Richard Beddard: scoring a potential FTSE 100 stock

Our analyst admires this fantastic British company, which has delivered through thick and thin.

7th May 2021 17:05

by Richard Beddard from interactive investor

Our analyst admires this fantastic British company, which has delivered through thick and thin.

It is always reassuring to see companies reinforcing their competitive advantages and rolling out tried and tested strategies.

One of the reasons builders keep coming back to Howdens (LSE:HWDN) for fitted kitchens is its policy of near 100% stock availability, which means jobs are not delayed because tradesmen are waiting for parts.

Building on advantage

In this year’s annual report, the company reports that it is augmenting weekly stock replenishments for its depots with next day delivery of fast-moving items from regional distribution hubs.

It is a small thing perhaps, but it demonstrates Howdens’ focus on meeting the needs of small builders.

- Shares for the future: everything you need to know

- Bill Ackman: THE serious threat to investors in 2021

- Stocks that made you a fortune in the 2020-21 tax year

As well as stock availability, Howdens consults builders in the design of kitchens, gives them enough credit to complete a job and be paid for it before paying for the parts, locates depots in easy to access locations (which also happen to be cheap to rent), and provides sales materials and kitchen designers. Depot managers have the autonomy to set prices within limits, and cultivate loyal customers.

While it might not seem revolutionary, focusing only on trade customers was new when Howdens was founded in 1995. Other kitchen suppliers operate retail and trade counters, but since prices are not confidential it is difficult for trade customers to decide their own markup.

Rolling out the format

Howdens says it sells one in every three kitchens in the UK, a testament to a unique business but also, perhaps, a statistic that foreshadows saturation.

The company has more than 750 UK depots, and believes there is scope for 850. In the current financial year, it plans to open 35 new depots in the UK, but also 11 in France where it currently has 30 depots and has been operating for over a decade.

France may in the not too distant future become the focus of Howdens’ roll-out. Sales growth there, despite the pandemic, has encouraged it to accelerate its opening programme.

Howdens says that the French market now is similar to the UK in 1995, with limited direct trade-only competition and a movement away from DIY as kitchens become more complex.

Despite Brexit, it is an attractive market for investment.

Profitable through thick and thin

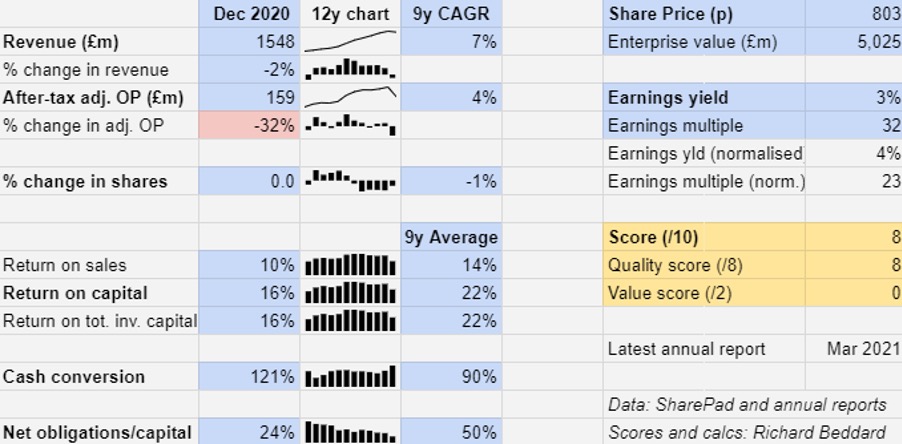

Revenue fell 86% during the worst part of the first lockdown, business recovered swiftly after it ended, and Howdens only earned 2% less revenue over the whole year.

Profit, though, fell 32% which the company attributed to lower prices and an extended promotional period to rekindle demand, higher sales of less profitable products, and the higher cost of operating through a pandemic without government support, which it took initially but repaid during the year end.

People are reluctant to rip out their kitchens while they cannot eat out, so the company sold fewer high margin kitchen cabinets, and more products like flooring and interior doors, which the company buys in.

Net obligations declined because Howdens opened fewer new depots than anticipated, stopped buying back shares, and suspended the dividend (since reinstated) to make sure it had enough cash to survive the unknowable consequences of the pandemic.

In a trading update for the 16 weeks to April 2021, Howdens reported a substantial increase in revenue compared to 2020, when operations were curtailed due to the first lockdown.

Perhaps more importantly, it earned 13.1% more revenue than it did during the same period in 2019 (8.9% more on a same store basis), although profit may still be subdued because of the product mix.

In Continental Europe (mostly France) revenue was up 37.6% compared to 2019 (19.7% on a same store basis). Maybe the format is catching on.

Scoring Howdens

I admire Howdens. It has operated essentially the same strategy since 1995, when it was founded and, while saturation in the UK is a genuine concern, the good news coming out of France has bolstered my confidence that the company can keep growing.

It seems churlish to mention high levels of executive pay after a year that Howdens, through no fault of its own, failed to achieve its targets. It therefore did not pay large bonuses and share awards to its chief executive and finance director, who also sacrificed a small proportion of their pay in solidarity with furloughed workers during the first lockdown.

But the scenarios presented in the annual report remind us that if the company does achieve certain targets in 2021, chief executive Andrew Livingstone could earn in excess of £3 million.

I am torn by this. On one hand I believe it is typical of the overpayment of executives in general, but on the other hand the company has a highly incentivised culture. Depot managers receive good bonuses and the many plaudits the company receives suggests it is a good place to work.

Howdens’ motto is to be “worthwhile for all concerned”, and I believe it is.

Since it divested from MFI, the doomed furniture retailer, in 2006, and rid itself of a legacy of unoccupied stores early in the last decade, Howdens has prospered mightily and grown through thick and thin.

Kitchens are expensive, and profitability would be reduced in a severe recession, but even saddled by the legacy of MFI, Howdens performed robustly during the Great Financial Crisis.

Does the business make good money? [2]

+ High return on capital

+ Strong cash flows

+ Solid profit margins

What could stop it growing profitably? [2]

+ Strong finances, despite large pension obligation

? Recession

? Saturation in the UK

How does its strategy address the risks? [2]

+ Improvement of ranges, depots, and systems

+ Continue roll out in UK

+ Accelerating roll out in France

Will we all benefit? [2]

+ Aims to be “Worthwhile for all concerned”

+ Depot managers rewarded for depot performance

+ Explains itself very well

Is the share price low relative to profit? [0]

? Profit in 2020 was depressed. On a normalised basis, the shares are reasonably priced.

A score of 8 out of 9 indicates Howdens should be a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Howdens.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio it powers, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.