Richard Beddard: paradise postponed for this engineering stock?

Richard Beddard runs the slide rule over a company that could be a good long-term investment.

9th October 2020 15:28

by Richard Beddard from interactive investor

Richard Beddard runs the slide rule over a company that could be a good long-term investment.

Let us roll the clock back a year, to what I thought of engineering firm when I last scored it. Then we can appraise what the company achieved in its most recent financial year and what it might achieve in future.

A reconditioned dynamo

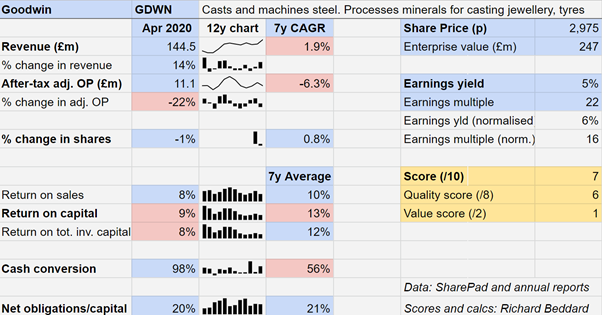

Goodwin (LSE:GDWN) is a collection of many companies organised into two divisions: Mechanical Engineering and Refractory Engineering.

Mechanical Engineering principally casts and machines large steel components for a wide range of industrial, construction and military customers. Refractory Engineering mostly makes minerals used to cast jewellery and tyres.

The two divisions are distinct, but vertically integrated within themselves. Goodwin International produces finished components supplied by Goodwin Steel Castings. Various Goodwin casting powder suppliers are supplied by mineral producer Hoben International, also owned by Goodwin.

Historically, Refractory Engineering is the smaller and less profitable of the two divisions, but helped by the closure of a competitor it had gone through a purple patch and grown to be half of the business by revenue, and more by profit.

This reversal of fortune also came about because of a slump in the Mechanical Engineering division after the collapse of the oil price in 2015. Goodwin Steel Castings’ totemic foundry in Stoke-on-Trent went quiet for a while because demand for check valves and other components for oil and gas pipelines, tankers and terminals vanished.

The company used the downtime to re-equip, enabling it to manufacture high performance alloy castings up to 35 tonnes that only a handful of rivals can match. This, Goodwin promised, would hasten its diversification into the defence and nuclear decommissioning markets.

Overall, the company had stopped growing and profitability had slumped to modest levels. Goodwin needed its Mechanical Engineering division to be busy to return to the impressive levels of profitable growth it achieved before the oil price slump.

The company’s managers expected a burgeoning order book and mooted large contracts to get it there. It seemed as though the Mechanical Engineering division was soon to reawaken.

Having invested heavily in the foundry and innovating new products, Goodwin also promised more generous dividends paid out of more stable cash flows.

Paradise postponed

One year on, a 14% increase in revenue in the year to April 2020 has been accompanied by a 22% decline in adjusted operating profit.

Goodwin’s return on capital (ROC) before interest but after tax at the standard corporation tax rate is bumping along at an adequate 9%, whereas before 2015 it was not uncommon for the company to achieve more than 20% ROC.

Cash conversion has improved, though it is still highly volatile, and to its credit the company has financed the reconfiguration of the foundry itself rather than increasing borrowing or seeking new funds from shareholders.

Although this is not the turnaround we might have expected, the company is upbeat. Profit is lower because of trouble with two contracts, which the company is confident of resolving. Covid-19 hampered the final two months of the financial year and the start of the new one.

But the message in the annual report is that paradise is merely postponed.

Goodwin’s order book stands at £183 million, 11% higher than the already elevated levels of 2019, and it mostly excludes revenue from the “largest purchase agreement the group has entered into”, in June, for making nuclear waste storage boxes.

Goodwin expects this agreement to result in significant revenue from 2021 for a number of years. That and other new contracts will reduce the company’s revenue from oil and gas to less than 20% of the total and return the Mechanical Engineering division to prominence with a 65% share of revenue.

Since Goodwin was unable to maintain the high profit margins it earned from oil and gas customers as sales plummeted, the mooted revitalisation of Mechanical Engineering with new business from other sectors would be good news.

Much of the incoming work is from new products, some patented, and Goodwin anticipates “respectable margins in areas such as national defence capability and projects of national importance.”

As revenue from these projects increases, perhaps profit margins will recover too.

Easat Radar Systems, another company in the Mechanical Engineering Division, may also be on the road to recovery after a change in strategy.

The outlook for the Refractory Engineering business is more uncertain due to its reliance on consumer demand for jewellery during the pandemic, which fell sharply and is recovering slowly.

Nevertheless, Goodwin has been investing in the division. It has acquired Castaldo, a manufacturer of silicone rubber and wax used in jewellery casting, and a mineral processing site that will allow it to increase capacity.

Scoring Goodwin

Judging by Goodwin’s recent performance, the company is a mediocre business and the shares are not particularly cheap. But that conclusion would overlook a century of experience casting steel and the changes the company has made that have yet to have a big impact on the results.

The Goodwin family still owns a controlling interest and the executive board members are mostly sixth-generation descendants of the founder. Under the stewardship of the fifth and sixth generations the company grew spectacularly.

That said, family ownership can be a double-edged sword. The board received a windfall last year when a generous incentive plan paid off. The plan was meant to motivate the board to reorient the business, which it did, but shareholders are still waiting for the returns from their labour.

Does the business make good money? [1]

? Recent returns on capital undistinguished

? Weak average cash flow

+ Potential for improvement in both

What could stop it growing profitably? [2]

+ Modest financial obligations

+ New business is less cyclical

? Maybe 3D printing will become a viable alternative to casting in jewellery manufacture

How does its strategy address the risks? [2]

+ Diverse industrial and geographical markets

+ Vertical integration of both divisions

+ Focus on markets where competition is limited

Will we all benefit? [2]

+ Goodwin family owns >50% of the shares

+ Experienced management

? Need to keep an eye on incentives

Are the shares cheap [1]

? It depends on whether Goodwin delivers on its promise

Valuing Goodwin

A share price of £29.75 values the enterprise at about £250 million, or 22 times adjusted profit, which looks a bit pricey.

I think Goodwin probably will deliver higher levels of profitability in future, although I do not know if it will achieve the level of ROC and the growth rates it did before the oil price crash.

In valuing Goodwin I have hedged my bets, normalising returns over the last seven years, which includes two of the good years before 2015 and of course all of the lean years since.

On that basis the normalised multiple is a more reasonable 16 times adjusted profit and Goodwin probably is a good long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.