Richard Beddard: is filter-maker Porvair worth your money?

Our companies analyst’s revamped Decision Engine lists his top stocks.

28th August 2020 15:45

by Richard Beddard from interactive investor

Designed to generate ideas for portfolios, our companies analyst’s revamped Decision Engine lists his top stocks.

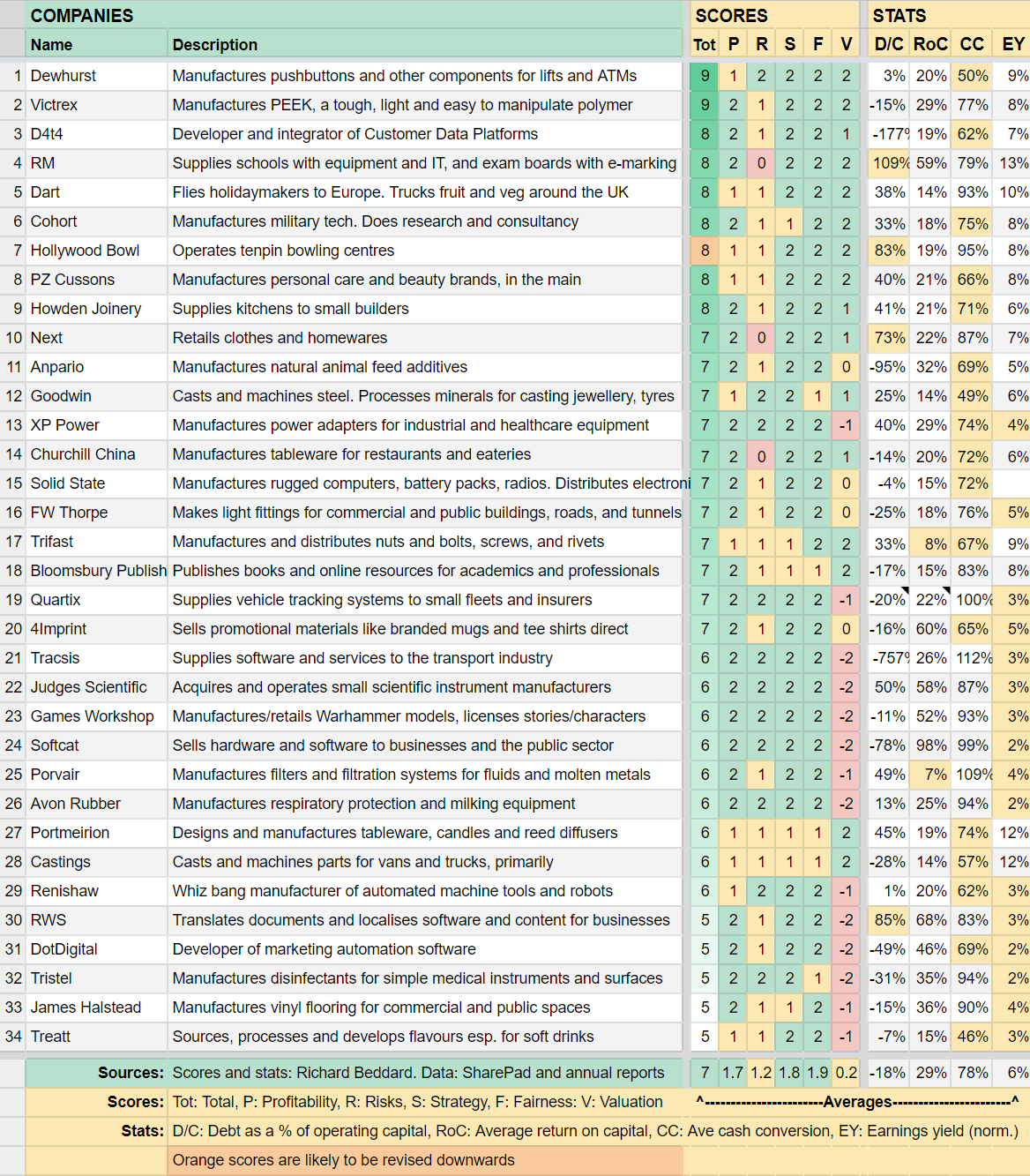

Readers will know that I regularly publish updated results from an investing system of my own creation called the Decision Engine, which helps assess if any of a list of 34 companies are cheap or not.

