Richard Beddard: can this stock keep boxing clever?

5th August 2022 14:45

by Richard Beddard from interactive investor

Our companies analyst appraises a profitable business in an un-flashy industry that enjoys a scale advantage and has expansion ambitions.

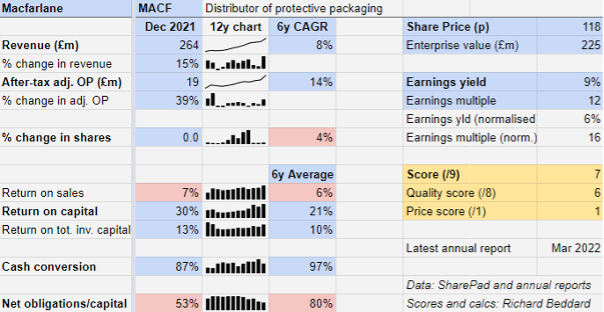

This is my first time scoring Macfarlane (LSE:MACF), a company that is earning far from mundane returns from what on the face of it is a pretty mundane product.

Cardboard, tape and bubble wrap

Macfarlane is a distributor of cardboard boxes, tape and bubble wrap, packaging used to protect things being stored or transported. It also manufactures bespoke packaging for high-value items.

The company operates a UK nationwide network of 27 regional distribution centres, three satellite sites and four factories.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

Macfarlane says it is the largest specialist UK protective packaging distributor, the market leader with a nationwide footprint. It sits between bigger, often multinational, general distributors such UK-listed Bunzl (LSE:BNZL) and regional rivals.

The products are mundane, but distributors add value by providing advice on reducing the cost, both financial and environmental, of packaging. For example, Macfarlane’s new “Packaging Optimiser” is a software tool that adds automation to the sales process, dubbed the “Significant Six”.

The Packaging Optimiser breaks a businesses’ packaging costs into six factors: storage, transport, damage and returns, administration, productivity, and materials, so customers can, as the name implies, optimise costs.

Scale is probably Macfarlane’s biggest advantage. Its nationwide footprint and 20,000 customers means it can source products cheaply from manufacturers and supply customers at all their UK sites (sometimes on an exclusive basis).

The company also saves customers money by supplying them just in time, so they do not have to tie money up in stock and storage space.

Manufacturing gives Macfarlane the opportunity to add more value, but it is a comparatively modest business. It contributed a little more than 10% of £264 million in the year to December 2021.

A profitable business

We are more than halfway through Macfarlane’s financial year. The company should report its results for January to June later this month, but it has already given investors a steer on the year to December 2022.

In the annual report, chief executive Peter Atkinson wrote that the company expects growth in revenue and profit, and confirmed this expectation in a trading update in May.

- Shares for the future: our own Warren Buffett names 23 shares in his ‘buy’ zone

- Read more from Richard Beddard here

- Read more of our content on UK shares here

Flagging orders from online retailers, which had been buoyed during the lockdowns, are being replaced by recovering orders from industrial customers.

Sales will also benefit from the first full year of contributions from two small acquisitions in early 2021, a Cornish distributor which Macfarlane has plugged into its network, and a manufacturer, which the company is integrating with its existing manufacturing businesses.

In May this year, Macfarlane acquired German distributor PackMann, which should also improve revenue and profit.

Longer term, return on capital has been improving for a decade, surpassing the previous high of 28% in 2019.

Something has changed. Ten years earlier, in the first half of the last decade, return on capital fluctuated between 10% and 15%.

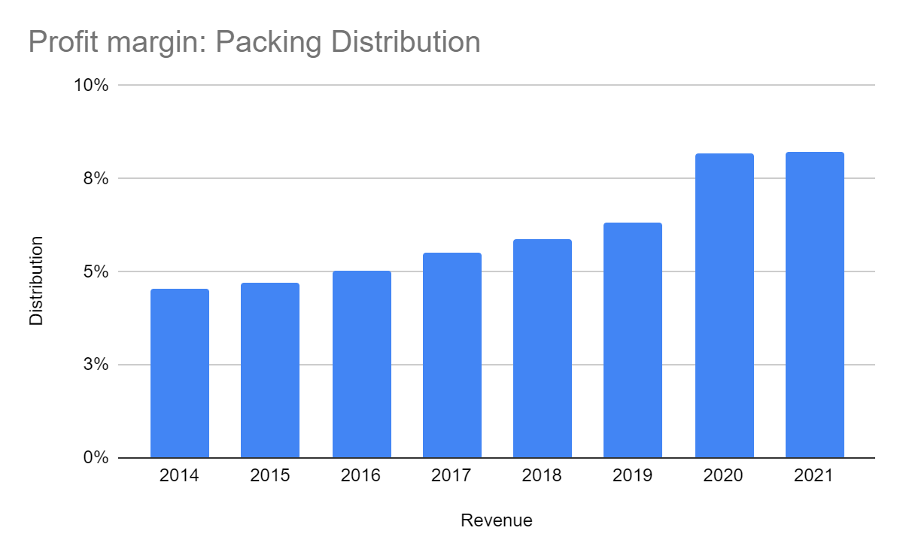

The most significant factor is probably the profitability of the packaging division, where profit margins have doubled in the last 10 years:

Source: Macfarlane annual reports

It looks as though the pandemic accelerated a rising trend. Between 2014 and 2018, profit margins increased from 4% to 6% and then during the pandemic years they increased to 8%.

