Richard Beddard: a new score for my top 10 company

Shares in this British high-tech business haven’t been this low for over three years, but our columnist likes the company and, using his new scoring system, gives it a solid 9 out of 10.

10th November 2023 15:27

by Richard Beddard from interactive investor

Fifty years ago, Renishaw (LSE:RSW) launched the TP1 touch-trigger probe, now the most common probe used in coordinate measuring machines (CMMs).

CMMs are machine tools used on production lines to measure qualities like the geometry and surface finish of components, often to test whether they conform to the specification.

Since then, the company has expanded the product range to include full blown CMMs and other measuring machines, position encoders used to control all manner of machines and robots, high volume 3D printers and surgical robots.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

One of its latest innovations, Renishaw Central, is a smart factory software platform, which collects data from machines across facilities and allows engineers to update machining and quality-control parameters remotely.

Products like these have enabled Renishaw to grow profitably under its own steam into a near £700 million revenue business.

Precision and automation

The bulk of Renishaw’s revenue - 94% of total revenue in 2023 and 98% of profit - comes from manufacturing technologies, which bring precision and automation to the manufacturing process.

Precision is important to manufacturers because the products Renishaw’s end-customers make are shrinking and simultaneously becoming more complex. Automation increases productivity and reduces the need for skilled workers, who are in increasingly short supply.

Renishaw brings 50 years of innovation to bear on the design process, and it eats its own cooking. Its in-house manufacturing automation platform, RAMTIC, was initially developed over 30 years ago. The company says every product developed since has been conceived around it.

Manufacturing in house is an example of vertical integration, a policy that also extends downstream to sales. Renishaw has offices in 36 countries.

Vertical integration sets up virtuous circles. For example, by using its own tools Renishaw’s engineers not only learn how to improve them, but manufacturing is more efficient and less wasteful.

- Share Sleuth: better to buy high-quality firms amid recession fears

- Stockwatch: can UK retail sector withstand fall in money supply?

Automation reduces the cost of running factories below capacity during downturns and allows Renishaw to ramp up production quickly when business recovers, satisfying customers more quickly than competitors.

By locating sales offices near machine builders and distributors, who buy the probes and encoders, and manufacturers of other products who buy complete machines, it provides better service than relying on distributors alone.

In turn this means it sells more and learns more from customers and retains their business for longer. The customer that bought the first TP1 probe Renishaw sold is still a customer today.

Risk and reward

Renishaw’s products are in high demand when business is booming and factories are tooling up, but demand dries up when industries go into recession.

The encoders are used extensively in the semiconductor industry to control machines that manufacture silicon wafers and cut silicon chips.

Long term this is a high-growth market because of the increasing use of electronic components and sensors in things we use every day like cars and consumer goods.

In addition, the concentration of semiconductor manufacturing in Taiwan, a country claimed by China, is driving other industrialised economies to manufacture semiconductors closer to home. This is releasing a wave of new investment, although like all waves, it will probably be followed by a backwash.

During the financial year ending in June, though, Renishaw experienced a slump in optical encoder sales because of lower capital investment by semiconductor manufacturers. This left semiconductor machine manufacturers with a surplus of machines and Renishaw with fewer orders.

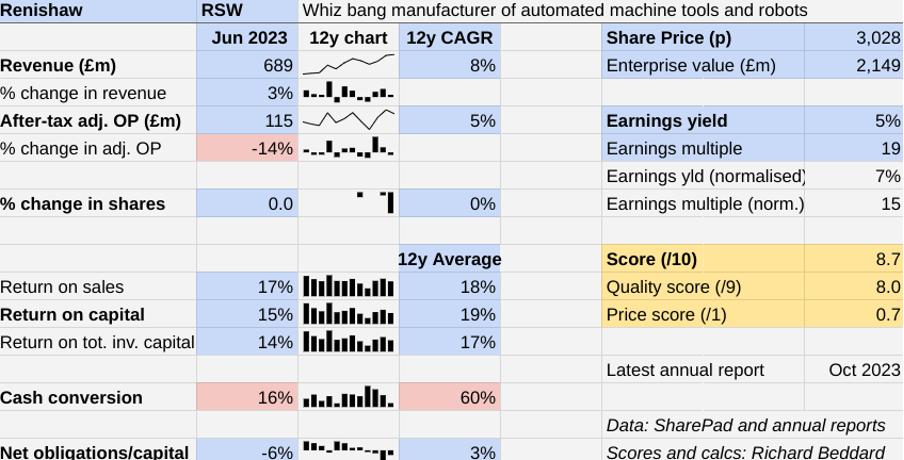

Revenue increased by 3% thanks to higher sales of other products and systems, but adjusted profit fell 14% due to higher labour costs.

