Richard Beddard: a new share for a new year

A takeover has forced change upon our columnist who analyses a company in this sector for the first time. Here are his observations and score out of 10.

5th January 2024 15:01

by Richard Beddard from interactive investor

Happy new year!

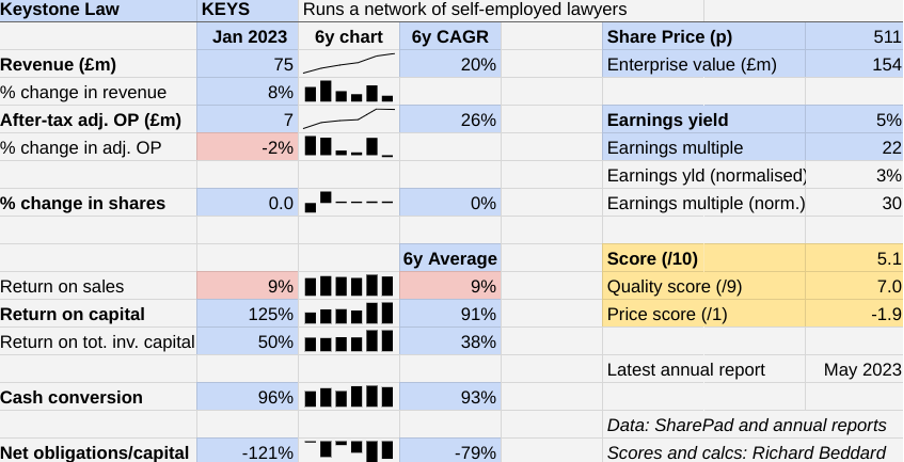

To bring in the new year, a new share joins the 39 other shares in the Decision Engine. Keystone Law Group Ordinary Shares (LSE:KEYS) fills the place left by Hotel Chocolat, which is delisting after its acquisition by Mars.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

In terms of its share price and financial performance, Keystone Law is the UK’s most successful listed law firm.

A new kind of law firm

We must understand, though, that the company is unlike most other law firms.

Traditionally, law firms are partnerships. The senior lawyers, partners, own the firm.

Often they borrow the money to buy into the partnership, which they return out of their income. Partners have a say in how the firm is run and share in its profit.

Profit is, as always, what is left over after all the costs are paid, things such as swanky offices, training, secretaries, pay, employee benefits and taxes, expenses and so on.

Partnership provides status and a career path for ambitious lawyers, but to meet profit targets, the partners must bring in lots of business. It is a big commitment.

Since a change in the law in 2007, law firms have been allowed to list on the stock market. Very few have, probably because it breaks the partnership model.

Senior lawyers at listed firms are rewarded with shares, but since outside shareholders also have a claim on profit there is less money for them.

I understand that traditional partnerships are finding willing recruits at listed law firms.

The first law firm to list was Gateley (Holdings) (LSE:GTLY) in 2015. Its subsequent performance has been adequate but pedestrian. Much better, though, than the handful that followed it - with one exception.

The exception is Keystone Law, but as I said, it is not a traditional law firm.

It is the only listed distributed law firm.

Serving self-employed lawyers

Technically, Keystone Law does not employ many lawyers. Most of the lawyers that work under the Keystone Law banner are self-employed.

Lawyers can work part time if they want to, and work from their own homes or offices. They can also employ other lawyers and administrative staff.

Keystone Law supplies services such as insurance. It contracts with clients, bills them, pays the lawyers, maintains a small team of junior lawyers who provide legal support, and provides marketing tools.

Value is created by centralising and automating these processes, lowering the cost of legal services and freeing lawyers to focus on providing them.

Barring headquarters and a few shared offices, Keystone Law does not have to pay for offices. It does not train lawyers. It avoids employment costs, such as holiday pay, sick pay and taxes, and it does not have to fund much of a management hierarchy.

There is also value in the network of lawyers. Keystone Law says about 30% of fees are earned from work referred by one Keystone lawyer to another. Lawyers can also work together in ad-hoc teams for the same client.

This network, like the other administrative services, is facilitated by a proprietary IT network and events.

Lowering costs means there is more money to go around. Keystone Law pays its lawyers 60% of the fees they earn plus 15% in the majority of cases when the lawyer recruited the client. The company says most of its lawyers earn more than they would in a traditional partnership.

This system will not suit everyone, pay is more variable than at traditional law firms, but that is a price some lawyers are prepared to pay for freedom.

As of July 2023, Keystone Law says it had 415 principals on its books. Many of these principals employ other fee-earners, lawyers and paralegals, in “pods”. They also make money for Keystone Law.

