Shares for the future: upgrades and downgrades

In light of Covid-19, Richard Beddard rejigs the Decision Engine – which firms have been downgraded?

2nd October 2020 14:52

by Richard Beddard from interactive investor

In light of Covid-19, Richard Beddard rejigs the Decision Engine – which firms have been downgraded?

Before I rank all the shares in the Decision Engine table this month, I need to change some of the scores by which the shares are ranked. This is a breach of protocol.

Normally, I score a share once a year as soon as possible after the company has published its annual report, and that is that. The first four elements of the score: profitability, risks, strategy, and fairness remain the same for a year or so.

Despite the fixed element in the scores, the rankings change every time we publish the table because I re-score up to five shares a month. Also, there is a variable element to the score, value, which fluctuates all the time as share prices move up and down.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

I rarely re-score in between annual reports because it is exhausting constantly re-evaluating shares, I need to make time to find new shares to evaluate, and usually short-term changes of fortune do not much impact the long-term criteria I evaluate.

Changes in a company’s average profitability only become apparent over many years, risks build and dissipate slowly, strategies take time to play out and corporate cultures that treat staff, shareholders, customers and suppliers well can last generations.

The pandemic, though, has dramatically changed the prospects of some companies over the short and medium term, and while I am mainly interested in whether they will prosper over 10 years or more, they have to survive to reach that goal.

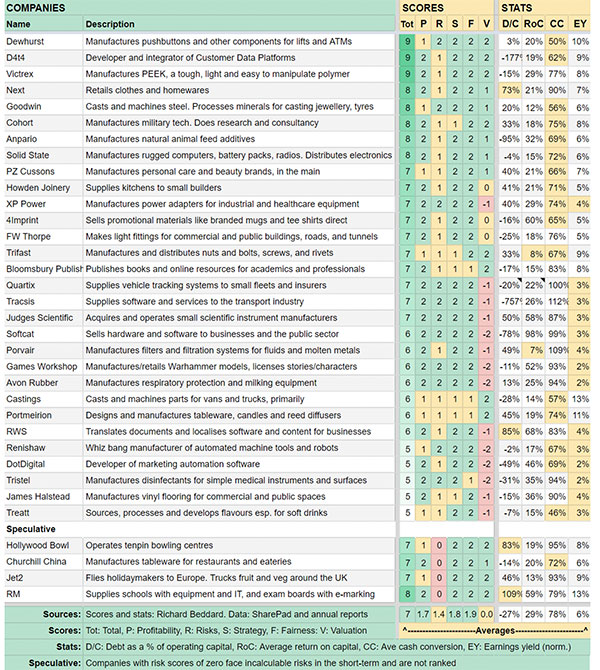

There is a small subset of Decision Engine members that I cannot just assume will survive and ultimately prosper in a way that benefits shareholders, even though they have been terrific businesses. The Decision Engine helps assess if a list of 34 firms are cheap or not.

Either the impact of the pandemic on them is disproportionate, or their financial positions going into the pandemic were less than ideal, or both.

I have dealt with most of these situations in the regular annual reviews, since it became obvious how serious things are. I gave Churchill China (LSE:CHH), Jet2 (LSE:JET2), Next (LSE:NXT), and RM (LSE:RM.), admirable companies all of them, a score of zero for risks because I did not feel I could form an opinion on the short and medium term.

Downgrading Hollywood Bowl

I feel the same way about Hollywood Bowl (LSE:BOWL), which I scored in the very early days of the pandemic and normally would not score again until next year. Hopefully temporarily, I have decided to reduce its risk score to zero, too.

Hollywood Bowl has many virtues, principally a disciplined formula for acquiring, opening and refurbishing bowling alleys executed well by its current managers.

But it is risky for two reasons, in addition to the fact that the pandemic initially closed bowling alleys down and social distancing has reduced how many people can bowl now.

Hollywood Bowl only floated in 2016 and its relatively short history means we haven’t witnessed how it has performed during a big recession.

Also, the company was, relative to the other companies I follow, one of the most dependent on outside finance (leases in the main, but also bank debt) going into the financial crisis.

Since then revenues have collapsed, the company has taken on more debt and although furlough money, agreements with landlords, curbed capital expenditure, a share placing and other measures have reduced costs and brought in cash, I cannot assume Hollywood Bowl’s financial position will be acceptable to me in six months or two years’ time.

Upgrading Next

Next published a mammoth half-year results statement last week and, in the first paragraph, chief executive Simon Wolfson wrote a sentence that should be framed and mounted in the boardroom of every listed company.

Source: Sharepad

To digress, I would add that the same should be said of investors. If we cannot explain how a business makes money, what the risks are, and how it plans to make more, we probably don’t understand the business. Ditto financial writers.

Next’s openness, as it wrestles with competition from internet-only retailers while it has itself changed into a predominantly internet retailer, is the main reason I follow the firm.

But perhaps unlike Hollywood Bowl, Next’s internet operations gave it a plan B. It will make less money in the year to January 2021 than in the year to January 2020, but the company says it will make some profit under any of the scenarios it envisages, both in accounting and cash terms, and that along with cost savings it will be less indebted.

