Richard Beddard: two reasons to be cheerful about this small-cap

17th March 2023 14:48

by Richard Beddard from interactive investor

A new trend may be establishing itself at this technology business, and our columnist rates it highly enough to believe it may well be a good long-term investment.

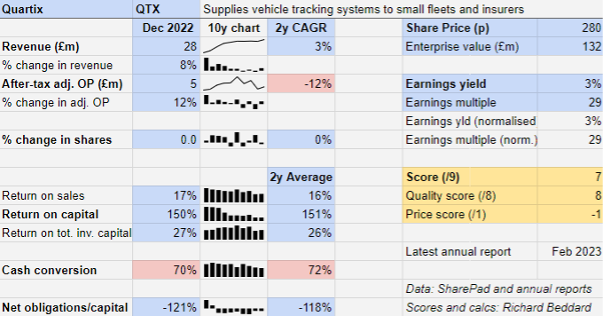

A quick glance at the performance of Quartix Technologies (LSE:QTX) raises a big question. It is a highly profitable cash-rich business that makes less profit than it did a few years ago. How come?

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

A tale of two markets

Quartix’s product, a vehicle tracking subscription for van fleets, is much more popular than it was but not enough to offset a decline in sales to insurers, who install trackers in the cars of newly qualified drivers, and downward pressure on the price of vehicle tracking systems.

This may not seem like a particularly attractive investment proposition, especially as the shares trade on a multiple 29 times adjusted profit. But in 2022, growth in the fleet business overcame the familiar headwinds as revenue increased 8% and adjusted profit increased 12%.

We can be cautiously optimistic that a new trend may be establishing itself. Cautiously, because we cannot extrapolate much for a year’s trading, and because the picture is muddied by rising costs and changes in accounting policy.

- Richard Beddard: this share scores almost perfect marks

- Shares for the future: why I think these 24 shares are good value

Reasons to be cheerful

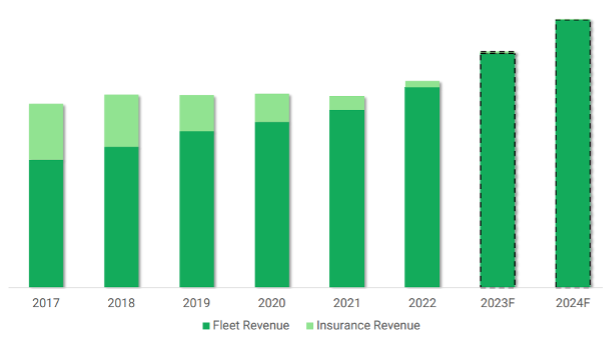

The first reason to be cheerful is the decline of the insurance business, which is now all but insignificant. Quartix has been withdrawing from this market, which in 2017 was worth over 30% of total revenue.

In 2022, a more than 50% decline in insurance revenue to less than 3% of the total, could not eradicate the more than 12% increase in fleet revenue to over 97% of the total. Because the insurance business is now so small, in future the company’s growth curve will fall in-line with the fleet tracking business:

Source: Quartix results presentation 2022. Fleet revenue grew from £17 million in 2017 to nearly £26 million in 2022, a compound annual growth rate of 9.5%

The second reason to be cheerful is that price erosion is decreasing. Vehicle trackers are not particularly sophisticated products and there are many of them in the market, which is why prices have fallen.

Prices of new contracts have been stable for about four years, but because they are lower than they used to be, Quartix experiences price erosion as it replaces old customers on higher tariffs with new customers on lower tariffs, or customers renegotiate. The longer prices remain stable, the more the gap between new and historical pricing diminishes, and along with it price erosion.

In 2022, price erosion was nearly 5%, compared to more than 6% in 2021.

The company is taking steps that may eventually stop prices falling in real terms. From 2022, new contracts contain an inflation clause that will make it easier to raise prices when the initial contract term ends. Quartix is also taking a softly-softly approach to raising prices for customers currently on favourable terms.

Reasons for caution

Set against these positive developments is rising costs.

Component costs have risen as Quartix incorporates 4G technology to prepare for the obsolescence of 2G networks in the UK and Europe, a process that may start as early as 2025 and require the company to replace any remaining 2G Quartix devices in operation. Currently, due to the sunsetting of the 3G network in the US, Quartix is replacing trackers there at its own cost.

The company must also pay staff more, and support a larger and better paid board now founder Andy Walters has become a non-executive director. He took very modest sums out of the business in pay.

A change in accounting policy will also boost the profits Quartix reports in future in comparison to the cash it actually earns. That’s because the company has chosen to bring its revenue recognition policy into line with competitors by spreading the cost of supplying a new contract over its typical two-year lifetime, instead of expensing it at the beginning.

These costs include the cost of the device, sales commission, carriage, and installation.

It is a reasonable decision, since Quartix receives revenue throughout the term of each contract, but it will slightly flatter historical comparisons.

In 2022, cash conversion was also weakened by an increase in working capital due to component cost inflation and a decision to increase stock to mitigate shortages.

A generic product with mass appeal

Vehicle trackers help fleet managers at building firms, water companies, and road-mark painters for example, keep tabs on their vehicles.

