Share Sleuth: no longer bowled over, so time to sell

8th March 2023 09:41

by Richard Beddard from interactive investor

Richard Beddard has called it a day on a company he bought shortly before the pandemic. By selling, he now has firepower to add a new holding or top up an existing member of the portfolio.

On February 28, I liquidated the Share Sleuth portfolio’s holding in Hollywood Bowl (LSE:BOWL), the UK’s biggest chain of tenpin bowling centres, a nascent chain of mini-golf centres, and since May last year, the owner of a chain of bowling centres in Canada.

In February, the company acquired three more bowling centres in Canada, where it expects to replicate the success of its UK tenpin bowling centres.

- Learn with ii: How to Buy Shares| Top UK Shares | Cashback Offers

Selling Hollywood Bowl

No money actually changed hands, the Share Sleuth portfolio is a virtual portfolio started with £30,000 of pretend money in September 2009. However, I keep the accounting as realistic as possible, charging the portfolio £10 in broker fees for every trade and paying stamp duty on main market purchases.

After the fees, liquidating the portfolio’s holding of 1,615 shares raised £3,931 at a share price of a fraction over 244p.

Hollywood Bowl’s short time in the portfolio, indeed its relatively short time listed on the stockmarket, has been an eventful one.

I added the shares as the pandemic approached and watched the price plummet towards oblivion as it became increasingly apparent that bowling alleys, like other hospitality businesses, faced an indefinite period of closures and restrictions.

The company successfully negotiated its way through that period, launched a new mini-golf concept, and, as it emerged from the pandemic it acquired a bowling business in Canada.

For all of Hollywood Bowl’s endeavour, and my shredded nerves, the portfolio exits with a return of 14.8%, or 5% on an annualised basis according to SharePad.

Mixed feelings

Hollywood Bowl is probably a good long-term investment. I gave the share a six out of nine when I scored it in February, but I also had mixed feelings including questions about how it will perform during a recession, its new and less tried and tested formats, and my sense that some of the company’s reporting is overly promotional.

I find it very hard to sell a share when I have doubts but I have not completely lost confidence, and as usual I made a meal out of it. I had intended to remove the share in the middle of February, but my final decision got caught up in preparations to go on a trip.

Rather than relying on a snap judgement, I put some distance between myself and the decision by deferring it until my return.

In the cold light of the dawn of 28 February, I was still comfortable with the decision to remove Hollywood Bowl from the portfolio.

- Shares for the future: why I think these 24 shares are good value

- 10 UK shares Warren Buffett might put in his ISA in 2023

- Insider: bosses spend over £1m on FTSE 100, AIM and Aston Martin

The share’s score of 6 out of 9 ranked it 30th out of the 40 shares in my Decision Engine, so, according to my analysis, there were 29 better companies to invest in, many of them only marginally so, but plenty scored 8 and one scored 9.

In last month's Share Sleuth update, I reported that I was itching to invest more of the portfolio in this group of high scoring shares but lacked the money to do so. Liquidating Hollywood Bowl has provided me with the firepower I need.

Very soon I will either add a completely new holding, Auto Trader Group (LSE:AUTO) (ranked 9 out of 40) is the best candidate, or top up an existing one. Focusrite (LSE:TUNE), ranked 1, is top of the list.

In trading lower-ranked shares for higher ranked shares, I hope to improve the portfolio, but Hollywood Bowl was not the only lower-ranked share I could have disposed of. I chose not to remove nine other companies: Porvair (LSE:PRV), Judges Scientific (LSE:JDG), Bloomsbury Publishing (LSE:BMY), 4imprint (LSE:FOUR), Bunzl (LSE:BNZL), D4t4 Solutions (LSE:D4T4), Quartix Technologies (LSE:QTX), Solid State (LSE:SOLI), and Jet2 (LSE:JET2). They were also sitting outside my buy-zone.

There are two reasons I chose Hollywood Bowl. The first is proximity. I reviewed Hollywood Bowl most recently, which means its score is freshest. Some of the other companies are due to be scored again very soon and I would like to have that opportunity.

The other is instinct. We are often told that our instincts mislead us, especially in investing, but psychologist Daniel Kahnemann found that instinct is more reliable after having rigorously scored (in the case of his study) candidates for employment.

I hope that is true for me, and the portfolio’s candidates.

Happy days

Since the last update a month ago, the Share Sleuth portfolio has received a bumper crop of notional dividends from Cohort (LSE:CHRT), Dewhurst Group (LSE:DWHT), Focusrite (LSE:TUNE), Games Workshop (LSE:GAW), Hollywood Bowl, RWS Holdings (LSE:RWS), Solid State, and Victrex (LSE:VCT).