The pandemic has been a test of Next’s internet strategy and it is passing the test. The internet is ensuring the company’s survival. And its ambitious plans to use its copious infrastructure to help other retailers by powering their internet and fulfilment activities reached a milestone in the first half-year, when its first partner site, Childsplay Clothing, went online.

I think I was too harsh on Next, and have raised its risk score back up to 1.

This month’s table

The purpose of the Decision Engine is to inform the trades I make in the Share Sleuth portfolio, which is also updated monthly on interactive investor shortly after this article is published.

Because companies such as Churchill China, Jet2 and the rest are first-rate in pretty much every category I score except the peculiar circumstances of their susceptibility to the pandemic, their overall scores are still high enough to consider investing.

But since I cannot form a view on the risks, such an investment would be speculative. I would be gambling that these companies will survive in a form that will allow shareholders to prosper as the pandemic recedes and they resume their high-quality operations.

If I were a betting man, I would take that gamble, but I am not, so as far as the Share Sleuth portfolio goes I will not trade shares that score zero for risk until I am more confident in their prospects.

I am overriding my own system until I know more. And because I am treating these shares differently to the others, I have changed the way they are presented in the table.

They are now collected at the bottom under the heading “Speculative” and ordered alphabetically, not by their speculative scores.

I cannot tell you how much I detest this kludge. Simplicity is my watchword and bifurcating the table is the opposite of simplicity.

The pandemic has complicated life in so many ways and it seems it is no different for those of us following investing systems.

Since the last Decision Engine update, I have scored or re-scored four shares highlighted in bold in the table below.

| Name | Description | Latest profile |

|---|---|---|

| 4imprint (LSE:FOUR) | Sells promotional materials such as branded mugs and T-shirts direct | |

| Anpario (LSE:ANP) | Manufactures natural animal feed additives | https://bit.ly/swANP2020 |

| Avon Rubber (LSE:AVON) | Manufactures respiratory protection and milking equipment | https://bit.ly/swBMY2020 |

| Bloomsbury Publishing (LSE:BMY) | Publishes books and online resources for academics and professionals | http://bit.ly/swBMY2019 |

| Castings (LSE:CGS) | Casts and machines parts for vans and trucks, primarily | https://bit.ly/swCGS2020 |

| Cohort (LSE:CHRT) | Manufactures military tech. Undertakes research and consultancy | http://bit.ly/deCHRT2020 |

| D4t4 (LSE:D4T4) | Developer and integrator of Customer Data Platforms | https://bit.ly/swD4T42020 |

| Dewhurst (DWHT) | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| dotDigital (LSE:DOTD) | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| FW Thorpe (LSE:TFW) | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| Games Workshop (LSE:GAW) | Manufactures/retails Warhammer models, licenses stories/characters | http://bit.ly/swGAW2020 |

| Goodwin (LSE:GDWN) | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| Howden Joinery (LSE:HWDN) | Supplies kitchens to small builders | http://bit.ly/sw2020HWDN |

| James Halstead (LSE:JHD) | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

| Judges Scientific (LSE:JDG) | Acquires and operates small scientific instrument manufacturers | https://bit.ly/swJDG2020 |

| Next (LSE:NXT) | Retails clothes and homewares | https://bit.ly/swNXT2020 |

| Portmeirion (LSE:PMP) | Designs and manufactures tableware, candles and reed diffusers | https://bit.ly/swPMP2020 |

| Porvair (LSE:PRV) | Manufactures filters and filtration systems for fluids and molten metals | http://bit.ly/dePRV2020 |

| PZ Cussons (LSE:PZC) | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| Quartix (LSE:QTX) | Supplies vehicle tracking systems to small fleets and insurers | https://bit.ly/swQTX2020 |

| Renishaw (LSE:RSW) | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/deRSW2020 |

| RWS (LSE:RWS) | Translates documents and localises software and content for businesses | https://bit.ly/swRWS2020 |

| Softcat (LSE:SCT) | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| Solid State (LSE:SOLI) | Manufactures rugged computers, battery packs, radios. Distributes electronics | https://bit.ly/swSOLI2020 |

| Tracsis (LSE:TRCS) | Supplies software and services to the transport industry | https://bit.ly/sw2020TRCS |

| Treatt (LSE:TET) | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2020 |

| Trifast (LSE:TRI) | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/deTRI2020 |

| Tristel (LSE:TSTL) | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| Victrex (LSE:VCT) | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2020 |

| XP Power (LSE:XPP) | Manufactures power adapters for industrial and healthcare equipment | https://bit.ly/swXPP2020 |

| Speculative | ||

| Hollywood Bowl (LSE:BOWL) | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| Churchill China (LSE:CHH) | Manufactures tableware for restaurants and eateries | https://bit.ly/swCHH2020 |

| Jet2 (LSE:JET2) | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/deJET22020 |

| RM (LSE:RM.) | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2020 |

Richard owns shares in Hollywood Bowl, Next, and many of the shares ranked by the Decision Engine. His aim is to own more of the shares near the top of the list than those near the bottom!

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.