Richard Beddard: why I own shares in this software firm

13th August 2021 15:01

by Richard Beddard from interactive investor

Our ‘Decision Engine’ columnist considers the merits of a tech company with some in-demand intellectual property.

These are confusing times for investors in developers that make software for large enterprises.

Often share prices are sky high because of the relentless digitisation of business accelerated by the pandemic, but revenue and profits are less lively because of the heavy investment required to be competitive and the industry-wide shift to supplying software as an annually billed service.

One such company is D4t4 (LSE:D4T4), and one such investor is me.

D4t4 owns Celebrus, a software platform that comes in two flavours: a customer data platform (CDP) and a fraud data platform (FDP). Celebrus CDP is well established, and Celebrus FDP was launched in June.

Before D4t4 acquired Celebrus in 2015, it was a customer of Celebrus, sometimes including Celebrus in the IT systems it built as a systems integrator.

Today, Celebrus and broader data management systems incorporating Celebrus account for 81% of D4t4’s revenue.

Celebrus captures data from a company’s digital interactions with customers so its IT systems can react in real time to facilitate a sale or intercept a fraud. It promises to identify fraudsters using their digital interactions with a business before the fraud even takes place.

Celebrating Celebrus

D4t4 says the most common way of monitoring interactions requires websites to be tagged, which means companies must decide in advance what they want to know. Tagging is inflexible because if the requirements change, then websites must be re-coded.

Celebrus captures all customer interactions with “digital touchpoints” (websites and chatbots for example), every click, search, mouseover, and piece of text in real time.

Rather spookily Celebrus can capture whether we are left or right-handed, how big our finger is and how much pressure we put on our touchpads.

Since all the data is collected by customer’s systems, Celebrus is compliant with burgeoning privacy regulations. It does not depend on third-party cookies to identify a customer, which are increasingly blocked, legally by privacy legislation, and technically in Apple’s software, for example.

- How our 10 Dogs of the Footsie are faring

- Read more of our content on UK shares here

- Check out our award-winning stocks and shares ISA

Celebrus combines information from a company’s other software systems, for example age, gender, and credit score, in real-time to determine how to respond to the customer.

It wants online interactions to be like selling face to face, which means real time is measured in milliseconds, not hours.

The platform spans all digital channels, using natural language processing to report emotion in customers’ conversations with chatbots, for example, allowing a human to take over if the software deems it necessary.

D4t4 says this level of sophistication is not yet used by most businesses, banks and insurance companies are in the vanguard, and other sectors like retail and healthcare are following.

In a nutshell, Celebrus promises to improve customers’ experience of digital channels, and stop companies and their customers being ripped off.

The company is intensifying its efforts to court customers directly, but most of its sales are made through partners, bigger enterprise software providers that integrate Celebrus with their software.

Partnering is an efficient route to market for a small company like D4t4, but these are very important relationships. The company’s biggest partner earned D4t4 nearly half of its revenue.

Unsurprisingly D4t4 is seeking more partners and appealing to end-customers directly.

Why D4t4 is not growing (much)

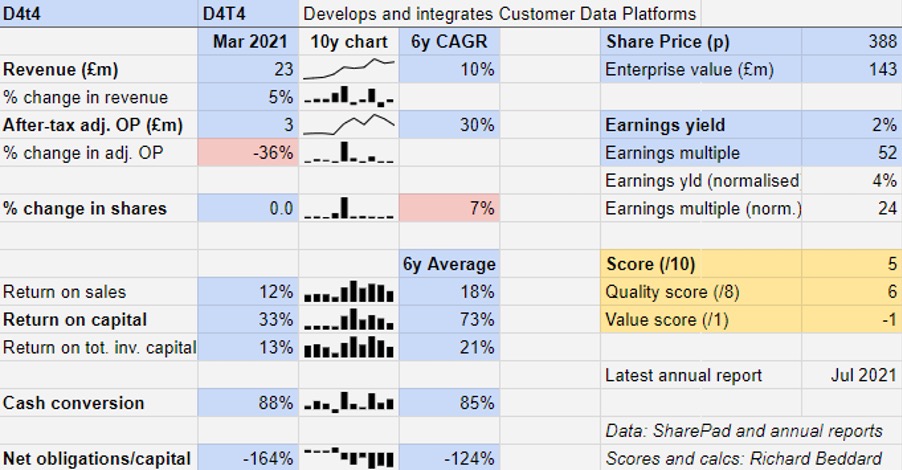

Past performance is not a guide to future performance

Profit contracted in 2021 for the second year in a row for several reasons.

