A recovery stock for risk takers and one that's unlikely to disappoint

1st March 2023 10:21

by Rodney Hobson from interactive investor

After urging investors to sell this stock, the price has fallen significantly and now looks attractive for risk takers. Our overseas investing expert also backs a solid boring company that won't give you sleepless nights.

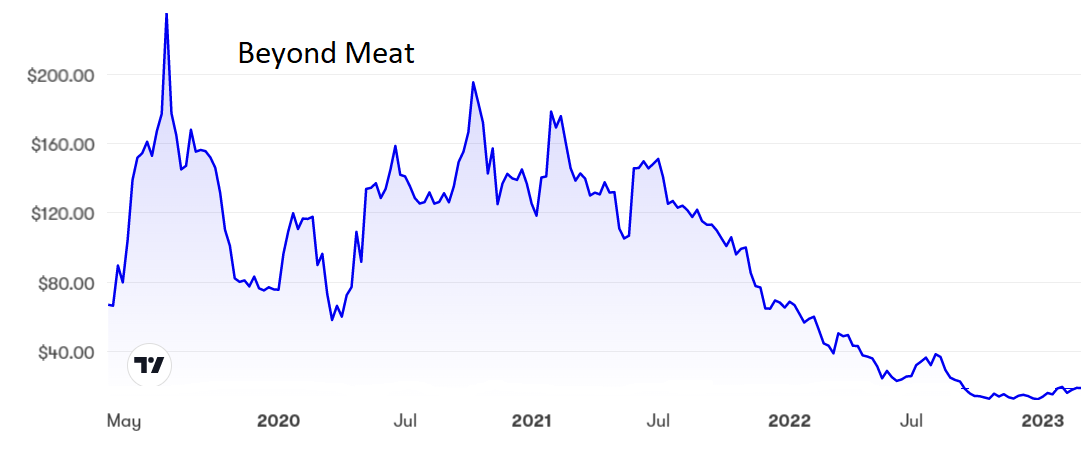

The collapse in the share price of Beyond Meat Inc (NASDAQ:BYND) was quite remarkable but the company that once seemed to have so much promise may be turning the corner at last.

The maker of plant-based meat (if that is not a contradiction in terms) has finally got costs under control. It expects operating expenses to fall by 22% this year compared with a 9% rise in 2022. Drastic measures include sacking 200 workers, tightening up its supply chain, renegotiating contracts and speeding up automation in its manufacturing.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

On the downside, it still has to cope with stagnating demand for substitute meat while tackling rising costs for raw materials, distribution and energy. Life will continue to be tough but at least the company seems to be getting its act together.

It needs to. Revenue fell 9.8% to $418.9 million last year and the net loss doubled to $366.1 million. Rather alarmingly, revenue in the final quarter slumped 20.6% compared with the same quarter a year earlier. The only consolation was that analysts had expected even worse.

Chief executive Ethan Brown is promising to improve margins as well as reduce operating expenses and inventory levels, and he reckons that Beyond Meat will start to generate cash in the second half of this year. There is a heavy burden on his shoulders, but he may well be the man for the job. If he fails, it is hard to see anyone else succeeding.

The shares hit $235 in the middle of 2019 but they have been as low as $15 in recent months. However, they started to bottom out in the second half of 2022 and could now be on the rise again. This is not a share for those who seek a dividend as repeated losses have delayed any prospect of a payout for some time.

Source: interactive investor. Past performance is not a guide to future performance.

If vegans have not grown in numbers as quickly as many people expected, the elderly certainly are doing, so medical insurance and healthcare provider UnitedHealth Group Inc (NYSE:UNH) will have a guaranteed expanding demand for its services.

Having upped its guidance for 2022 in November, UnitedHealth has kept its word after a great final quarter that saw revenue up 12% to $73.7 billion and earnings 25% higher at $6.9 billion. Revenue for the full year gained 13% to $324.2 billion with earnings up 19% at $6.9 billion.

The company expects further growth this year and it looks likely to deliver again.

A great deal of good news has been factored into the share price since it hit a low of $206 in March 2020 at the height of the pandemic, but the stock has come off the boil after peaking around $550 on three occasions late last year.

Even so, at $476 the price/earnings (PE) ratio is a little on the high side at 22.8, while the yield is on the low side at 1.3%. However, these statistics are by no means off-putting for such a solid and profitable company.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I warned investors more than a year ago to sell Beyond Meat when the fall took the shares back below $90 and repeated that advice at $47 last March. At $18 this is worth considering as a recovery stock but only those with an appetite for risk should buy. Those who do so should monitor the stock carefully for any signs that the bad times have not gone away.

Buy UnitedHealth if you like solid boring companies that are unlikely to produce hefty gains but are equally unlikely to disappoint. The downside is probably limited to $472, while $500 should be possible in the near term.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.