Richard Beddard: this light maker is not cheap, but quality shines through

Rock-solid FW Thorpe is having a stable rather than a knockout year, but its future looks bright.

23rd October 2020 14:30

by Richard Beddard from interactive investor

Rock-solid FW Thorpe is having a stable rather than a knockout year, but its future looks bright, according to our companies analyst.

Lighting system manufacturer FW Thorpe (LSE:TFW) defied the national lockdown at the beginning of the coronavirus pandemic by remaining profitable and paying furloughed staff in full throughout April, May, and June without taking government money.

2020 was a year in which rail and hospital contracts were to the fore at FW Thorpe. Source #SeeUsInANewLight, a gallery of Thorlux projects.

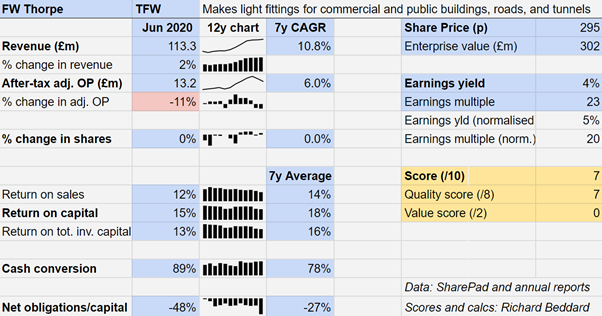

What might have been a banner year turned out to be a resilient one. In the year to June 2020, revenue improved 2% but profit was down 11% compared to 2019.

Since the national lockdown, when facilities were operated with a skeleton staff while they were adapted to operate safely, the company has traded in-line with the previous year. It has a healthy order book.

The account of lockdown in the annual report is striking because of how well prepared the company was for home working and social distancing. Its IT systems were already up to scratch, and it had mothballed manufacturing facilities it could bring back into use to allow it to spread work out.

But the good news comes with a caveat.

FW Thorpe has been meeting pent-up demand from the lockdown and doing work agreed before the pandemic. The company expects a recession and orders to fall due to the economic fallout and continuing restrictions, which hamper sales visits and have closed its showrooms.

The world’s pandemic woes come on top of potential difficulties specific to the lighting industry.

Growing now the bubble is over

Over the last decade or so, persuading companies and organisations to upgrade their lighting was easy because of the advent of LED systems. They are more reliable than fluorescent lighting and cost less over the lifetime of the product.

- 10 quality AIM shares that are beating the market

- Shares for the future: a test-case for essentialism

Now 90% of FW Thorpe’s revenue is LED. Many businesses and organisations have LED lights, and the company must give them another reason to buy new systems.

The replacement cycle is one. FW Thorpe expects LED systems to last ten years or more, so the company says the replacement market will soon be a target again.

Adding functionality

FW Thorpe is also improving the quality of its white lights, cutting glare and reducing the ecological impact of its systems.

It is adding functionality through its SmartScan wireless management system, which incorporates sensors that control lights, and also reports on room occupancy and air quality. This saves companies the cost of installing multiple systems and lets them monitor the performance of their buildings.

Other capabilities have been incorporated to provide a smart building solution. These include vehicle activity monitoring and dock usage, along with third-party technologies for mains electricity usage monitoring and solar power generation data.

Providing controls gives FW Thorpe more differentiated products to sell and makes it harder for contractors to substitute cheaper light fittings once specifiers have decided they want the functionality.

In just four years SmartScan has become a major money spinner, earning £26 million in revenue in 2020, nearly 40% of Thorlux’s total and nearly 25% of the whole group’s. Thorlux is FW Thorpe’s original brand and biggest business.

In 2015, the year before Thorlux introduced SmartScan, it earned revenue of £54 million, £12 million less than in 2020. Though Thorlux has always sold controls, it seems they are becoming a more significant revenue earner.

Expanding overseas

The company has also been stealthily expanding overseas, which helps it supply multinationals and gives it products that fit local markets. It also provides new export markets for Thorlux and new products and capabilities.

In 2020 FW Thorpe earned 30% of its revenue abroad, compared to 10% in 2010, partly from overseas offices in Ireland, Germany, the United Arab Emirates and Australia and partly through buying Lightronics (2015) and Famostar (2018) in the Netherlands and a stake in Luxintec (2016), a Spanish company.

Lightronics, best known for its vandal-resistant lighting, has become something of a test-case for export-led growth and FW Thorpe’s patient approach. Five years on from the acquisition it only sold £0.4 million worth of Thorlux industrial lighting in 2020. The company says it has yet to find the best route to market.

While they work on synergies, though, the overseas companies have grown in their own right.

Shifting sectors

Thorlux is maintaining its focus on healthcare and logistics, where demand should hold up, as well as retail, but it is making more effort in education where there are still plenty of fluorescent lights to replace.

- Shares for the future: upgrades and downgrades

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It warns that finding new markets to replace those where investment falls will take time, and certain very large scale projects may require it to offer volume discounts which will reduce operating margins, or offer services like installation and surveys, which attract only a small mark-up but may also bump-up the value of subsequent orders.

On the other hand, FW Thorpe already has its fingers in many pies. Thorlux supplies a wide range of internal and external lighting and control systems designed for railway stations, warehouses, factories, offices, shops, restaurants and schools.

The company also owns specialist businesses that manufacture emergency exit lights, clean room lighting equipment, sign lighting, lighting for roads and tunnels, street lights and LED lighting solutions for vehicles, including emergency vehicles.

Family culture

FW Thorpe aims to distinguish itself through innovation and customer service through the lifetime of the product. Customers want to know the company will still be around to provide spares and upgrades.

FW Thorpe’s strong balance sheet is a competitive advantage, along with its commitment to innovation and finding new markets. This is unlike Dialight, another well-known UK listed LED lighting company, which has struggled to diversify from its heavy industrial niche.

FW Thorpe is a family-owned business that prides itself on its long-term ethos and the training, retention and promotion of staff.

Scoring FW Thorpe

I like companies that are straight with investors about their prospects and spell out how they plan to make more money. FW Thorpe’s annual report does exactly that, which makes scoring it relatively straightforward.

Does the business make good money? [2]

+ Decent return on capital, return on sales, cash conversion

What could stop it growing profitably? [1]

+ Extremely strong finances, pension scheme in surplus

? Big multinational competitors extending UK footprint

? LED upgrades brought forward replacement cycle, hangover could follow

How does its strategy address the risks? [2]

+ Innovation addresses competition, expands market

+ So does international expansion

+ Shifts between markets opportunistically

Will we all benefit? [2]

+ Family-owned business invests for long-term

+ Motivates, trains, retains and promotes staff

+ Annual report is very informative for shareholders

Is the share price low? [0]

+ A share price of 295p values the enterprise at about £300 million, about 20 times adjusted profit

Shares in FW Thorpe are not obviously cheap, but it is a very good business. I think it is suitable for long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.