Richard Beddard: it’s complicated, but I rate this volatile share highly

16th September 2022 15:45

by Richard Beddard from interactive investor

There’s potential for conflict within this £200 million business, but Richard still thinks it will likely be a good long-term investment. Here’s how he scores it.

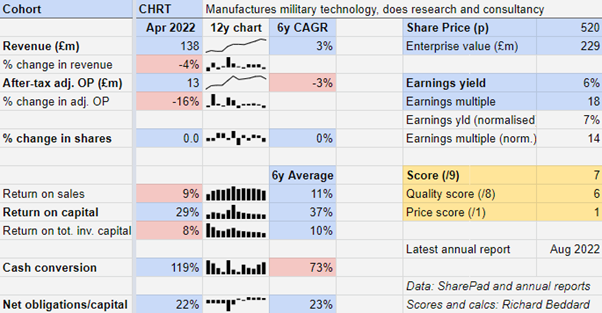

Cohort (LSE:CHRT) is a collection of niche defence technology businesses run by experts. The results for the year to April 2020 show that even experts sometimes misstep.

The company supplies hardware, software, training, technical support and research services to armed forces and defence contractors.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

Its biggest sources of revenue are communication and information systems, but it also makes weapons systems, provides cyber security and data protection services and earns modest revenue from civilian traffic enforcement systems.

A poor year

Revenue fell 4% in the year to April 2022, although without the first full-year contribution from ELAC, a supplier of sonar systems, revenue would have declined 12%. Profit fell 16% (26% excluding ELAC).

Revenue and profit declined at two of Cohort’s six subsidiaries: EID, a manufacturer of communication systems and Chess, which supplies targeting, surveillance and anti-drone systems.

At EID, Cohort says the previous year the company benefited from an unusually large order, which combined with delays to new orders make revenue in the year to April 2022 look shabby in comparison

At Chess, relatively low demand was only the beginning of the bad news. For the second year running, contracts took longer to fulfil than expected and cost more than anticipated to deliver, which Cohort blames on growing pains.

Cohort has shuffled the deck at Chess, reorganising the business, terminating an unprofitable contract, and moving the managing director to a business development role and appointing another employee to the top job.

MASS, which provides electronic warfare and cyber security services, was most impacted by Covid-19 because its training activities are carried out at customers’ sites. Even though it failed to increase revenue, MASS, is Cohort’s most profitable business and profit improved.

In addition to the idiosyncratic problems faced by these subsidiaries, across its portfolio of six businesses, Cohort is experiencing difficulty recruiting highly qualified personnel and sourcing semiconductors

Things may be looking up though. The company had a record order book in April, and this month SEA, which has a strong maritime heritage but also sells traffic management solutions, won a new five-year contract worth £34 million to supply anti-submarine warfare and countermeasure systems to the Royal Navy.

On balance, Cohort says it should benefit from increased defence spending in the UK and from NATO’s resolve following the invasion of Ukraine, but it also warns that maintenance, upgrades, and training supplied under long-term contracts can be delayed if armed forces are at a higher state of operational readiness.

While defence is rising up government spending priorities, so are other commitments, principally ameliorating the rapid rise in the cost of living.

Contraction is unusual, Cohort has grown revenue in eight of the last 10 years and profit in seven of them. A more worrying trend might be the erosion of return on capital.

Acquisition risk

Return on capital (ROC) of 29% shows Cohort earns much profit in relation to the tangible capital it requires to operate, nevertheless profitability is lower than in recent years.

More concerning, perhaps, is return on total invested capital (ROTIC), which includes the unamortised value of Cohort’s acquisitions. This shows how much profit Cohort makes on all the capital it employs, operating capital like ROC, and the capital it spent to buy businesses.

It tells us whether Cohort has been a good acquirer. The jury is out.

Recent acquisitions were mostly responsible for the poor returns of 2022. Cohort acquired Chess in 2018, and EID in 2016, and an eight per cent ROTIC is an unexciting return for investors.

On the other hand, this is only one year. If Cohort has fixed these businesses, returns should improve.

Cohort has achieved 10% compound annual growth in profit since 2008, without recourse to raising money from shareholders or borrowing extravagantly.

Managing complexity

The failings of Chess and EID bring into question perhaps the two most important elements of Cohort’s strategy: acquisition and international diversification. This may be more costly and capricious than the company thought.

The strategy is to acquire niche businesses and improve them.

In other words, it wants to provide them with the benefits of a large company without quashing their entrepreneurialism.

Cohort says it can open doors to defence departments and large customers, provide funding, and encourage subsidiaries to share expertise and customers.

Light-touch strategic, financial and regulatory control of the subsidiaries is not only an efficient way to operate, Cohort says, but a beacon to the owners that might sell their businesses to Cohort.