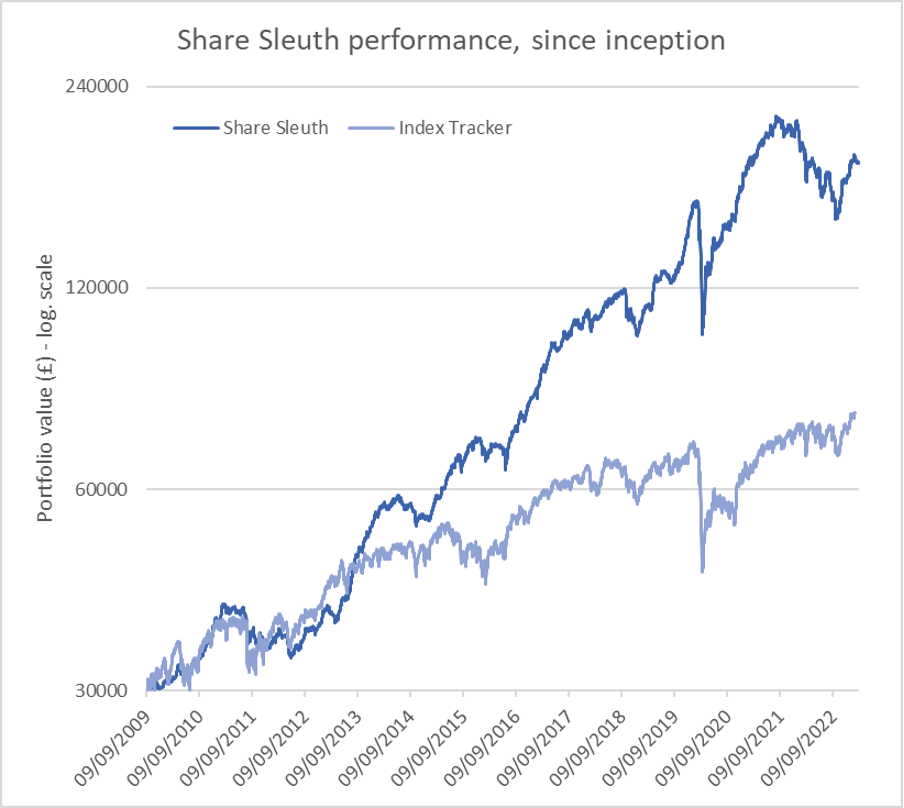

At the close on Monday 6 March 2023, Share Sleuth was worth £184,178, 514% more than the £30,000 of pretend money I started with in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £78,590, an increase of 161%.

The portfolio now has a cash balance of £7,833, more than enough to fund the acquisition of a new share. The minimum trade size is 2.5% of the value of the portfolio, or about £4,600. Happy days.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 7,833 | ||||

Shares | 176,345 | ||||

Since 9 September 2009 | 30,000 | 184,178 | 514 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 3,653 | -10 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,354 | 24 |

BNZL | Bunzl | 201 | 4,714 | 5,885 | 25 |

CHH | Churchill China | 682 | 8,013 | 8,252 | 3 |

CHRT | Cohort | 1,600 | 3,747 | 8,008 | 114 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,629 | 3 |

DWHT | Dewhurst | 532 | 1,754 | 6,118 | 249 |

FOUR | 4Imprint | 190 | 3,688 | 8,769 | 138 |

GAW | Games Workshop | 148 | 4,709 | 13,409 | 185 |

GDWN | Goodwin | 266 | 6,646 | 9,044 | 36 |

GRMN | Garmin | 53 | 4,413 | 4,329 | -2 |

HWDN | Howden Joinery | 2,020 | 12,718 | 14,386 | 13 |

JDG | Judges Scientific | 85 | 2,082 | 7,990 | 284 |

JET2 | Jet2 | 456 | 250 | 6,108 | 2,343 |

LTHM | James Latham | 750 | 9,235 | 9,938 | 8 |

NXT | Next | 106 | 6,071 | 7,501 | 24 |

PRV | Porvair | 906 | 4,999 | 5,663 | 13 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,422 | -12 |

QTX | Quartix | 1,085 | 2,798 | 3,147 | 12 |

RSW | Renishaw | 92 | 1,739 | 3,864 | 122 |

RWS | RWS | 1,000 | 4,696 | 3,530 | -25 |

SOLI | Solid State | 356 | 1,028 | 4,664 | 354 |

TET | Treatt | 763 | 1,082 | 4,174 | 286 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,500 | 240 |

TSTL | Tristel | 750 | 268 | 2,606 | 872 |

TUNE | Focusrite | 400 | 4,530 | 2,880 | -36 |

VCT | Victrex | 292 | 6,432 | 5,148 | -20 |

XPP | XP Power | 240 | 4,589 | 5,376 | 17 |

Notes

February: Removed Hollywood Bowl

Costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £184,178 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £78,590 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 6 March 2023.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Hollywood Bowl. He also owns all the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.