Richard Beddard: this share scores almost perfect marks

10th March 2023 15:14

by Richard Beddard from interactive investor

It works for the world’s largest and most famous brands and for the biggest companies in its field, and our columnist is a fan. Here’s why he thinks it’s a good long-term investment.

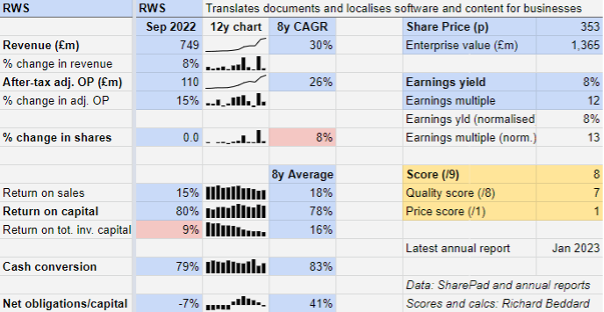

Translator RWS Holdings (LSE:RWS) has grown mightily since the turn of the millennium. In the year to September 2022, it earned revenues of nearly £750 million and employed more than 2,000 in-house translators and 30,000 freelancers.

Software, though, in the form of machine translation and artificial intelligence, is doing increasing amounts of the translation, and RWS has added considerable technological capabilities to its human ones.

- Learn with ii: How to Buy Shares| Top UK Shares | Cashback Offers

Four divisions, one platform

In addition to IP Services, RWS’ original patent translation and filing business, which is now its smallest, the company operates three divisions built around businesses that RWS has acquired over the last seven years.

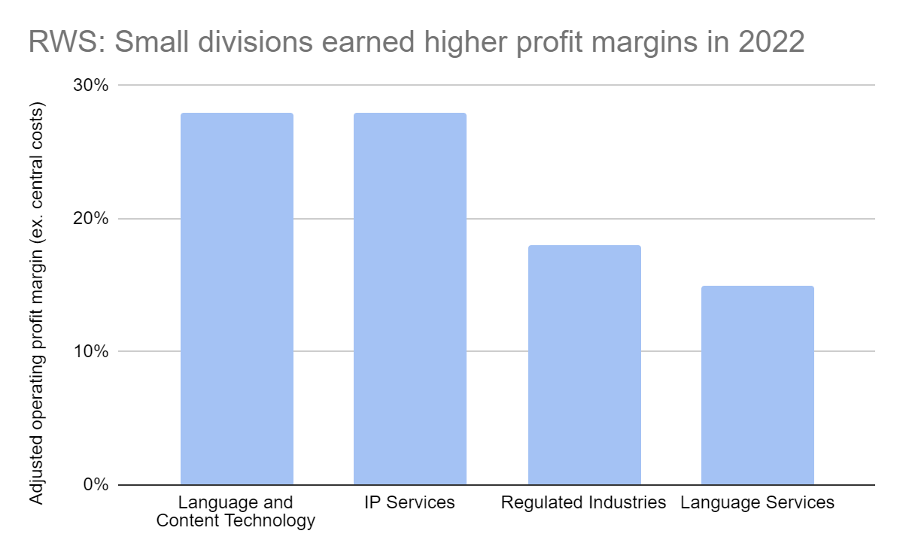

The biggest is Language Services: translation, localisation and interpretation for companies serving international markets. It generated 35% of total profit (excluding central costs) from 46% of total revenue in the year to September 2022.

Despite a healthy profit margin of 15%, Language Services is the least impressive division in terms of profitability.

Source: RWS annual report 2022, adjustments are the author’s

The second biggest division, which brought in 21% of profit from 23% of revenue, is Regulated Industries, which does technical translation for pharmaceutical companies, medical device suppliers, law firms, and the finance industry.

Following the acquisition in November 2020 of SDL, a large UK based rival, RWS combined SDL’s machine translation platform with another one acquired five months earlier, and created a fourth division. It provides machine translation software, increasingly as a service plugged directly into customers’ systems.

This Language and Content Technology division, which also includes document creation, content management, and translation tools, is highly profitable too. It earned 24% of RWS’ profit, from 17% of its revenue.

- Share Sleuth: no longer bowled over, so time to sell

- Shares for the future: why I think these 24 shares are good value

Machine translation is what it sounds like, a software platform dubbed Language Weaver for high volume translation. Given recent advances in artificial intelligence, machine translation could disrupt RWS’ other businesses, but Language Weaver and the company’s machine translation tools may also be their biggest enabler.

The company has acquired a significant capability. It says it has 45 patents applying to machine translation and its expertise dates back to before 2010, when SDL acquired Language Weaver.

Flat 2022

Growth in 2022 was helped by a full year contribution from SDL (as opposed to 11 months in 2021) and currency movements. On a like-for-like basis, revenue contracted by 1%.

Judging by high returns on capital and pretty consistent profit margins, the company has grown and acquired profitable businesses, although they were not cheap.

Factoring in the acquired intangible assets at cost, return on total invested capital (ROTIC) is 9%. That is a viable return, and over time if RWS grows efficiently, ROTIC should improve because the numerator of the ROTIC calculation, profit, will increase while the denominator includes the cost of the acquisitions the company has already made, which is a sunk cost and will not increase.