Historically reliant on the UK MOD, which directly and indirectly through subcontractors still accounts for just over half of total revenue, Cohort has focused on acquiring foreign companies, Portugal’s EID and Germany’s ELAC, as well as UK exporters, like Chess.

However, the trouble this year came from an overseas subsidiary (EID) and an exporter (Chess), and revenue from international markets declined from 42% of total revenue to 35%.

In addition, administrative costs at headquarters have risen as Cohort builds commercial, legal and financial capabilities to support its subsidiaries in export markets.

Once the businesses have acquired, Cohort wants to grow them. It says it spends 50% of profit on innovation to stay at the forefront of defence and security technology.

This year’s annual report highlights ‘Spot’, a mobile quadruped robot that can carry out autonomous missions to deliver medical aid, food, and fuel, or detect threats like hostile drones. MCL, a value-added distributor of military hardware and Cohort subsidiary, is importing Spot from its maker Boston Dynamics and supplying it to the UK MOD.

Researchers at SEA led aspects of the development of the menacingly named Future Individual Lethality System (FILS) in partnership with Dstl (The MoD’s Defence Science and Technology Laboratory). FILS, which has yet to enter service, provides a more accurate sight picture for a weapon, and also shares the picture to other weapons and sensors.

Cohort is also continuously developing its own products. During the year ELAC successfully tested a new generation of digital hydrophones, submarine sonar systems that listen out for enemy submarines.

The third plank of the company’s strategy after acquiring businesses and fostering growth is getting them to share knowledge and customers. Beleaguered Chess is working with SEA on a new decoy launcher, for example, and EID is working with ELAC and SEA to promote their products to the Portuguese Navy.

This bit of the strategy puzzles me.

The businesses supply different products and services and have different competitive advantages. Some like EID, are low-cost manufacturers, some, like MCL, are basically importers of technology, others like, MASS rent out people with very specific expertise.

They are the definition of niche businesses, which by design have limited overlap.

I wonder whether the cost of managing and organising such disparate businesses might outweigh the benefit, if not now, then when more businesses are added.

Couple this with complexities like long-term fixed price contracts, which can be unpredictable in terms of when the revenue is earned and ultimate profitability, and you have quite a complex business. Reassuringly, in inflationary times, the fixed prices are indexed.

Diversification is a sensible response to one risk, dependence on the UK MOD, but it replaces it with another, adding more complexity to an already complex business.

A company with purpose

Although the defence industry is often shunned by investors with social objectives, perhaps some are reconsidering that stance following the invasion of Ukraine. Long standing chairman Nick Prest says:

“It is clearer than ever that strong defence means a strong defence industry... That is something that Cohort’s leadership and employees understand well, and for many of us it is a large part of our motivation at work. We therefore believe that an activity that generates social value as well as business success... is worthy of investor consideration.”

Cohort says its capabilities derive from its employees, some of them army reservists. Because they fulfil long-term contracts, they develop lasting and responsive relationships with customers, a virtuous circle.

- Resilient stocks the pros are backing as inflation winners

- Glimmer of hope for savers as inflation juggernaut slows to 9.9%

For such a complex business the quality of management is even more critical than usual. Here, Cohort scores well.

Its chairman Nick Prest co-founded Cohort in 2006. He joined the MOD as a graduate and is a former chief executive of Alvis, a defence contractor taken over by BAE Systems in 2004. Cohort chief executive Andrew Thomis and finance director Simon Walther are both Alvis alumni too, who have been with the business since the early days.

The company’s other co-founder retires as a non-executive director at the AGM later this month. He is the company’s biggest shareholder with a 22% stake.

Cohort explains itself very clearly in its annual reports, attesting to its open culture

Scoring Cohort

Does the business make good money? [2]

- High ROC, but declining

- Middling profit margin

- Decent cash conversion

What could stop it growing profitably? [1]

- Reliance on MOD spending

- Collection of niche technology businesses resists competition

- May be overpaying for acquisitions

How does its strategy address the risks? [1]

- International expansion

- Encourages autonomy in subsidiaries

- Increasing complexity

Will we all benefit? [2]

- Very experienced management

- Motivated and skilled employees

- Good communication with shareholders

Is the share price low relative to profit? [1]

- Yes. A share price of 520p values the enterprise at about £229 million, 14 times normalised profit.

My score this year reflects a slight loss of confidence. There is the potential for a conflict between Cohort’s strategy of operating semi-autonomous businesses and increasing complexity as it grows, so I am not sure the strategy addresses the risks.

However, a score of 7 out of 9 means it probably remains a good long-term investment.

It is ranked 18 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Cohort

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.