Richard Beddard: my biggest stock is still one to own

19th May 2023 15:06

by Richard Beddard from interactive investor

This company is worth more than any other in our columnist’s portfolio and still scores enough points to make it a good long-term investment. Here’s why.

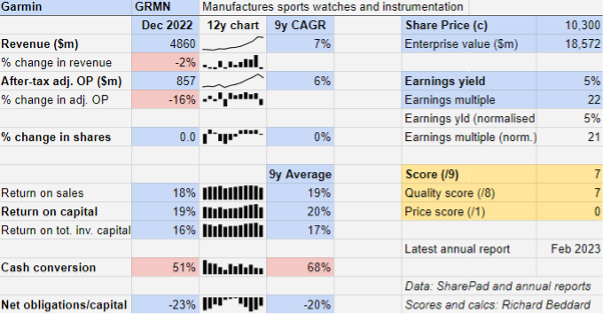

Garmin Ltd (NYSE:GRMN) has endured a Covid hangover, but its commitment to long-term investment is undiminished.

From fitness tracking to flight decks

If you know Garmin it is probably because before the smartphone it was most famous for making car satnavs. Or maybe you are sporty or outdoorsy and have one of its many watches.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Garmin is much more than a fitness and adventure watch maker. Indeed, it is much more than a watchmaker. It makes handheld navigation devices, bike trainers, golfing aids, dog trackers and training devices, integrated flight decks for aircraft and helicopters, marine chartplotters, displays, fishfinders, and autopilots, and infotainment systems for cars.

The common factor is the technology, which is wireless and incorporates location systems, sensors and integrated digital displays.

Covid hangover

In the year to December 2022, revenue declined 2%, a break in the long-term uptrend.

The decline was a hangover from bumper profits during the previous pandemic years when exercise boomed and people bought lots of fitness gear.

A sharp rise in the value of the US dollar against other currencies took 4% off revenue too.

Garmin operated less efficiently due to delays and cost increases because of shortages as the pandemic abated and war broke out. As a result, adjusted profit declined 16% in the 53-week year to December 2022

Shortages also required Garmin to buy more stock at higher prices, which hurt cash conversion. Nevertheless, it still had net cash at the year-end, something it has achieved in every year I have calculated (more than a decade).

Garmin remains resolutely profitable.

Survivor

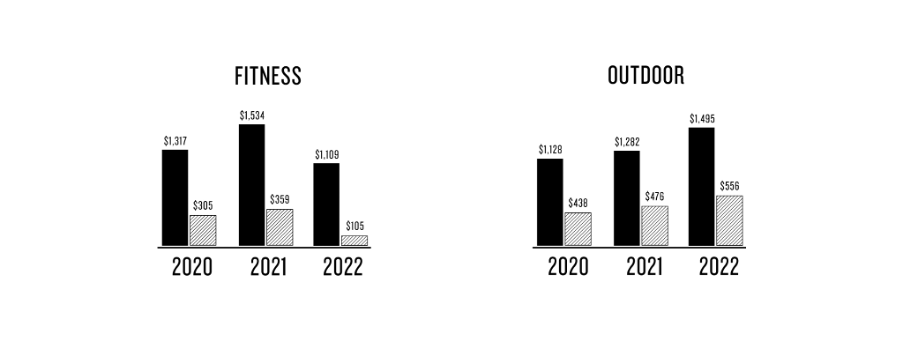

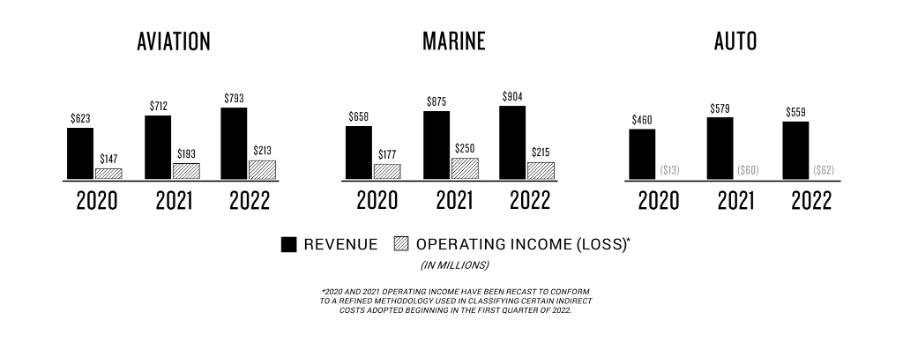

Garmin prospered when smartphones took away much of the satnav market 15 or so years ago because it was not a one-trick pony. Today it operates five business segments: Auto, Aviation, Fitness, Marine and Outdoor.

Source: Garmin annual report, 2022

Although the company has many rivals, they do not compete in more than one segment. Apple Inc (NASDAQ:AAPL), which makes smartwatches, does not make flight decks, and Jeppesen (a subsidiary of Boeing (NYSE:BA)) and Thales (EURONEXT:HO), which make flight decks, do not make smartwatches.