- The Income Investor: two dividend stocks with capital growth potential

- Stockwatch: here’s what I’d do with BT shares

Cash conversion, the ratio of profit to cash flow, was only 16% due to investment, including the cost of enlarging Renishaw’s Miskin factory in Wales, and the rebuilding of stock after the pandemic shortages. Renishaw now has more encoders than customers need, and sales in the current year should release cash. High levels of capital expenditure will continue until the factory extension is complete in December.

It could have been worse. Since Renishaw supplies machine tools to a number of cyclical markets, including automotive, aerospace and consumer electronics, simultaneous downturns are a big worry.

Renishaw mitigates the risk by maintaining high cash balances and manufacturing efficiently so it can ramp up production rapidly when needed.

Although it has managed the risk very well in the past, remaining profitable and cash generative through thick and thin, we cannot eliminate the risk of catastrophe completely.

Events at XP Power Ltd (LSE:XPP), a company that supplies the semiconductor market with power converters, show how apparently strong businesses in cyclical markets can slip up. It had a robust looking investment-led strategy until high investment, acquisitions, an unexpected fine, and the weird trading patterns due to the pandemic combined to undermine its financial position.

Worsening relations with China are also restricting trade, which so far seem to be delaying Spectroscope deliveries, a small part of Renishaw’s business.

The Asia-Pacific region is Renishaw’s biggest market, so we need to keep an eye on geopolitical risk.

Meanwhile, as companies move operations around the World, Renishaw is following them. In 2023, it opened a technology centre in Bangalore, India.

Looking ahead

The company’s future depends on its ability to manage industrial cycles, while innovating to meet the increasingly exacting requirements of customers.

Research and development spending has fallen as a percentage of revenue in each of the previous four years (from 18% in 2019 to 9% in 2022), but it increased marginally as a proportion of slightly higher sales in 2023.

Perhaps it has found a new, and not insubstantial level. The company says it is getting more from less investment by focusing on flagship products, those that will result in revenue soonest, or are of most strategic importance.

The automation of manufacturing at Renishaw shifted the balance in staffing from keeping factories running to innovation and design, and Renishaw’s success has depended on its ability to recruit talented engineers attracted by a high-technology career.

Engineers, though, are in short supply, and in response to a spike in employee turnover in 2022 to nearly 11%, Renishaw increased pay by an average of over 10% in 2023. Employee turnover has fallen back down to below 7%, though the figure was below 6% in 2019.

This is, of course, money well spent as long as it helps maintain Renishaw’s competitive advantage.

Scoring Renishaw

I should also briefly mention Renishaw appears to be well on its way to being carbon neutral in terms of its own operations by 2028, and its annual report is illuminating.

I like Renishaw. Its founder and executive chairman David McMurtry, the inventor of the TP1, is a bit of a marmite figure in the City because he and co-founder and non-executive John Deer hold the majority of shares and control them through a voting agreement.

To my mind they have been great stewards and embody the company’s know-how, but they have already tried to retire once by putting the company up for sale in 2021. Although they did not find a buyer that met reportedly stringent conditions, and the directors affirmed their commitment for the foreseeable future, the two men are in their 80s.

The possibility of a long-term shareholding becoming a short-term one takes some shine off the investment if it is put up for sale again. While Renishaw’s market value is likely to grow significantly over the long term, it swings about wildly, and the company may not be in a position to control the timing.

This is the first time I have scored a share with my revised scoring system.

The Past (dependable) [2.5]

● Profitable growth: 8% revenue compound annual growth rate (CAGR) [1]

● Strong finances: Net cash since 2020 [1]

● Through thick and thin: Average return on capital (RoC) 19%, pandemic low 7% [0.5]

The Present (distinctive) [3]

● Discernible business: Vertically integrated, innovative [1]

● With experienced people: Experienced board, self-sufficient [1]

● That creates value for customers: Precision and automation [1]

The Future (directed) [2.5]

● Addressing challenges: Cyclical markets [1]

● With coherent actions: Automation, prudent finances [1]

● That reward all stakeholders fairly: Good stewardship, but uncertainty surrounds ownership [0.5]

The price (discounted?) [0.7]

+ Yes. A share price of £30.28 values the enterprise at about £2.1 billion, 15 times normalised profit.

A rounded score of 9 out of 10 indicates Renishaw is a good long-term investment.

It is ranked 10 out of 40 stocks in the Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Renishaw

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.