Richard Beddard: a high-scoring share with a swagger

8th July 2022 15:12

by Richard Beddard from interactive investor

While the last two years have been testing for this small but well-known company, the next two years should demonstrate its true quality, believes our columnist.

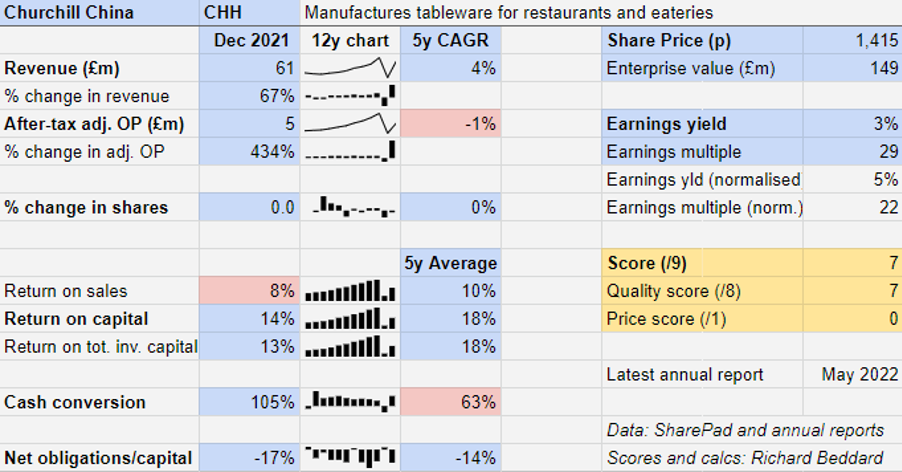

The pandemic has put a nasty chip in Churchill China (LSE:CHH)’s record of growing revenue, profit margins, and return on capital, but the case for investing in this stalwart remains: it has a superior product, and it can make it relatively inexpensively.

Churchill China was impacted so badly because it makes tableware for the hospitality industry.

In 2020, revenue plummeted 46% due to the closure of hotels, restaurants and other public eateries during the pandemic, and Churchill China hardly made a profit.

The cracks begin to disappear

As the pandemic and its impact gradually abated in 2021, there was a partial recovery.

Revenue recovered faster than profit as pandemic restrictions were lifted because of the cost of rapidly increasing production levels, but the company says its market share increased for its troubles, as supply from competitors remained constrained.

The recovery in revenue depleted record stocks manufactured in 2020 in anticipation of the easing of restrictions on caterers, which improved cash conversion.

At the AGM in June, Churchill China reported record demand and the expectation of further improvement in 2022, although like all of its peers it is having to manage cost inflation.

So far, it says it has passed price increases on to customers, who have limited other options.

Island evolution

Churchill China’s success is a result of the separate and centuries long evolution of the UK potteries and their European competitors, stemming from the local clays available to them.

While continental competitors churn out white porcelain plates in large volumes, a staple of the hospitality industry, Churchill China has found a sweet spot when it comes to showcasing or “framing the food” on patterned plates, which have become increasingly popular.

This is because Churchill China is earthenwear. It uses ball and china clays originally sourced in Staffordshire and now trucked in from Devon and Cornwall.

The processes developed to turn the clay into tableware results in a highly durable product with a pattern that, due to recently developed techniques, can be laid at low cost under the glaze, rather than within or on top of it.

Because the pattern is buried under more glaze, it takes longer to wear off, so the process gives Churchill China both a cost and quality advantage.

Such is the importance of Churchill China’s supply of raw materials, it bought the co-owners, other Staffordshire potters, of one of its suppliers, Furlong Mills, in 2019 and 2020.

As well as providing security, sole ownership should allow Churchill China to develop better materials for its manufacturing processes, and better processes for its materials.

While it would be possible for European manufacturers to develop similar methods to Churchill China, it would mean undoing hundreds of years of their evolution to pursue an unfamiliar technology. Judging by Churchill China’s swagger when I have asked them about this, it is unlikely to happen.

In Britain, Churchill China has relatively few competitors due to the shrinkage of the industry in previous decades due to the relentless competition from cheap, often Far Eastern, imports.

The other listed Staffordshire pottery, Portmeirion, sells highly decorative tableware to people like you and I, and has diversified into scented candles and other homewares.

Its nearest UK competitor may be Steelite, just down the road in Stoke on Trent. It too sells attractive, durable tableware to the hospitality industry.

