Share Sleuth: better to buy high-quality firms amid recession fears

Richard Beddard has cash to put to work, and having looked at all the potential options, there was one standout company.

8th November 2023 09:55

by Richard Beddard from interactive investor

In last week’s Decision Engine update, I noted that there was a record 31 shares scoring 7 or more out of 9, my benchmark for value. Now I know the reason why.

The Share Sleuth portfolio, a group of shares picked from the 40 scored and ranked in the Decision Engine, declined in value by about 8% in October (it has recovered a little bit since). In principle, this means good companies are cheaper.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Money to burn

With a cash balance of £9,890 when I sat down to think about trading on 1 November, Share Sleuth had more than enough money to fund two trades. The portfolio’s minimum trade size of 2.5% of its total size had shrunk in proportion with the portfolio to £4,130.

With money to burn, and a record number of shares qualifying for investment, you might have thought I would honour the age-old aphorism to be “greedy when others are fearful”, but being a cautious type, I restrict myself to a single trade.

My mantra is to be neither greedy nor fearful, but to keep on evaluating companies, improving the portfolio incrementally once a month by reducing a holding I have little confidence in or adding shares that I have lots of confidence in.

- Shares for the future: a record month and a new scoring system

- Richard Beddard: I want to believe in this speculative share

I should mention that this month there was an opportunity to reduce the size of a holding. Goodwin (LSE:GDWN), which I re-scored a few weeks ago, is one of the shares bucking the market. Its share price has gone up so much, the Decision Engine is telling me Share Sleuth owns too much of it.

I can live with that for a month or two. As a general rule, I like to keep the portfolio near fully invested, with just enough cash to make one addition at the minimum trade size.

Since I could add shares to the portfolio and maintain that level of cash, I was in buy mode.

Spoilt for choice

Of the 31 shares scoring seven or more out of nine, Advanced Medical Solutions Group (LSE:AMS) (score: 8), Focusrite (LSE:TUNE) (9), Quartix Technologies (LSE:QTX) (9), and RWS Holdings (LSE:RWS) (8) were technically unavailable because I prefer not to trade shares that I have already traded this year.

4Imprint (score: 7), Bloomsbury Publishing (LSE:BMY) (7), Cohort (LSE:CHRT) (7), Thorpe (F W) (LSE:TFW) (7), Games Workshop Group (LSE:GAW) (7), Garmin Ltd (NYSE:GRMN) (7), Goodwin (7), Howden Joinery Group (LSE:HWDN) (7), Latham (James) (LSE:LTHM) (7), Jet2 (LSE:JET2) (7), Solid State (LSE:SOLI) (7), and Victrex (LSE:VCT) (7) were already fully represented in the portfolio.

That left Churchill China (LSE:CHH) (score: 9), Dewhurst Group (LSE:DWHT) (8), Porvair (LSE:PRV) (8), Treatt (LSE:TET) (8), Renishaw (LSE:RSW) (8), Bunzl (LSE:BNZL) (8), an extremely speculative XP Power Ltd (LSE:XPP) (7), Anpario (LSE:ANP) (7), D4t4 Solutions (LSE:D4T4) (7) and PZ Cussons (LSE:PZC) (7) as existing holdings that I could add to because they were underrepresented.

Elsewhere, Oxford Instruments (LSE:OXIG) (8), Macfarlane Group (LSE:MACF) (8), Auto Trader Group (LSE:AUTO) (7), Softcat (LSE:SCT) (7) and James Halstead (LSE:JHD) (7), were potential first-time additions.

Churchill China was the standout candidate for three reasons. It was the only available share that scored 9, and all the 8’s except Oxford Instruments, have either published annual reports and are due to be re-scored or will be publishing within the next six months or so.

Although it was tempting to add Oxford Instruments, because it would have been a new holding, there was no need to because the portfolio already had 28 members.

- Richard Beddard: why these shareholders will continue to prosper

- Stockwatch: a very curious potential takeover situation

Churchill China sells tableware to the hospitality industry, and a friendly distributor tells me times are tough. The company warned that demand might weaken, particularly in the UK, when it published its half-year results in September.

To my mind, it is better to buy high-quality firms when there are fears about recession. The share price is low in relation to Churchill China’s average profit, which is why the score is so high. Perhaps I am being a little bit greedy when others are fearful after all.

Although I am sorry David Taylor, the company’s long-serving chief financial officer, has retired because he has helped me to understand the business over the years, I have corresponded with his successor and gained a favourable impression. With the founding family represented on the board, and a very experienced chief executive in place, I do not expect much to change.

I last scored Churchill China in July.

Adding more Churchill China

Having slept on the decision, on Thursday 2 November I added 376 more shares in Churchill China at a price of £11.17. The trade cost £4,210, including £10 in lieu of broker fees. It was a fraction over the Share Sleuth portfolio’s minimum trade size.