A small device sends back data on vehicle locations, how well vans are being driven, and accidents. Trackers enable businesses to route vehicles more efficiently, encourage drivers to reduce fuel consumption by driving better, and catch drivers that moonlight or sleep on the job.

Quartix profits by keeping costs low, providing a generic service that many customers install and configure themselves, and by operating from a call centre in Newtown in North Wales and a low-key head office in Cambridge.

The company’s main expense is acquiring new customers through price comparison sites and direct marketing, costs it bears because once it has attracted customers, they tend to stick around and grow their fleets.

Once a tracker is installed, the cost of providing the service is small, and Quartix typically only loses 12% of fleet subscriptions each year. Customers stick with Quartix for nearly 10 years on average, and it is still earning revenue from customers recruited two decades ago.

This is why the company chose to supply fleets rather than insurers. The cost of acquiring insurance customers might be lower, but each tracker would only be installed for the first year of the new driver’s insurance.

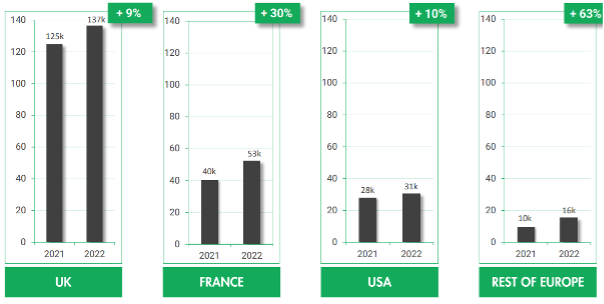

Having grown consistently in the UK, where in 2022 it earned 65% of revenue, Quartix has established sizeable and rapidly growing businesses in France (20% of revenue), and the US (12% of revenue). Growth in other European territories is very rapid, but from a small base.

Source: Quartix final results presentation 2022. Growth in the subscription base was strong in all territories, except the US.

Being its most mature market, the UK tends to grow slowest, although in 2022 the US disappointed as Quartix re-jigged its expansion plan to focus on Texas. It is investing in new field sales and telesales people, so hopefully profitable growth will follow.

Last year, the company launched two additional products, a checklist app that helps drivers ensure their vehicle is safe, and an app that uses tracking data to help customers work out which internal combustion vehicles they would be better off trading in for electric vehicles.

Although simplicity and standardisation are core principles at Quartix, the development of add-on services, and the company’s European and American expansion may increase the cost and complexity of the business.

Quartix has beefed up its presence in France, where it is easier to recruit people with language skills to serve Europe, and it is also employing field sales staff and distributors in the UK, France and Texas, a strategy it intends to roll out in Italy next.

In the past it has stuck to direct sales, but as it seeks to attract larger customers Quartix believes field sales is the low-cost option.

Longer-term, driverless cars may dispense with the need for separate vehicle trackers, but Quartix is primarily used in vans that must ply busy urban streets and village lanes. Driverless technology in that context may be a distant jet-packy prospect. Even if it is not, the device is only a small part of the service, and Quartix’s data analytics may still be required.

Founders’ mentality

Quartix was founded in 2001 by four friends, three of whom are substantial shareholders. One of them, Andy Walters, only recently resigned as chief executive and remains a non-executive director.

I believe they developed a unique low-cost strategy that has allowed the company to thrive in a very competitive market, and that strategy is probably enabled by a unique culture that values togetherness, transparency, simplicity, and meaningful connections between employees and customers. Trustpilot reviews are heartening.

Voluntary staff turnover is high, though. In 2022, 20% of employees left, down from 28% in 2021. Quartix says it is taking steps to improve these figures, including benchmarking pay to ensure it is fair, and a newly formed social xommittee in Newtown, its main operational centre.

There is even a sign of original thinking in the new board’s remuneration policy. The performance conditions of the Long-Term Incentive Plan targets growth in revenue and free cash flow as well as total shareholder return, a combination of statistics more likely to reward skill than those that most companies employ.

Scoring Quartix

I think I will favour Quartix for as long as its core business is a simple generic tracking system.

Unlike some competitors, Quartix has stayed away from designing bespoke systems for large customers, a sometimes costly way of winning business that may bind customers for a while, but does not necessarily lead to repeat business.

Costs are rising and prices are under pressure across the industry, so Quartix must keep its overall cost base lower than rivals through automation and self-service, to keep growing profitably. This is in its DNA.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

+ Good average cash conversion

What could stop it growing profitably? [2]

+ Strong finances

+ Competitors overcomplicate things

? Low-cost business model under some pressure

How does its strategy address the risks? [2]

+ Generic product has wide appeal

+ Expansion in Europe and the US

? Sale of add-ons (early days)

Will we all benefit? [2]

+ Founder and major shareholder is a non-executive director

+ Transparent, sharing, uncomplicated culture

? Staff turnover

Is the share price low relative to profit? [-1]

+ No. A share price of 280p values the enterprise at about £132 million, about 29 times adjusted profit.

Despite the high share price, a score of 7 out of 9 suggests Quartix may well be a good long-term investment.

It is ranked 18 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Quartix.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.