Garmin’s focus comes not, evidently, from the markets it serves, but the technology in the devices it makes. In this the company is an expert, having developed products that use the Global Positioning System (GPS) since the technology was declassified by the US government in the 1980s.

Within Garmin’s commendable performance is a business that is detracting from it, though.

Consumer Auto, satnavs for motorists, bikers, truckers, and off-road vehicles, is just about profitable, but the company has invested for over a decade to become a supplier of infotainment components and systems to car manufacturers and their suppliers.

These systems incorporate entertainment, digital instrument clusters, heads-up displays and navigation systems.”

It is BMW’s lead supplier, and it also counts Toyota, Honda and Mercedes as customers. Apparently, this is not enough. The division is loss-making and still investing heavily to win more contracts and prosper.

Glass half-full, Garmin will make OEM (Original Equipment Manufacturer) Auto a success even though revenue declined by 4% in 2022, and it expects the division to lose money again in 2023.

- Shares for the future: how I would set up a new portfolio step by step

- Bill Ackman unveils new position in Google parent Alphabet

- Warren Buffett reveals his biggest holdings including UK’s Diageo

The other challenged segment in 2022 was fitness. Revenue declined 28% and operating profit margin was just under 9%, much lower than the 37% achieved by the Outdoor segment after very successful adventure watch launches.

One of those launches, the fēnix® 7 adventure watch, will go into space on the first manned flight of the SpaceX Starship.

Garmin has been a beneficiary of the boom in fitness tracking, but the sector is maturing and also contested by tech giants Apple and Alphabet (NASDAQ:GOOGL). The size of Apple’s watch business dwarfs the whole of Garmin.

While the strength of the opposition is awesome, the threat may loom larger than it is. Fitness is one part of the Garmin business, and it is a different business from its bigger competitors.

Garmin approaches markets from the bottom up, creating products for enthusiasts and professionals. The emphasis is on ruggedness, long battery life, reliability, usability in the cold and the wet, or scorching temperatures and brilliant light. This is what differentiates a Garmin, say, and the general purpose Apple Watch.

In the first quarter of the new financial year, growth returned to the fitness division, although that was more than offset by declines in the bigger Outdoor segment, as sales of adventure watches declined after last year’s banner year.

Garmin’s determination to keep investing is evident in the company’s Research and Development (R&D) spend. It has amounted to 16 to 17% of revenue in each of the last three years, and the company holds a total of over 1,800 patents.

Investment, and the fact that Garmin operates its own factories, means it can bring a multitude of products to market quickly. These new products are the basis of future profitability.

Scoring Garmin

Garmin wants to be an enduring company by creating superior products. I believe its products and track record show it is living up to this aspiration.

It was founded in 1984 by Gary Burrell (the “Gar” in Garmin) and Dr Min Kao (the “min”). Mr Burrell has passed away, but his son remains a major shareholder and board member and so does Dr Min Kao, who is executive chairman. Chief executive Clifton Premble joined Garmin in 1989 as a software developer.

Consistent management has probably fostered a unique culture, and capabilities.

- 10 great UK shares that Warren Buffett would pick

- Stockwatch: this billion-pound business has real momentum

But there are a couple of wrinkles in the investment case.

There are many advantages to manufacturing in Taiwan, where Garmin manufactures high volume products. It is probably cheaper to manufacture there than it would be at home. Taiwan is closer to suppliers, and the company has a huge investment in four facilities and a trained workforce.

Taiwan is a geopolitical hotspot claimed by China, though. Disruption due to escalating tension could be significant, and catastrophic in the event of war, but Garmin remains committed.

There is also a technical wrinkle. Garmin is listed in the US but headquartered in Switzerland.

It pays the dividend to overseas investors from reserves, which means we do not have to pay withholding tax levied on dividends.

However, the reserves will eventually run out, the rules might change, or Garmin might change its dividend policy. Then overseas investors would have to negotiate with the Swiss authorities or suffer a withholding tax on dividends.

My view is most of the returns from an investment in Garmin will come from growth, and worst case, an unwelcome tax on the dividend would probably not put me off the investment.

Does the business make good money? [2]

+ High Return on capital

+ High Profit margin

? Decent average cash conversion

What could stop it growing profitably? [2]

+ Financially strong

+ Niche products resist competition

? Location of volume manufacturing in Taiwan

How does its strategy address the risks? [1]

+ Heavy investment in R&D

+ Vertical integration

− No sign of Garmin reducing its Taiwan dependency

Will we all benefit? [2]

+ Very experienced management

+ People focus

? Swiss domicile

Is the share price low relative to profit? [0]

+ It is about right. A share price of $103 values the enterprise at $18.5 billion, about 21 times normalised profit.

A score of 7 out of 9 indicates Garmin is a good long-term investment.

It is ranked 23 out of 40 shares in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Garmin.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.