The portfolio’s holding in Churchill China is now about 7% of its total value, the third-biggest after Goodwin (over 8%) and Howden Joinery (nearly 8%).

Share Sleuth performance

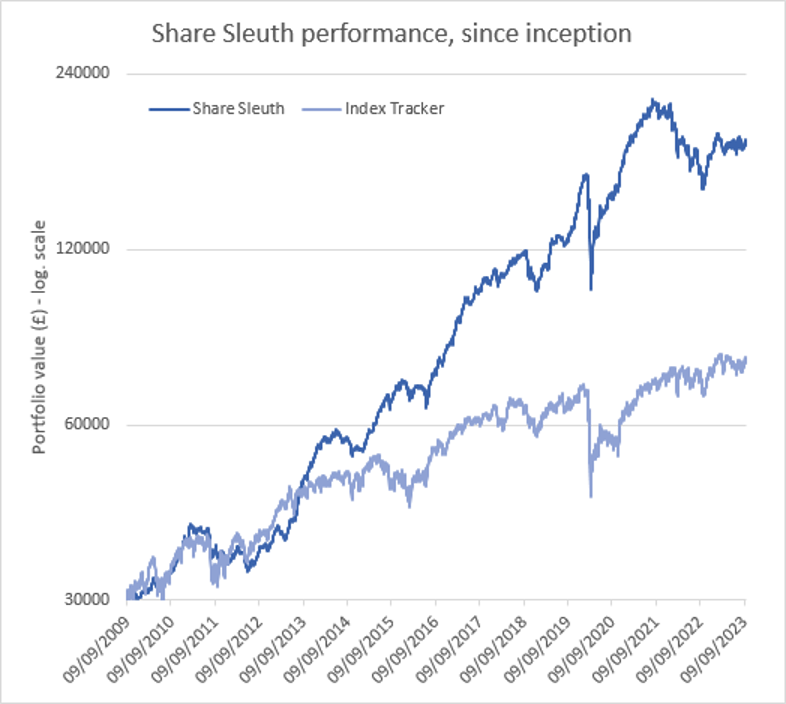

At the close on Friday 3 November, Share Sleuth was worth £168,882, 463% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £75,416, an increase of 151%.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 5,740 | ||||

Shares | 163,142 | ||||

Since 9 September 2009 | 30,000 | 168,882 | 463 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,613 | -36 |

BMY | Bloomsbury | 1,681 | 5,915 | 6,993 | 18 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,215 | -6 |

BNZL | Bunzl | 201 | 4,714 | 5,865 | 24 |

CHH | Churchill China | 1,058 | 8,013 | 11,479 | 43 |

CHRT | Cohort | 1,600 | 3,747 | 7,680 | 105 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,536 | -28 |

DWHT | Dewhurst | 532 | 1,754 | 3,990 | 128 |

FOUR | 4Imprint | 190 | 3,688 | 9,633 | 161 |

GAW | Games Workshop | 100 | 4,571 | 10,430 | 128 |

GDWN | Goodwin | 266 | 6,646 | 14,098 | 112 |

GRMN | Garmin | 53 | 4,413 | 4,933 | 12 |

HWDN | Howden Joinery | 2,020 | 12,718 | 12,940 | 2 |

JDG | Judges Scientific | 34 | 833 | 2,836 | 240 |

JET2 | Jet2 | 456 | 250 | 4,770 | 1,808 |

LTHM | James Latham | 750 | 9,235 | 7,425 | -20 |

PRV | Porvair | 906 | 4,999 | 4,874 | -2 |

PZC | PZ Cussons | 1,870 | 3,878 | 2,491 | -36 |

QTX | Quartix | 3,285 | 7,296 | 4,599 | -37 |

RSW | Renishaw | 92 | 1,739 | 2,810 | 62 |

RWS | RWS | 2,790 | 9,199 | 6,194 | -33 |

SOLI | Solid State | 356 | 1,028 | 4,361 | 324 |

TET | Treatt | 763 | 1,082 | 3,472 | 221 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,280 | 230 |

TSTL | Tristel | 750 | 268 | 2,963 | 1,004 |

TUNE | Focusrite | 1,050 | 9,123 | 4,725 | -48 |

VCT | Victrex | 292 | 6,432 | 4,336 | -33 |

XPP | XP Power | 240 | 4,589 | 2,602 | -43 |

Notes

October (2 Nov) Added more Churchill China

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £168,882 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £75,416 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 3 November 2023.

After dividends paid during the month from Advanced Medical Solutions, Cohort, Churchill China, Games Workshop, Jet2, Judges Scientific, and Quartix, Share Sleuth’s cash pile is £5,740.

The minimum trade size, 2.5% of the portfolio’s value, is £4,220.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Churchill China and most of the shares in the Share Sleuth portfolio

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.