In common with many other software companies, D4T4 is changing the way it sells software from perpetual licenses to annual.

Perpetual licenses bring in more revenue and profit up front, while annual licenses mean the company sacrifices some of that revenue for regular annual payments (as long as the customer still wants to use the software).

D4t4 also earns annual recurring revenue (ARR) from support and maintenance contracts, and the recurring element of its income increased 11% in the year to March 2021 to £10.6 million (just over 46%).

Assuming D4t4 does not lose many customers, it has not in the recent past, these recurring revenues should compound such that, in the fullness of time they are more impactful than the loss of revenue from the sale of fewer perpetual licenses. Resurgent growth should follow.

- Richard Beddard: can this firm keep delivering magic for investors?

- Read more Richard Beddard articles here

D4t4 anticipates this point might come in the company’s 2023 financial year, the year after the current one.

Even so, but for one-off costs relating to the development of Celebrus FDP of £1.2 million, and foreign exchange movements that cost the company £0.7 million, profit in 2021 would have increased somewhat.

The company also says some customers were distracted by the internal challenges of dealing with the pandemic and paused or slowed strategic projects like Celebrus implementations.

This had a modest impact on revenue growth in 2021 but the quid pro quo should be an increase in demand, as companies rush to digitise and make their businesses more resilient.

Heavy investment, the switch to annual subscriptions and the pandemic have obscured the growth trend. Management says it is intact, but uncomfortably for investors it is not obvious.

Celebrus FDP may continue dragging on profit for some time since it typically takes D4t4 over a year to make a sale and although it will approach many Celebrus CDP customers, it is not the marketers within those companies it needs to speak to.

Henc,e D4t4 is financing a “loud” public relations (PR) campaign, and it must also recruit more consultants to sell Celebrus FDP.

Board changes

The company is still founder-managed, but the founders are stepping back and the board is being reshaped, another confounding factor.

John Lythall, a former chief executive, recently stood down as non-executive director and Peter Kear, the current chief executive, expects to step down and become a non-executive director by June next year.

He is being replaced by Bill Bruno who has been promoted from president of the US business to deputy chief executive.

D4t4 has just appointed a new chief financial officer too after the previous one left earlier this year.

Meanwhile, D4t4’s chief technology officer and chief operating officer have stepped down from the main board and will form part of an operations board.

- Subscribe to the ii YouTube channel for our latest interviews

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

The idea is to focus the main board on strategy and corporate affairs, leaving the operations board to focus on execution.

Wholesale changes in boards can be a sign of trouble, but Kear is 65 next year so maybe his reasons for stepping back are personal, and that has created the opportunity to rethink how the board operates.

While small boards comprising only two directors are becoming the norm, there are disadvantages. Such boards often extract a high price for their work, and arguably a board should include a broader array of talent.

Scoring D4t4

D4t4 is difficult to score because the company and its markets are changing.

It is also a small company, and my nagging fear is another, maybe larger and better resourced, software company will develop capabilities that rival Celebrus as a feature of their own software.

But D4t4 plausibly claims unique patented intellectual property that companies outside its financial services niche are only just beginning to realise they need: real-time, compliant, and personalised data to facilitate or block digital transactions in the moment.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Decent cash flow

What could stop it growing profitably? [1]

+ Very strong finances

? Investment and transition to subscriptions weighing on profit

? Dependent on sales partners

How does its strategy address the risks? [2]

+ Partnering with more software firms

+ Engaging directly with clients

+ Improving CDP and inventing new platforms (FDP)

Will we all benefit? [1]

? Executives are reasonably paid, for now

? Old guard is stepping back although Kear remains a 4% shareholder

? Staff are strategic priority

Is the share price low relative to profit? [-1]

? No, a share price of 388p values the enterprise at 52 times adjusted profit (24 times on a normalised basis)

A score of 5 out of 9 means I think the company probably is a good long-term investment.

But it also incorporates some uncertainty and a relatively high share price.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in D4t4

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.