The pension timebomb that could derail your portfolio

11th April 2018 10:01

by Marina Gerner from interactive investor

Earlier this year the facilities outsourcer and construction firm Carillion fell into liquidation, putting thousands of jobs at risk and leaving shareholders with large losses. The ballooning of the firm's pension scheme deficit to £900 million was one of the main reasons for its collapse.

Labour MP Debbie Abrahams said at the time: "Carillion failed in its duty to ensure its pension provision was adequately managed and resourced. Despite profit warnings and unsustainable debt levels, it allowed its deficit to grow."

Following the company's collapse, the prime minister, Theresa May, pledged to stop "executives who try to line their own pockets" at the expense of workers' pensions.

The size of a company's pension scheme deficit can affect the firm's health, because this debt has to be serviced, and that can undermine the company's ability to grow its dividends or fund investment in future growth.

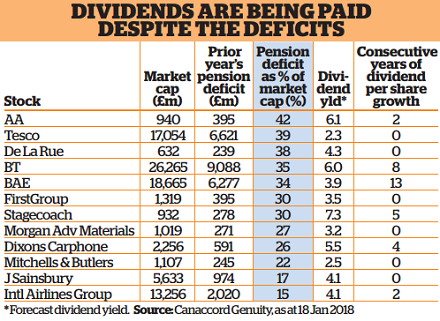

We asked Canaccord Genuity Wealth Management to find out which dividend paying firms in the have the biggest pension deficits. Canaccord has produced a list of 12 stocks that includes household names such as , , and (see box below).

So how should investors view such businesses? Are fund managers put off businesses that carry big pension deficits?

Pensioners face pension provision shortfall

The demise of Carillion was not a self contained event: the company's dramatic collapse rippled through the construction industry and hit thousands of its suppliers. "Numerous small and medium enterprises have either sunk or are desperately bailing out water, hoping to stay afloat," says Simon McGarry, a senior equity analyst at Canaccord Genuity.

Carillion's existing pensioners form another group of victims, and the Pension Protection Fund, the industry lifeboat, has steamed in to assess their schemes and try to protect these pensioners' futures.

Stuart Price, partner and actuary at Quantum Advisory, points out that while members of pension schemes are protected with compensation from the Pension Protection Fund, benefits will generally be lower than the sums they had been expecting from their employer.

He says: "I believe more onus should be on ensuring defined benefit schemes are adequately and continually financed, and receive their fair share of contributions versus payments to directors and shareholders."

So companies will have to find ways to finance their pension burdens for as long as defined benefit schemes continue to exist.

Secondary consideration

According to a 2017 report by JLT Employee Benefits, 41 companies could have settled their pension shortfall in full with a payment worth less than one year's dividend, while a further 25 companies would need to cut their dividends for one or two years in order to get rid of their pension deficits.

In Carillion's case, the size of the company's pension deficit was a principal reason why the company ended up going into liquidation, but the writing was on the wall in the previous year. In autumn 2016 Canaccord Genuity Wealth Management warned that Carillion's pension deficit was disproportionately large - a massive 37% of its market capitalisation.

Only a company profitable over the long term could have generated enough cash to meet such a shortfall. In Carillion's case, its profitability could not withstand worsening cash flow and rising debt, which was exacerbated by its pension deficit.

"At the time we warned that the pension deficit would affect its shareholder dividend," says McGarry.

"In September 2016 Carillion investors enjoyed their 17th consecutive year of dividend growth. But the pension deficit was indeed a sign of what was to come."

Carillion was forced to cut its dividend in July 2017, following a Brexit-related slowdown in the pace of orders. As a result, its share price plummeted by 70%.

McGarry says: "Of course, the pension deficit wasn't the only reason behind Carillion going under, but it was a sign of the trouble the company was in."

As well as having to grapple with big pension deficits, a number of the shares in the table below have other issues to resolve. The AA, for example, which tops the table, issued a profits warning in February after conceding that its profit figures will fall not meet analysts' expectations.

The firm said it will be investing more money back into its business, which led the firm to cut its dividend from 9p to 2p. also appears to be under the cosh. The firm issued a profit warning last summer, but has so far retained payouts.

"August's profit warning highlighted a lack of UK earnings visibility that management will have to work hard to restore," adds McGarry.

Moreover, a significant number of FTSE 100 companies have a problem with pension scheme funding that represents a material risk to their business, according to the JLT Employee Benefits report.

It states that 10 FTSE 100 companies have total disclosed pension liabilities greater than their equity market values (a company's assets minus its liabilities).

's total disclosed pension liabilities are triple its equity market value, according to the report. BAE Systems' total disclosed pension liabilities are almost double its equity market value.

Low interest rates have hit pension schemes hard

Multiple causes of current pension deficits can affect any company running a defined benefit scheme, of which there are more than 2,000 in the UK. The latest Office for National Statistics figures on UK pension liabilities reveal that final salary entitlements still account for a massive £2 trillion of the UK's £7.6 trillion of pension obligations.

The recent bankruptcies of companies such as BHS, Toys R Us and Carillion illustrate that while a company's pension scheme debt alone is unlikely to bring it down, it can significantly hamper that firm's corporate activity.

"A big pension deficit can obviously be a negative, as the debt must be serviced by the company," says Darius McDermott, managing director at FundCalibre.

He says it is something to be aware of, especially if an investor thinks a company's pension deficit could cause it to reduce its dividends or cut them altogether.

He adds: "Investors need to carefully try to establish whether a pension deficit can be funded. But this can be difficult, due to the way it is reported. What looks like a fully funded deficit in one year can appear to be an underfunded deficit in another year. You need to look at a firm's finances as a whole."

McDermott adds: "More and more companies with defined benefit pension schemes are selling their books to the likes of [insurer and fund manager] L&G, to get rid of the burden."

That said, he adds that a number of contrarian fund managers he is talking to at the moment believe opportunity is emerging among some companies with large pension scheme deficits.

He says: "The increase in life expectancy - which was putting ever more pressure on defined benefit pension schemes - seems to have plateaued, at least for the time being. And rising interest rates would be good, as the deficit will be eroded naturally. It could help trigger a "value" rally."

However, Mark Slater, manager of the , and , is cautious. He says: "We are wary of firms with large pension deficits. Rising interest rates do not automatically make such companies attractive."

Jonathan Barber, fund manager of , argues that pension deficits are just one of the many variables his team takes into account when considering investment opportunities.

He says: "When we look at a company with a pension deficit, we ensure we take into account the impact of its valuation."

Barber explains that the quantitative easing seen over the past nine years has brought about artificially low interest rates, which have exacerbated company pension fund deficits, as businesses use these artificially low rates to calculate their pension liabilities.

He says: "Assuming that bond yields have indeed turned the corner, after a 35-year bull market, we would expect the pension scheme deficits to improve as bond yields slowly begin to normalise."

So where does all that leave private investors assessing UK equities? It's possible that a pick-up in bond yields could help companies with large pension deficits to ease their burdens in the long run. However, wise investors will be wary of the companies with the greatest liabilities.

Source: Canaccord Genuity Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.