Richard Beddard: what will follow this UK share’s annus mirabilis?

12th August 2022 14:37

by Richard Beddard from interactive investor

Having had an exceptional year, companies analyst Richard Beddard examines prospects for this AIM firm in normal times. Is it a good long-term investment?

Timber importer James Latham (LSE:LTHM) has burnished its reputation as the UK’s leading independent distributor. In the process it has earned shareholders a windfall.

Valuing the company on the basis of profit or growth in the year to March 2022 would be a mistake. They are the result of an unusual set of circumstances, and chairman Nick Latham does not believe the company can repeat results he describes as exceptional.

That does not mean Lathams is a bad investment. In expecting the current year to be less profitable than the last one, traders may well be overlooking the fact that the company is a good earner in a typical year.

- Discover: How to buy Shares | Free regular investing | Super 60 Investment Ideas

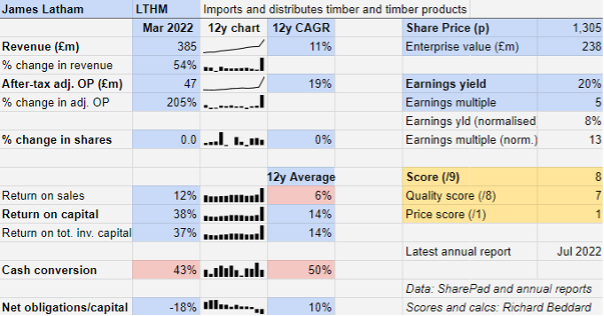

If we normalise Latham’s profit such that it earned a typical return on capital of 14% in 2022 instead of the astonishing 38% it actually earned, the share price still only values the enterprise at 13 times adjusted profit.

That seems like a modest price for a proven market leader capable of steady growth in normal times.

A series of extraordinary events

Here is Latham’s extraordinary year, laid out in the context of the previous 11:

I am not going to use adjectives, because the numbers speak for themselves. Revenue increased 54% and profit increased 205%. The company earned a profit margin of 12%, double the 5-6% it has earned previously. Return on Capital, at 38%, was nearly triple the 12-year average of 14%.

This performance was the product of rapacious demand, particularly in the US, which caused European manufacturers to direct supply there. That created shortages here, which were compounded by shipping problems.

The demand is not sustainable, so the 11% compound annual growth rate (CAGR) in revenue and 19% CAGR in adjusted profit over the last 12 years may give a false impression of how fast the company is growing.

But in the 12 years to the previous year end in March 2021, the company had achieved a respectable 7% CAGR in revenue and 12% CAGR in adjusted profit.

For the second year running, Lathams had more cash than financial obligations at the end of its financial year.

The only pink statistic in my table is cash conversion at 43%, below Lathams’ modest 12-year average of 50%, which is itself well below most of the distributors I follow.

A testament to supplier and customer relationships

I think we can forgive Lathams its cash conversion.

To secure supply for customers, it bought more timber which has tied cash up in stock.

That stock, though, was the reason for Lathams’ success, because it meant it could supply builders, joiners, door and kitchen manufacturers, and shop-fitters, when others could not.

Lathams was amply rewarded.

The extraordinary increase in revenue and profit was driven by higher prices as well as the sale of a greater proportion of specialty products. Higher volumes also meant the company was operating more efficiently.

That James Latham could source so much timber is testament to its relationships with suppliers, and the fact that it could pass on the higher cost and more to customers, shows how highly they value it as a supplier.

Lathams is also a conservatively financed company, which means it prefers to own pretty much everything it needs to operate, including warehouses and vehicles, rather than lease them or outsource.

When it purchases these items it feels the cash cost immediately but experiences the benefits over time, so the company could appear to be loss-making in a year of very heavy capital expenditure, when in fact it has merely made big investments.

This situation is what depreciation, a non-cash cost, is meant to correct. It allows companies to spread the cost out over the useful life of the asset, which affords us a more useful view of how well a company is trading.

While a large discrepancy between cash flow and profit can suggest the books are being cooked, in Latham’s case there is a much more simple explanation.

