Share Sleuth: the undervalued pandemic winner I’ve been buying

6th October 2022 11:01

by Richard Beddard from interactive investor

With some cash to spend Richard Beddard has added more shares in a firm that’s seen its competitive position enhanced following the pandemic.

Since the last Share Sleuth update at the beginning of September I have added more shares to the portfolio’s holding in timber importer and distributor James Latham (LSE:LTHM).

I scored Lathams in August and it currently scores 8 out of 9. Any share that scores 7 or more is undervalued to my mind.

Adding more James Latham

James Latham is a long-established business that delivered freak results during the pandemic because it was able to supply customers when other suppliers could not. As the nation’s leading distributor, it could still source timber at a time of acute shortage because it was a valuable customer of multiple suppliers.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

Like most businesses, joiners and shop-fitters probably appreciate a reliable source of supply now more than ever.

Last year’s result is not a new normal though. It will have gained the loyalty of more customers but it will not sustain the return on capital of 38% it achieved in the year to March 2022, nearly three times its 14% long-term average.

Profit will fall in 2023 as the company’s dependable long-term growth trend begins to re-establish itself. But I think the share price undervalues those prospects, and it is exiting the pandemic with its competitive position enhanced.

On Tuesday 27 September I added 350 more shares taking the portfolio’s James Latham holding to 750 shares. The price, quoted by a broker, was £11.39 and the total cost was £3,996.50, after deducting £10 in lieu of fees.

The trade was a fraction above my minimum trade size of 2.5% of the value of the portfolio. It was funded by dividends, and money realised from a reduction in the portfolio’s holding in Solid State (LSE:SOLI) last month.

Passing on Anpario...

I might also have added shares in Anpario (LSE:ANP), a natural animal feed additive manufacturer, and Marks Electrical Group Ordinary Shares (LSE:MRK), an online retailer of fridges, cookers, washing machines and TVs.

The three shares had two things in common. They all scored 8 out of 9, and they were all underrepresented in the portfolio, which had modest holdings in Anpario and Lathams, and no holding in Marks Electrical.

Despite the announcement of a contraction in profit during the first half of Anpario’s financial year that sent the share price skidding down 25%, I am still confident in the investment.

Farming is a fickle business and Anpario shareholders are accustomed to growth coming in fits and starts. Farmers are struggling due to high energy prices, which means they have less to spend on nutritional supplements at a time when the costs of raw materials and shipping is rising.

The company has raised prices, and profitability is improving but reading between the lines of the half-year results it seems Anpario would consider matching last year’s profit for the full year a good outcome.

- Share Sleuth: taking profits from this almost-perfect firm

- Why UK smaller company funds are under the cosh

- Watch our video: Harry Nimmo’s six tips for stock picking success

I think this stumble is a result of unstable business conditions and, thanks to the sell-off, we have an opportunity to buy the shares cheaply for the long term.

I did not take the opportunity because I restrict the portfolio to one trade a month and in the tiebreak situation, James Latham won.

It was Anpario’s status as a supplier to the meat farming industry, a major source of carbon emissions, that was the sticking point. Anpario benefits as wealthier populations in developing countries eat more meat, but eating more meat is not good for the environment and many of us in wealthier countries are eating less.

This creates a conflict that I may not have properly thought through when I scored Anpario, and when it came to committing more of the portfolio’s money, I choked.

...And Marks Electrical

Marks Electrical is a share I have considered adding to the portfolio many times this year because it is such a distinctive business.

What troubles me each time is the company’s short track record as a listed firm. Marks Electrical floated less than a year ago in November 2021.

A short track record means the historical data cannot tell us much about how the company performs through thick and thin. As an online retailer, Marks Electrical experienced a surge in demand during the pandemic when rival stores were closed, and people did not want to visit them.

When I scored Marks Electrical, I recognised it would not necessarily sustain the high levels of profitability it was achieving, but I should have paid more attention to something else.

To remain invested for the long term, we require the company to remain listed.

Mark Smithson, the company’s founder, still owns 74% of the shares, which, combined with the 1.9% shares of each of his two sons, is more than enough to vote the company private.

Generally, founders and their families are a good reason to invest in a business. Owner operators are committed to building businesses for the long-term because they have the most to gain. If they have co-existed with other shareholders for a long time, we can perhaps be confident they are committed to their listings.

Nothing I have read suggests Mr Smithson would take his business private, but Marks Electrical has had a difficult debut. The company has performed well, but the shares have declined 50% in its first year on the stock market. The shares look cheap to me, and they might look cheap to him too.

Perhaps Marks Electrical was an idea that came to me too early.