Rapid change in legal land

Keystone’s is a disruptive business model, unlikely to take much business from prestige law firms that earn revenues of one or two billion pounds each, but apparently nibbling away at the middle market. These are firms with revenues in the tens and hundreds of millions like Keystone itself.

Keystone reckons the middle market is worth about £10 billion and comprises nearly 200 firms. At £75 million, the company’s revenue is less than 1% of that, so, on the face of it there is plenty of potential for growth.

However, the whole middle market is not accessible to Keystone. A thriving traditional law sector is necessary, because without it, Keystone would have no lawyers with lots of existing client relationships to recruit.

Also, though Keystone claims to be the original and biggest distributed law firm by revenue, there are similar but unlisted distributed law firms. Keystone reckons there are over 2,000 consultant lawyers working for them.

- Shares for the future: what I think about when I think about investing

- Richard Beddard: best and worst annual reports of 2023

Although Keystone Law is largest by revenue, one rival, Setfords, claims to have more lawyers.

The company might also be forced to make adjustments if the government shifts the definition of self-employment, as it has done in the past.

One more threat, I think, comes from technology. So far it has been Keystone’s friend. The company’s bespoke IT system enables the network that has enabled it to compete at low cost.

However, artificial intelligence promises to lower costs across the board, as computers draw up contracts for example. Maybe the march of the machines could disrupt the disruptor’s model.

These risks are unfathomable to me, partly because Keystone says little about its IT system and nothing at all about AI in its annual report. IT could differentiate the company from other distributed networks, and AI could already be helping Keystone lawyers.

We just do not know.

High-quality numbers

What we do know is that Keystone is performing like a high-quality business.

Since it floated it has grown revenue and profit at a Compound Annual Growth Rate (CAGR) of 20% plus.

High demand for legal services as the economy bounced back from the pandemic has resulted in bumper profitability in the years to January 2022 and January 2023.

But in the year to January 2023, revenue grew only modestly and profit growth stalled due to a hot recruitment market.

The upswing in demand for legal services motivated law firms to pay lawyers more, reducing the attractiveness of self-employment and briefly halting the growth in the number of principals at Keystone Law.

Spiralling pay is self-defeating, Keystone Law says. It means partners must bring in even more business, which they will be unable to do when demand for legal services subsides. When targets become unachievable, lawyers will once again consider self-employment in greater numbers.

- Eight reasons for UK investors to be positive in 2024

- The hot stories you were reading in every month of 2023

This may be what happened in the half year to July 2023, when Keystone Law increased its principal count by 17 (net of losses). That provoked double-digit growth in revenue and profit, encouraging brokers to forecast double-digit growth for the full year ending this month.

Profit margins are modest, the inevitable result of paying 75% of fee income to lawyers, but since the amount it pays lawyers varies in line with the fees they bring in, the risk to profitability when revenue falls is lessened compared to a traditional law firm.

Cash conversion is excellent because Keystone does not pay the lawyers until it has been paid by their clients.

Low capital requirements (few offices, little working capital) translate into very high return on capital, and surplus cash on the balance sheet.

Scoring Keystone Law

This is the first time I have scored any law firm, and Keystone’s track record as a listed firm is fairly short, so I am erring on the side of caution.

That said, it has very experienced management in chief executive James Knight, who founded the company in 2002 and owns 29% of the shares.

The company says it binds lawyers to it through events, its IT network, and the simplicity of its fee split, but has little to say about head office employees except that they are “equally important” for success.

The Past (dependable) [2.5]

● Profitable growth: 20%+ CAGR revenue and profit growth since 2017 [1]

● Strong finances: Near 100% cash conversion, cash surplus [1]

● Through thick and thin: Probably, but short track record as lifted firm [0.5]

The Present (distinctive) [3]

● Discernible business: One of a few distributed law firms [1]

● With experienced people: Founder CEO [1]

● That creates value for customers: Enables self-employed [1]

The Future (directed) [1.5]

● Addressing challenges: Competitors emerging, technology moving? [0]

● With coherent actions: Has little to say on challenges [0.5]

● That reward all stakeholders fairly: Appeals to certain type of lawyer [1]

The price (discounted?) [-1.9]

+ No. A share price of 511p values the enterprise at £154 million, about 30 times normalised profit.

The problem I have had scoring Keystone Law is a familiar one. How to judge a people-focused business when companies say little about their cultures, and technology threatens to take the roles of people.

A score of 5.1 out of 10 indicates Keystone Law is fairly valued.

It is ranked 32 out of 40 shares in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.