Since last month’s Decision Engine update I have scored two companies: Games Workshop (LSE:GAW) and Porvair (LSE:PRV).

Games Workshop still gets top marks in terms of profitability, risks, strategy and fairness, but it has a hefty valuation.

Porvair’s score is documented later in this article.

Although I have investigated two new companies, QinetiQ (LSE:QQ.) and Motorpoint (LSE:MOTR), I chose not to score them. Therefore I have not incorporated them in the Decision Engine, and they will not be ranked against the shares I follow most closely.

The companies may be good long-term investments, as they are profitable and appear to have strong cultures, but I am not confident enough in Motorpoint’s finances and QinetiQ’s growth prospects to displace an existing company ranked by the Decision Engine.

I am not keen to enlarge the Decision Engine either. Thirty-four companies is close to the maximum I can analyse every year, while also researching alternatives that might have better long-term prospects.

The 34 companies in the Decision Engine are therefore the same as last month, although the rankings have shifted because of movements in share prices and therefore valuations.

Shares for the future

All of the shares in the Decision Engine are, in my opinion, good long-term investments, but some are better than others. Scoring these shares involves a lot of judgement but generally the higher up the list a company is, the stronger its ‘buy’ and ‘hold’ credentials.

Scoring Porvair

Normally I score companies as soon as I can after they publish their annual reports. But there is a seasonal rush of reports in the first half of the year and I sometimes fall behind.

