Richard Beddard: this long-term investment could become a short-term trade

7th October 2022 14:07

by Richard Beddard from interactive investor

Record revenue and profit plus a rock-solid balance sheet make this one of Richard’s favourite stocks, but there’s more to this multi-billion-pound tech firm.

There is a charming anecdote in the timeline contained in Renishaw (LSE:RSW)'s annual report.

The timeline starts in 1973 with the launch of the company’s first commercial probe, the TP1. Early production took place in the home of one of its two founders, and the dust seals were made from the underlay of the other founders’ carpet.

David McMurtry, the owner of the carpet, remains Renishaw's executive chairman and largest shareholder, and John Deer, the owner of the house, is its deputy chairman and second-largest shareholder.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

The company they co-founded earned a record £671 million revenue in the year to June 2022.

Manufacturing technology

Renishaw makes manufacturing technology. Its products co-ordinate measuring systems and gauges that measure components, probes used on machine tools such as lathes and milling machines, and encoders that feed back the position of machines in order to calibrate and control them.

One of Renishaw’s big new launches in the year to June 2022 was an ultrasonic probe for REVO, the company’s market leading coordinate measuring system. Most probes rely on touch, which makes it difficult to inspect the inside of hollow parts like drive shafts and aerospace blades, a problem Renishaw has solved without adding additional equipment and stages to the manufacturing process.

The company also makes Additive Manufacturing (AM) machines, 3D printers that manufacture shapes too complex for other metal manufacturing processes like casting, forging and machining.

Manufacturing technology earned Renishaw 95% of its revenue in the year to June 2022 and 96% of its adjusted operating profit.

The remainder came from a second division. It makes Raman microscopes, which are machines that analyse the chemical structure of materials in pharmacology, geology and batteries. It also makes healthcare devices like surgical robots and robotic drug delivery systems for people with degenerative neurological conditions.

Record year

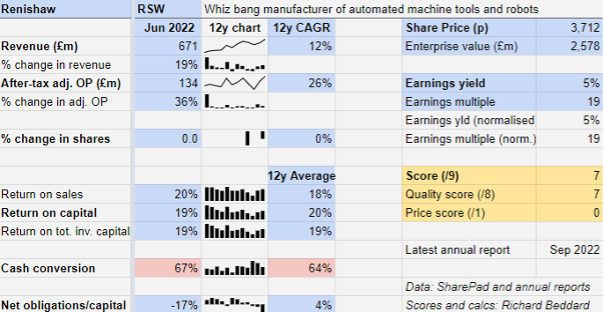

Mostly thanks to booming sales of manufacturing technology, Renishaw earned record revenue and profit in the year to June 2022, while achieving a return on capital close to the company’s 20% long-term average.

Even cash conversion, which is generally held back by investment, was slightly ahead of average.

Since the year-end though, Renishaw says orders have weakened from semiconductor and electronics equipment makers, one of its biggest sectors, and market sentiment generally is becoming more cautious.

While the averages are excellent, there is quite a bit of variation in Renishaw’s results from year to year. Profitability blows hot and cold because its customers supply cyclical industries.

The company's balance sheet, though, is rock solid.

Transforming Tomorrow

Research and Development is perhaps Renishaw’s signature strategy.

The company innovates to make its tools more precise, more flexible, and easier to use, and as it moves into adjacent markets and makes its products compatible with third party software. It has nearly 1,800 patents.

It is expanding its research teams in materials science, artificial intelligence and Application Specific Integrated Circuit (ASIC) design.

In 2022, R&D increased in absolute terms but fell as a proportion of revenue for the fourth straight year to 9%, half the level the company achieved in 2019. This trend may have been exacerbated in 2022 by component shortages, which required Renishaw to divert design engineers working on new products to redesign old ones to incorporate alternative components.

Nine per cent is still a decent commitment to innovation, though further reductions might bring into question Renishaw's ability to stay at the forefront of technology.

The company says it is extracting more from less by focusing on flagship products, those that promise the greatest or swiftest returns, products like the RenAM500Q 3D printing platform.