It pays for its assets up front and because it is growing, it must commit more capital to warehouse space, stock and funding receivables than it has in the past.

Although Lathams’ pension fund is in surplus, it is still paying deficit recovery payments. After working capital and capital expenditure, this is a third significant drain on cash, although there may be a reduction in 2024 when the payments will be recalculated.

Reasons to be cautious

Many economists and pundits think the UK and other major economies are on the cusp of a recession, which may reduce demand for timber and reverse the conditions of 2022.

Given Lathams’ financial strength, this is unlikely to threaten the viability of the company but it could lead to an especially sharp reversal in its performance if the market switches from a state of under to over-supply.

In 2020 the risk of not being able to supply customers outweighed the risk they might not want the stockpile. No doubt the directors are keeping a close eye on stock levels and targets as the economic outlook shifts.

Lathams does not supply any information about market share, but by putting resources into diversifying the product range and expanding in Ireland, the company may be signalling that opportunities to grow sales of timber and panel products in the UK at the expense of competitors is limited.

Although the pension fund is still gobbling cash, it has been closed to new entrants for over a decade and is now in surplus, so the risk is probably diminishing.

Building on scale

One of the important advantages scale brings distributors is better prices from suppliers, but 2022 showed there is more to it than that. Lathams was big enough to be a large customer to multiple suppliers, which meant when one could not come up with the goods it could turn to another.

Its many supplier relationships are helping again as Lathams casts around for sources to replace supplies of birch plywood, which the company stopped sourcing from Russia when that country invaded Ukraine.

Scale and financial strength are allowing it to serve customers better than rivals too.

Its commitment to supply orders next day when required, and within 24 to 48 hours generally, is born of large stock holdings and a decision to operate two shifts or 24 hours a day from its depots.

The company is also increasing the range of products it supplies to include laminates like melamine and natural acrylic stone, a blend of natural minerals and pigments that is as easy to cut, shape and join as wood.

These and other specialised products like engineered wood, door blanks, cladding and decking earn higher profit margins than commodity panel products like plywood, Medium Density Fibreboard (MDF) and timber.

The company has made relatively small acquisitions in recent years to help it grow specific product areas and in particular regions.

It expects the latest, IJK Timber in Northern Ireland will enable it to develop panel product sales across Ireland.

Principles and profit

Lathams is not a complicated business. Family owned since 1757, it has a long-term ethos, and prides itself on its principled trading policies.

Those principles put a high priority on maintaining good relationships with suppliers and customers.

Decentralised operations provide opportunities for entrepreneurial depot managers to make decisions within limits set by the board.

The company’s Key Performance Indicators, the metrics it uses to judge itself, are encouraging. Only two are financial, but they are perhaps the most important: Like-for-like sales growth and return on capital.

In addition Lathams tracks injuries per 100,000 hours worked (coming down) and efficiency. It measures the weight of product sold per working day (rising) and stock turn (temporarily depressed to make sure it can supply through shortages).

The company also tracks emissions, but here it is somewhat hamstrung. Timber is a carbon-negative product, growing it takes carbon out of the atmosphere.

But most of Lathams emissions come from HGV diesel because it trucks timber around the country. There is no alternative to diesel for large trucks, though the company says it will review the availability of electric HGVs as these become available.

Scoring James Latham

Does the business make good money? [1]

+ Decent return on capital

? Modest profit margins most years

? Modest cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Market leader has scale advantages

? A severe recession could temporarily impact profitability

How does its strategy address the risks? [2]

+ Investment in stock and warehouses

+ Broadening speciality product range to improve margins

+ Modest acquisitions so far

Will we all benefit? [2]

+ Directors are owner managers and not extravagantly paid

+ Entrepreneurial culture, employees received handsome bonuses in 2022

? Emissions

Is the share price low relative to profit? [1]

+ Yes. A share price of £13.05 values the enterprise at about £238 million, about 13 times normalised profit.

Although the year 2022 belies this conclusion, Lathams is a steady grower. Growth will revert towards the long-term trend, but the company should retain customers and an enhanced reputation.

A score of 8 out of 9 indicates Lathams is a good long-term investment.

It is ranked 5 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in James Latham.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.