Prudential, Carnival, Shell and BP shares in double-digit surge

After an incredible plunge in share prices, these big hitters are leading a fightback.

24th March 2020 15:25

by Graeme Evans from interactive investor

After an incredible plunge in share prices, these big hitters are leading a fightback.

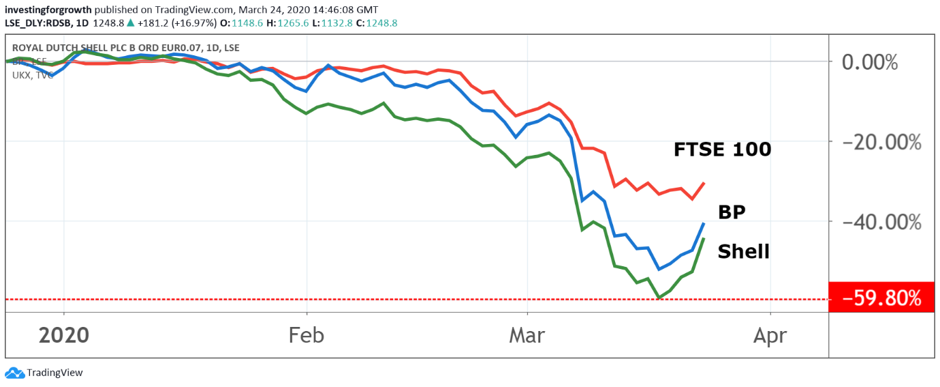

Investors were given some breathing space today, as Prudential (LSE:PRU) and fallen cruises giant Carnival (LSE:CCL) joined oil majors Shell (LSE:RDSB) and BP (LSE:BP.) in helping the FTSE 100 index pull back from last night's eight-year closing low.

The top-flight, which has lost a third of its value since mid-February, jumped more than 5% or 250 points after commodity prices were lifted by the prospect of further stimulus measures, including the US Federal Reserve's commitment to unlimited expansion of asset purchases.

Markets were also encouraged by signs of a slowing in the Covid-19 death rate in Italy.

Source: TradingView Past performance is not a guide to future performance

The rally helped to deflect investor attention from the near lock-down now affecting London-listed retailers and housebuilders, as well as the first of the economic indicators to reveal the severity of the coronavirus pandemic in the UK.

The purchasing managers' survey for March slumped to 37.1 in March, compared with 53 in February, with the situation set to get much worse once Friday's closure of all pubs and restaurants and today's ban on non-essential movement have been taken into account.

- Coronavirus crisis: An essential guide for all investors

- The single most important concept for every investor

- Eight practical things investors of all ages can do when stock markets fall

Much of this disruption, however, appears to have been factored in by investors, with Morgan Stanley today wondering whether markets are close to “peak uncertainty”.

The mood helped the price of a barrel of Brent crude rise 5%, having fallen as much as 60% in the year-to-date due to coronavirus and the OPEC and Russia production stand-off.

That provided a much-needed boost for Royal Dutch Shell, which has been the subject of heavy selling on fears that its prized dividend might be in jeopardy. Those worries have been reflected in a historical dividend yield now in the region of 15%.

Shell attempted yesterday to ease these concerns by announcing a series of measures to safeguard cash flows, including a reduction in operating costs and capital expenditure. It's also suspending its US$25 billion share buyback plan.

Shell's “B” shares were up 13%, with rival BP not far behind following an increase of 12%. Among other commodity-based stocks, precious metals miner Polymetal International surged 14% after gold prices rallied on the back of the Federal Reserve's pledge on bottomless quantitative easing.

Source: TradingView Past performance is not a guide to future performance

Anglo American (LSE:AAL) and BHP Billiton (LSE:BHP) both rose 10%, despite South Africa announcing a 21-day lockdown in order to curb the spread of coronavirus.

And Carnival, whose shares have collapsed in value from over £37 in January, peaked today at 1,180p for a gain of 95% from last week’s record low of 606p. But investors who are inclined to trade these high-risk markets have to be nimble. Carnival shares were back below 1,050p within half an hour.

Prudential was among the other major risers in the FTSE 100 index, with investors encouraged that the insurer is still committed to injecting third party capital into US arm Jackson.

The preferred plan is for a minority IPO, although in the face of current market turmoil chief executive Mike Wells said today that other options hadn't been ruled out. Shares rose 16% to 923.1p, having been trading at 1,489p as recently as mid-February.

Source: TradingView Past performance is not a guide to future performance

The rise also reflected recovery hopes for the Pru's core Asia business as China prepares to lift the lock-down in Wuhan, where the coronavirus outbreak first started.

Wells added:

“While the full consequences of Covid-19 are still emerging, Prudential has a highly resilient business model and remains well placed to continue to create value for shareholders, and support distribution partners and customers.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.