Portfolio performance

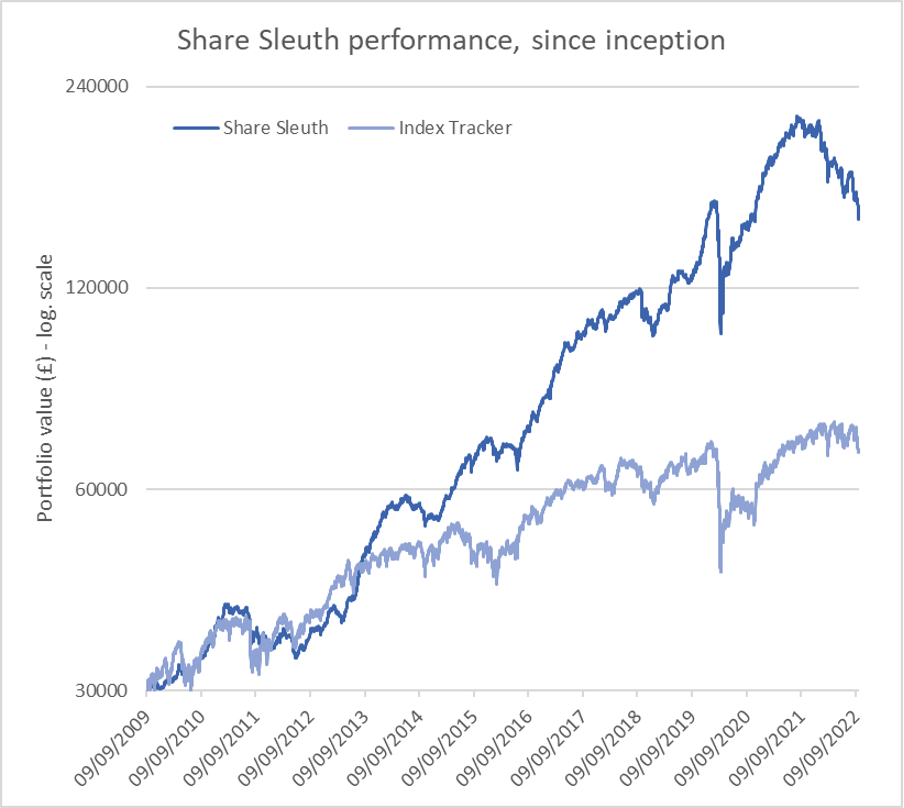

The terror continues. At the close on Monday 3 October, the Share Sleuth portfolio was worth £152,474, 408% more than the £30,000 of pretend money I started with in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £68,196, an increase of 161%.

Past performance is not a guide to future performance.

After this month’s trade and dividends paid by 4imprint Group (LSE:FOUR), Games Workshop Group (LSE:GAW), Garmin Ltd (NYSE:GRMN) and Quartix Technologies (LSE:QTX), the cash balance is £1,847.

That is insufficient to fund a purchase at my minimum trade size of 2.5% of the portfolio’s total value (£3,800).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 1,847 | ||||

Shares | 150,627 | ||||

Since 9 September 2009 | 30,000 | 152,474 | 408 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 4,665 | 15 |

BMY | Bloomsbury | 1,681 | 5,915 | 6,152 | 4 |

BNZL | Bunzl | 201 | 4,714 | 5,572 | 18 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,117 | -14 |

CHH | Churchill China | 682 | 8,013 | 8,798 | 10 |

CHRT | Cohort | 1,600 | 3,747 | 6,920 | 85 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,629 | 3 |

DWHT | Dewhurst | 532 | 1,754 | 5,480 | 212 |

FOUR | 4Imprint | 190 | 3,688 | 6,536 | 77 |

GAW | Games Workshop | 148 | 4,709 | 8,651 | 84 |

GDWN | Goodwin | 266 | 6,646 | 7,328 | 10 |

GRMN | Garmin | 53 | 4,413 | 3,782 | -14 |

HWDN | Howden Joinery | 2,020 | 12,718 | 10,375 | -18 |

JDG | Judges Scientific | 85 | 2,082 | 6,035 | 190 |

JET2 | Jet2 | 456 | 250 | 3,130 | 1,152 |

LTHM | James Latham | 750 | 9,235 | 8,213 | -11 |

NXT | Next | 106 | 6,071 | 5,126 | -16 |

PRV | Porvair | 906 | 4,999 | 4,530 | -9 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,605 | -7 |

QTX | Quartix | 1,085 | 2,798 | 3,418 | 22 |

RSW | Renishaw | 92 | 1,739 | 3,270 | 88 |

RWS | RWS | 1,000 | 4,696 | 3,202 | -32 |

SOLI | Solid State | 356 | 1,028 | 3,585 | 249 |

TET | Treatt | 763 | 1,082 | 4,372 | 304 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 6,960 | 215 |

TSTL | Tristel | 750 | 268 | 2,475 | 823 |

TUNE | Focusrite | 400 | 4,530 | 2,840 | -37 |

VCT | Victrex | 292 | 6,432 | 4,917 | -24 |

XPP | XP Power | 240 | 4,589 | 3,946 | -14 |

Table notes

September: Added to James Latham

- Costs include £10 broker fee, and 0.5% stamp duty where appropriate

- Cash earns no interest

- Dividends and sale proceeds are credited to the cash balance

- £30,000 invested on 9 September 2009 would be worth £152,474 today

- £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £68,196 today

- Objective: To beat the index tracker handsomely over five-year periods

- Source: SharePad, 3 October 2022

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the shares in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.