We need to keep an eye on restructuring costs, though, which, like the company, I have ignored in measuring adjusted profit.

In the year to September 2020, RWS treated £1.2 million of costs as exceptional. In 2021 it ignored £10.2 million of restructuring costs, and in 2022 it ignored a further £12.2 million.

In 2022, the costs were mostly related to the integration of SDL, a large translation company headquartered just down the road. Over the next two years RWS plans to spend nearly £16 million restructuring its finance and human resources functions, costs it also deems exceptional.

Restructuring can become all too routine at companies going through substantial change. Treating the cost as exceptional is a grey area, which may overstate profit.

In the context of adjusted pre-tax profits of about £150 million and similar operating cash flow, though, the impact of the adjustments to date is modest.

The day of reckoning is nigh

A risk that has dogged RWS for years is coming to fruition. A new European patent regime is coming into force imminently which will allow companies to file one patent for the 17 countries that have signed up so far, instead of a patent for each of them.

The bad news is this could substantially reduce the amount of patent translation business in Europe (A Unitary Patent needs to be filed only in English and one other European language). Indeed, it already has reduced demand, perhaps temporarily, because the European Patent Office (EPO) has allowed companies to delay patent filing pending the introduction of the regime.

The good news is the Unitary Patent has been so long coming, RWS has had plenty of time to prepare. Initially it diversified and more recently it has rationalised the IP Services division to make it more efficient at processing potentially less business.

- ‘High risk? I don’t see it that way’: the investment secrets of an ISA millionaire

- 10 UK shares Warren Buffett might put in his ISA in 2023

Although IP Services is now the company’s smallest division, it is still significant. In 2022, it generated 20% of RWS’ adjusted profit from 16% of its revenue.

That does not mean RWS stands to lose 20% of profit though. The European Patent business accounts for about a third of the division’s revenue, and there will still be some translation.

How much depends on the degree to which companies adopt the Unitary Patent. National systems will continue to operate alongside it, and in the past RWS has said its customers might prefer to use them.

Everything everywhere all at once

RWS’ strategy is to do more translation by winning more customers and becoming more efficient by offering the ideal mix of human and machine translation to every customer.

It says this “accelerated growth plan” brings a renewed focus on organic growth, but acquisitions will still play a part when it can bolt on profitable translation niches or new technical capabilities to its human-machine platform.

Towards an employee first culture

To the company’s credit, it reports comprehensive data on employee engagement and turnover. An employee engagement score of 69% is 3% below the average of similar companies, which RWS says gives it a baseline from which to improve.

Perhaps it is already improving. Voluntary staff turnover is a key performance indicator. It reduced over the year as the company implemented initiatives to refresh its self image and improve training.

One particular staffing advantage may come from its Campus scheme which gives work experience and translation tools to students at over 700 universities worldwide and offers a third of interns a full-time career once they graduate.

Andrew Brode, executive chairman and a major shareholder, is stepping down in October, but will retain a seat on the board. He guided the company through its momentous expansion.

His experience will remain an important resource, especially because chief executive Ian El-Mokadem and chief financial officer Candy Davies, are fairly green in their roles.

That said, Mr El-Mokadem’s keen focus on strategy and culture in the annual report suggests he may be a good appointment.

Scoring RWS

Technological disruption is unnerving because there is always the possibility that competitors will do it better, but RWS is embracing the challenge, rather than burying its head in the sand.

The company’s client list includes many of the world’s largest and most famous brands and very high proportions of the big patent filers, law firms, medical device manufacturers and pharmaceutical companies.

These are demanding customers, because a mistake in the translation of a patent, a clinical trial, or a legal document can have serious implications. Translation is a small part of the cost of providing a product or service globally, so it is probably not worth cutting corners and getting it wrong.

Being good at technical translation requires language skills and subject-specific knowledge. Historically, this combination of expertise has been RWS’s competitive advantage, but for many years RWS has used technology too.

Human and technical capabilities support each other. RWS’s linguists train its software, the software makes translation more efficient and less costly, and the linguists check the software’s output.

Scale, RWS is one of the largest global translation companies and only earns 11% of revenue in the UK, combined with technology gives it an advantage: The ability to serve customers anywhere, anytime, in growing volumes, in pretty much any language.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margins

+ Good average cash flow

What could stop it growing profitably? [1]

+ Strong finances, impressive customer base

? Unitary patent risk is crystallising

? Machine translation is disrupting the industry

How does its strategy address the risks? [2]

+ Acquisitions target niches and new capabilities

+ Technology positions RWS to benefit from disruption

+ Broader portfolio means more services to sell customers

Will we all benefit? [2]

+ Experienced chairman is RWS’ major shareholder

+ Comprehensive reporting of employee metrics

? Remuneration is considerable

Is the share price low relative to profit? [1]

+ Yes. A share price of 353p values the enterprise at nearly £1.4 billion, about 13 times normalised profit.

A score of 8 out of 9 indicates RWS is a good long-term investment.

It is ranked 6 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in RWS.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.