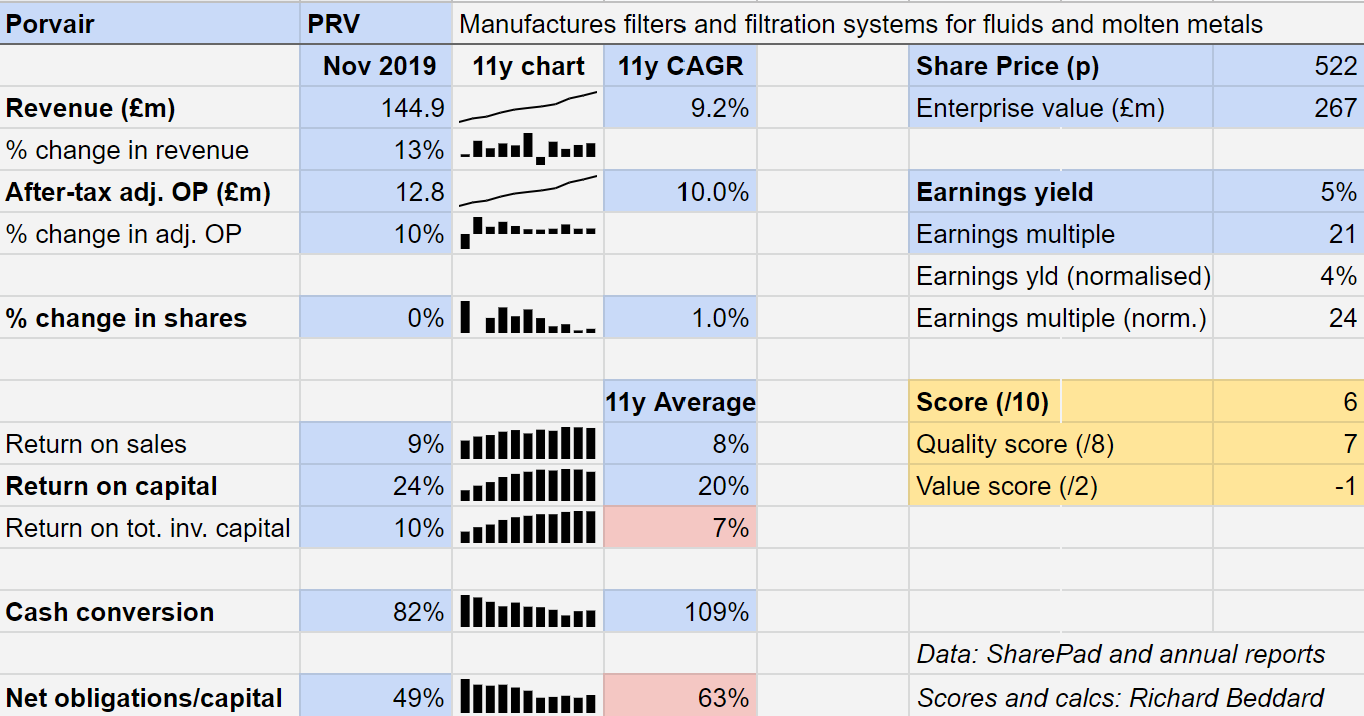

Today I am re-scoring Porvair, a company that closed its books last November and published its annual report in March.

The results were an improvement on the previous year, and the continuation of an improving trend that goes back over a decade:

Porvair has grown revenue and profit at a compound annual growth rate (CAGR) of about 10% over the last 11 years, and in the year to November 2019 return on sales (profit margins), and return on capital were above their long-term averages.

The results for the year to November 2020, and perhaps for longer, are unlikely to be as impressive, though, thanks to the pandemic and worsening relations with China.

The impact of both threats to Porvair’s business were visible in the company’s accounts for the half-year to May 2020.

Porvair continued to grow in the first quarter (December to February) but contracted sharply in the second (March to May).

Overall, revenue fell 8% in Porvair’s aerospace & industrial division, 6% in metal melt quality and 5% in the laboratory division.

Porvair is a specialist in filtration. The filters it makes have many applications. For example, some protect expensive equipment from impurities, such as the hydraulic systems in aeroplanes. Some improve the quality of aluminium and iron by filtering contaminants from molten metal, and others remove petrochemicals from ballast released into the sea by ships.

Filters are often small components, but not always. This giant filter element was one of four made by Porvair for a Chinese chemical company. At over 3m long it has a filtration area of 47m2. The quartet of filter elements are the largest Porvair has ever made. Source: porvairfiltration.com

The Laboratory division, responsible for nearly 29% of revenue, specialises in equipment for testing water quality. Unlike the rest of Porvair it suffered a weak first quarter as Chinese laboratories shut down early in the pandemic, and recovered strongly as the scientific effort to beat Covid-19 accelerated.

Most of Porvair’s end markets are cyclical though, and the company is preparing to weather a recession.

It has also written down the value of a Chinese metal filtration subsidiary. China is a price-sensitive market that Porvair had struggled to profit from. Ironically, the subsidiary made its first profit in 2019, but Porvair believes profit in future will be diminished by the deteriorating geopolitical situation.

Porvair should weather this recession.

Its products must be consumed according to maintenance schedules. So although demand will decrease if fewer planes fly or industrial plants operate below capacity, their operators cannot defer spending completely as they may put off spending on capital equipment.

During the great financial crisis the metal melt quality division made a loss, but demand otherwise held up well and overall the company remained profitable (return on capital bottomed out at 8%).

Today, metal melt quality is arguably a better business than it was, earning higher profit margins from new patented filters, and Porvair is less dependent on it (it contributed 27% of revenue in 2019).

But the peril for aerospace customers is more acute now, due to travel restrictions aimed at limiting the pandemic. Aerospace contributed about 15% of revenue in 2019.