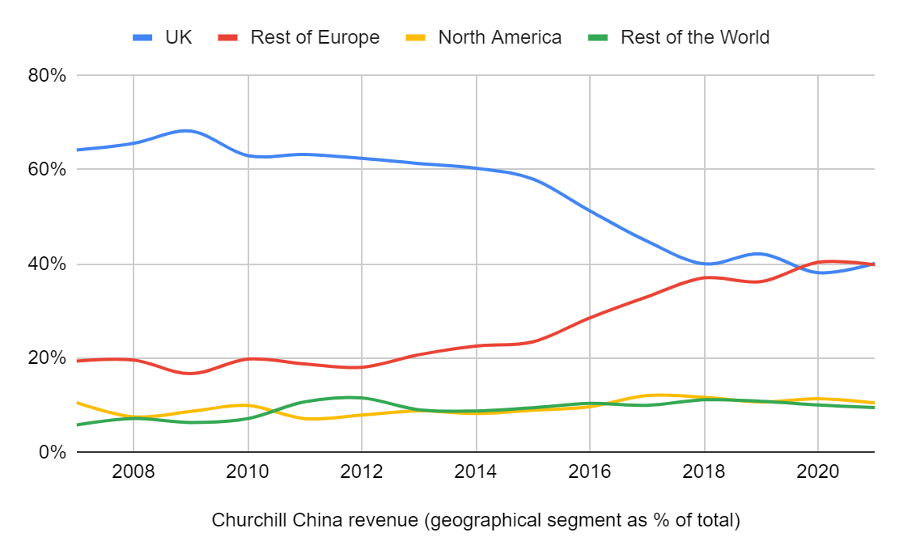

The contribution of patterned plates and European markets to Churchill China’s growth is indisputable.

Sales of value added (patterned) products to the hospitality industry have increased from less than 10% of total revenue in 2011, to over 55% of the total in 2021.

Source: Churchill China annual reports

Sales to the rest of Europe have increased from less than 20% of total revenue in 2021, to parity with sales in the UK at 40% of revenue in 2021.

Taking 2012 as our baseline, from when total revenue has increased 47%, rest of Europe revenue has increased by 224%, while UK revenue has declined by 6%.

The decline in UK revenue does not mean Churchill China has a problem at home. It was already big in the UK hospitality market in 2012, and revenue then included retail sales, a market Churchill China has gradually withdrawn from.

- The investments that will keep growing – even during a recession

- What an inflation shock really looks like

Gratifyingly, profitability has improved markedly too, providing further evidence that Churchill China has a cost and quality edge, although the pandemic years of 2020 and 2021 have complicated the picture.

Between 2012 and 2019, the company’s profit margin improved from 6% to 14% and its return on capital increased from 9% to 28%.

While a profit margin of 8% in 2021, and a return on capital of 14%, are closer to the 2012 level than the 2019 level, we can expect improvement in 2022, the first year of, hopefully, the new normal.

Underlying these achievements is sustained investment in a motivated workforce and technology to ensure Churchill China’s designs remain attractive, and that its manufacturing techniques are more flexible and efficient than competitors.

Scoring Churchill China

I like Churchill China. The financial strength and business acumen that enabled it to manufacture in anticipation of recovery, even in the teeth of a dramatic decline in demand in 2020, is one of the things I look for in a business.

The ability to supply at times of difficulty is a competitive advantage because in normal times customers wedded to one brand of tableware rarely switch to another.

Any company that gains market share, when others cannot fulfil demand, gains sticky customers because one of the attractive things about the hospitality market is that to replace breakages, or grow, customers need more of the same products.

In other words, they tend to be repeat purchasers.

While the last two years have been testing for Churchill China, the next two years should demonstrate its true quality.

Does the business make good money? [2]

+ High return on capital (impacted by pandemic)

+ Strengthening profit margins (impacted by pandemic)

? Cash conversion is reduced by pension fund payments

What could stop it growing profitably? [2]

+ Finances: Strong, can invest through cycle

+ Inflation: Currently able to raise prices

? UK trade relations with EU

How does its strategy address the risks? [2]

+ Investment in product development and automation

+ Vertical integration

+ Geographical expansion

Will we all benefit? [2]

+ Very experienced board

+ Staff development central to strategy

+ Communicates well with shareholders

Is the share price low relative to profit? [0]

+ It is fair. A share price of £14.15p values the enterprise at about £150 million, about 22 times normalised profit*

A score of 8 out of 9 indicates Churchill China is a good long-term investment.

It is ranked 6 out of 40 shares in my Decision Engine.

*This article was filed a week ago and readers should check the latest share price.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Churchill China.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.