relentless tide of buying.

And here’s the thing: many so-called active funds aren’t really active anymore. A lot of them “hug” their benchmarks so tightly that they’re essentially passive, but with higher fees. And that suggests the actual influence of passive investing may be even bigger than it appears.

But what’s the issue?

Low fees, hands-off investing, and instant diversification – sounds like a no-brainer. And for the most part, it is. But that new research paper argues that the rise of passive investing might be messing with market dynamics in ways that aren’t so harmless. Here are three big risks to keep on your radar:

1. Your diversification isn’t as solid as it might seem

One of the main promises of index investing is broad diversification – but that vow has started to break. The researchers found that stocks with high passive ownership have increasingly moved in lockstep, regardless of what’s happening with those firms. So while your ETF might look like an assorted mix of sectors and companies, it behaves more like a single, crowded trade – especially when markets get choppy.

That’s backed up by data: the beta(i.e. sensitivity to market swings) of passively held stocks has been trending upward for years, while the beta of actively held stocks has been falling. In plain English: passive-heavy stocks are becoming more sensitive to market-wide shocks, while actively owned stocks are acting more independently, reacting more to company-specific fundamentals than investor mood.

That goes to the very core of this big structural market shift. All those passive flows make stocks move more like one giant trade, both in rallies and in routs.

2. Markets can become more fragile when it matters most

When everyone buys and holds the same stuff for the same reasons, they sell for the same reasons, too. That’s the darker side of passive investing at scale: it creates a single, delicate trade. If one big index fund sees outflows, that pressure can ripple across portfolios holding the same stocks, triggering a rash of selling that overwhelms fundamentals.

Academics call this “stock fragility.” Basically, concentrated ownership and mechanical flows make stocks more vulnerable to synchronized selloffs. In fact, the paper shows that companies with high passive ETF ownership are more exposed to liquidity shocks – the kind that send prices plunging when buyers vanish.

It gets worse: other investors – including big institutions and even the companies themselves – tend to pull back when passive funds are forced sellers. So when the index sells, no one’s there to buy.

The result is more volatility, less liquidity, and a market that can go from calm to chaos in a heartbeat.

3. Markets can lose their sense of judgement

Passive funds don’t read earnings reports or grill management teams. They don’t care about competitive advantages, margins, or momentum shifts. They just follow their formulas: buying more of what’s gone up, selling less of what’s gone down. That gives investors low-cost market access, but it won’t give them any actual price discovery – the process that’s supposed to reward strong companies and punish weak ones.

That’s not just theory – it’s happening. Research shows that as passive ownership rises, it chips away at the link between a company’s fundamentals and its stock price. That leaves momentum and flows driving more of the action – not earnings, cash flow, or strategy. And the bigger the fund, the more cash it pulls in, the more momentum it fuels – and the further prices drift from reality.

Active managers should step in to correct these mispricings. But fighting the tide is costly and dangerous. Betting against the market’s darlings too early can mean years of underperformance, and even career risk. So instead of pushing back, many active managers sit tight, waiting for the bubble to get too big to ignore – just like they did during the dot-com era.

That delay creates a vicious cycle: passive flows inflate prices, active funds underperform, money shifts even further into passive, and fundamentals matter less and less.

So, is the shift toward passive investing all bad?

Well, no. In fact, other studies have found that ETFs and index funds can actually improve efficiency by boosting liquidity, cutting trading costs, and even strengthening corporate governance. And for everyday investors, the appeal is real: low costs, broad exposure, and a history of outperforming active funds after fees.

But the paper’s warnings deserve attention. Passive dominance may be making markets more fragile and more momentum-driven – and more vulnerable to sharp, synchronized selloffs when sentiment flips. So, while index funds might feel like the safest option in the room, you shouldn’t get lulled into a false sense of security.

What should you do, then?

Here’s where it gets interesting: the very distortions created by passive flows may be a source of opportunity.

When passive flows push prices away from fair value, they eventually snap back, often sharply. Investors who systematically rebalance toward fundamentals – whether through equal-weight indexes, value tilts, or fundamental-weighted funds based on sales, cash flow, or book value – are better positioned to benefit.

Think of it this way: the more distorted the market gets, the bigger the payoff when prices return to Earth. That’s what happened after the dot-com bubble. Cap-weighted indexes took years to recover, while equal-weighted and value-focused portfolios came out ahead.

So, consider replacing at least part of your stock exposure to non-cap-weighted indexes.

You could also go one step further. Since passive holdings everywhere concentrate heavily in US-listed, large-cap, and growth stocks, you could instead tilt toward non-US markets, small-cap, value shares.

Stéphane Renevier is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.