I like Porvair, and a recession might give us the opportunity to buy the shares at a reasonable price. This is how I score it:

Does the business make good money? [2]

+ High returns on operating capital

+ Excellent cash conversion

+ Modest return on sales

What could stop it growing profitably? [1]

? Defined benefit pension obligation is relatively modest (72% of operating capital)

? Cyclical end markets, e.g. metal and industrial filtration

? Aerospace industry acutely impacted by pandemic

? Small but pricey acquisitions. Average return on total invested capital is just 7%

How does its strategy address the risks? [2]

+ Develops and patents vital but relatively inexpensive components

+ Generates business from installed base e.g. in airframes, and gasification plants

+ Focus on technical differentiation, not price

+ Creating mini-monopolies e.g. in aluminium cast-house filtration and water filtration

+ Acquisitions broaden and strengthen niches

Will we all benefit? [2]

+ Directors own 2.4% of the shares

+ Chief executive Ben Stocks is very experienced

+ Company explains itself well and is responsive to queries

? Executives are highly paid

? Very few staff reviews online

Are the shares cheap? [-1]

− A share price of 522p values the enterprise at about £145 million, 21 times adjusted profit in the year to November 2019, a good year. The valuation is about 24 times normalised profit, assuming the business had earned its long-term average return on capital in 2019.

A score of 6/10 indicates that Porvair is probably a good long-term investment, but even though the shares have fallen 32% from their pre-pandemic peak in January their relatively high valuation still blunts the attraction.

Porvair is ranked 25th out of the 34 shares I track using the Decision Engine.

Company profiles

To find out how I scored each of the companies in the Decision Engine, please click on the links in this table:

| Name | Description | Profile |

|---|---|---|

| 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | https://bit.ly/swFOUR2020 |

| Anpario | Manufactures natural animal feed additives | https://bit.ly/swANP2020 |

| Avon Rubber | Manufactures respiratory protection and milking equipment | https://bit.ly/swBMY2020 |

| Bloomsbury Publishing | Publishes books and online resources for academics and professionals | http://bit.ly/swBMY2019 |

| Castings | Casts and machines parts for vans and trucks, primarily | https://bit.ly/swCGS2020 |

| Churchill China | Manufactures tableware for restaurants and eateries | https://bit.ly/swCHH2020 |

| Cohort | Manufactures military tech. Does research and consultancy | http://bit.ly/swCHRT2019 |

| D4t4 | Developer and integrator of Customer Data Platforms | https://bit.ly/swD4T42020 |

| Dart | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/swDTG2019 |

| Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| DotDigital | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| Games Workshop | Manufactures/retails Warhammer models, licenses stories/characters | http://bit.ly/swGAW2020 |

| Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| Hollywood Bowl | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| Howden Joinery | Supplies kitchens to small builders | http://bit.ly/sw2020HWDN |

| James Halstead | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

| Judges Scientific | Acquires and operates small scientific instrument manufacturers | https://bit.ly/swJDG2020 |

| Next | Retails clothes and homewares | https://bit.ly/swNXT2020 |

| Portmeirion | Designs and manufactures tableware, candles and reed diffusers | https://bit.ly/swPMP2020 |

| Porvair | Manufactures filters and filtration systems for fluids and molten metals | |

| PZ Cussons | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| Quartix | Supplies vehicle tracking systems to small fleets and insurers | https://bit.ly/swQTX2020 |

| Renishaw | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/swRSW2019 |

| RM | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2020 |

| RWS | Translates documents and localises software and content for businesses | https://bit.ly/swRWS2020 |

| Softcat | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| Solid State | Manufactures rugged computers, battery packs, radios. Distributes electronics | https://bit.ly/swSOLI2020 |

| Tracsis | Supplies software and services to the transport industry | http://bit.ly/sw2020TRCS |

| Treatt | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2020 |

| Trifast | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/swTRI2019 |

| Tristel | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| Victrex | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2020 |

| XP Power | Manufactures power adapters for industrial and healthcare equipment | https://bit.ly/swXPP2020 |

Richard owns most of the shares listed in the Decision Engine. He does not yet own shares in Porvair.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.