Perhaps this is evidence of Macfarlane’s market leadership. Other market leading distributors such as Bunzl, and James Latham (LSE:LTHM, a distributor of timber, have also profited handsomely because they are their suppliers’ most important customers and have been able to continue sourcing products during periods of shortage.

While conditions may be normalising, it seems likely customers will also remember who could supply them at a time of crisis, which will entrench their leadership.

Roll up, Roll up

The longer-term trend in profitability stems from a number of factors.

Packaging is becoming more complicated due to new laws such as the plastic packaging tax and pressure to reduce its environmental impact. This makes advice more valuable.

By 2021, 44% of Macfarlane’s revenue came from its online store, which may be reducing the cost of business through automation and self-service.

Macfarlane also chooses to focus on customers it is uniquely well placed to supply, those with nationwide operations such as Argos and DHL, which operate in markets with faster-than-average growth opportunities, such as e-commerce and third party logistics, in addition to its traditional industrial markets.

Perhaps most importantly, there is the ever-present logic of distribution: Increased scale improves a distributor’s buying power and makes the network more efficient by stacking warehouses higher, for example.

Macfarlane has acquired perhaps eight regional packaging distributors in the last eight years, which by dint of their similarity are easily incorporated.

Judging by the company’s healthy return on total invested capital (13%), a calculation that includes the unamortised cost of the acquisitions, this strategy has been a success.

- Richard Beddard: is this small-cap share worth the risk?

- 10 high-quality tech shares that might be on sale

Macfarlane’s hasty pace would have unsettled me if I had been a shareholder though.

I prefer a conservative approach where companies pay back the money borrowed to acquire companies before embarking on the next one. Until 2018, Macfarlane sped things up by issuing more shares.

Since then, the company has been more circumspect, helped also by the sale of a label printing business in December 2021, which has contributed to funding its latest acquisition, PackMann.

PackMann may be Macfarlane’s most significant acquisition to date. Hitherto it has adopted a policy of “following the customer” into Northern Europe by partnering with distributors there, but PackMann is a European distributor based near Heidelberg in Germany.

What could go wrong?

I may have discovered Macfarlane at an interesting juncture. It has proved itself in the UK by performing well at a time of shortage, but its strategy is shifting as it extends its ambition outside our shores.

Expansion into Europe is more risky than expanding in the UK. PackMann is a viable and profitable business in its own right, but it will probably be more difficult to derive extra benefits by integrating it.

Macfarlane is probably hoping to replicate what it has achieved in the UK by buying and building a powerful network of distributors in Europe but that may be because, due to its scale, acquisition opportunities in the UK are less attractive than they once were.

Financing more acquisitions may be risky too.

Macfarlane’s financial obligations are low compared to previous years, at 53% of operating capital. At this level, they mostly relate to leases on warehouses. Bank borrowings at the year end were lower than cash deposits, and the assets in its pension fund outweighed the liabilities.

I am slightly put off by this. To my mind, it means the company’s reliance on outside capital is unlikely to decrease, and given Macfarlane’s thirst for capital in the past, it is quite likely to increase.

Finally, if shortages subside, so too might Macfarlane’s profitability as competitors come back on stream.

In using the average return on capital of the last six years to calculate my price score, I have assumed some mean reversion but not back to the levels of a decade ago.

Fairness

Peter Atkinson, the company’s chief executive of 20 years, must take some of the credit for Macfarlane’s success. In what the company bills as a “re-positioning” of his salary, he is being well rewarded for it.

He has received a significant pay rise to £405,000 in 2022 and £435,000 in 2023 and a doubling of the maximum bonus to 100% of his now substantial pay packet. He also receives free shares worth up to 100% of salary each year depending on performance.

The company says the increase brings his pay into line with other smaller listed companies. This rings true, but it is regrettable to me because I believe executive pay in general is too high.

The pay hike will increase the ratio between the chief executive’s pay and staff’s. In 2021, it was 24 times the median.

The company monitors customer satisfaction and although the scores are high, Macfarlane hopes to improve by deploying new customer relationship management software, soliciting more customer feedback, and through the Packaging Optimiser.

On the environment, Macfarlane is helping customers reduce their impact and it is committed to reducing the emissions it controls, principally by converting 50% of its delivery fleet to EVs and the installation of solar panels at a rate of one site per year, which seems a little pedestrian.

Scoring Macfarlane

This is the first time I have scored Macfarlane. As always, the future is less clear than the past, but it is a profitable business in a fairly un-flashy industry that enjoys a scale advantage.

That is a good place to start.

Does the business make good money? [2]

+ Good return on capital

? Modest but stable profit margin

+ Strong cash conversion

What could stop it growing profitably? [1]

? Future thirst for capital

+ Market leader in UK

? Could roll-up strategy be running out of steam here?

How does its strategy address the risks? [2]

+ Roll-up strategy is tried and tested

+ Focus on national accounts in growing markets

? European roll-ups may be more risky

Will we all benefit? [1]

+ Experienced chief executive

? Not sure about employees and culture

? Uninspired by environmental targets

Is the share price low relative to profit? [1]

+ Yes. A share price of 118p values the enterprise at £225 million, about 16 times normalised profit.

A score of 7 out of 9 indicates Macfarlane probably is a good long-term investment.

To get to know it better, I have added the share to the Decision Engine. To make space for it I have removed Castings (LSE:CGS).

Macfarlane is ranked 21 out of 40 shares.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.