- Share Sleuth: the undervalued pandemic winner I’ve been buying

- Why FTSE 100’s second-biggest company is a bargain

- Three reasons to own UK blue-chip shares

It expects the RenAM500Q to hurry the adoption of 3D printing as a mainstream volume manufacturing method.

Most of the R&D and some manufacturing happens in the UK (Renishaw has earmarked £64 million to expand a facility at Miskin in Wales), but the company also operates manufacturing sites in Ireland and India and sales offices around the world.

In a sense, Renishaw is one of its own customers. It uses advanced manufacturing technology to manufacture advanced manufacturing technology using a process control system, RAMTIC (Renishaw Automated Milling, Turning and Inspection Centre) that it developed in 1992. What it does not learn from its own experience, it learns from customers through its many sales offices.

This vertical integration creates virtuous circles as customer feedback and manufacturing inform new developments. Along with operational gearing, vertical integration enabled the company to keep profit margins stable in 2022, despite rising costs due to component shortages.

Here too though, the company has been walking back from very high levels of expenditure. Last year, Renishaw planned to streamline its vertically integrated sales network.

This year, the company reports 65 “key locations”, compared to 79 sales offices in 2021. The terminology makes it difficult to know, but the difference may be closed offices.

Rationalisation is a good thing as long as Renishaw can still provide excellent engineering support to customers.

Together

The ultimate enabler of a strategy based on innovation and know-how is fostering and retaining it.

As well as the company’s venerable chairman and founder, Renishaw has very experienced executives and promotes from within, which is a sure way of maintaining and propagating a good culture.

The company says it recruited a record number of apprentices and graduates during the year, and as a demonstration of how far one of the more than 200 apprentices Renishaw currently employs can go, its chief executive Will Lee joined as a sponsored student.

Although voluntary employee turnover shot up to 10.7% during the year, the company explains that the labour market is unusually active post-pandemic, and it is modernising pay and rewards to encourage people to stay.

Renishaw makes manufacturing more efficient, reducing waste and energy costs. Like many companies, it is embracing net-zero targets under “Responsible Renishaw”, an initiative to guide employees.

One thing that could confound a long-term investment in Renishaw is that it may not remain listed.

Last year, the company’s elderly founders decided to sell their 53% interest, which prompted the company to put itself up for sale.

Although it failed to find a buyer and its founders recommitted themselves to the business for the foreseeable future, a change of ownership seems inevitable as both men are in their 80s.

We could find that our long-term investment has turned into a short-term trade, and the terms of that deal, I suppose, would depend on the circumstances at the time.

Scoring Renishaw

In this year’s annual report, Renishaw has developed a penchant for alliterative three- and four-word slogans.

Transforming Tomorrow Together is its purpose, which alludes to the future products, materials and therapies it is working with its customers to make.

To meet the exacting demands of modern manufacturing and healthcare it believes it must deliver precision, productivity and practicality.

And it can best do that if its employees share the common values of innovation, integrity, inspiration and involvement.

It is tempting to treat such slogans as guff, but I have visited Renishaw’s famous innovation centre, read the annual reports, and marvelled at the machines, and I believe all of these words describe Renishaw.

They add up to a long-term approach, both in development of products and in the cultivation of customers.

The demand for more precision, and more automation, are unlikely to go away as products become more complex, part tolerances become tighter, and manufacturers seek to ameliorate high labour costs and skill shortages.

Does the business make good money? [2]

+ High but variable return on capital

+ Ditto, profit margin

+ Decent cash conversion considering levels of investment

What could stop it growing profitably? [2]

+ Sensitive to economic cycles but has very strong finances

+ Reputation, patents and know-how, resists competition

How does its strategy address the risks? [2]

+ Innovation

+ Vertical integration

+ Scientific and medical products are less cyclical and may become more significant

Will we all benefit? [1]

+ Very experienced management

+ Puts employees first

− Uncertainty about ownership

Is the share price low relative to profit? [0]

+ It is a fair price. A share price of £37.12 values the enterprise at about £2.6 billion, about 19 times normalised profit.

A score of 7 out of 9 indicates Renishaw is a good long-term investment.

It is ranked 15 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Renishaw.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.