A share this analyst really believes in

The shares aren’t cheap, but our companies analyst rates this vehicle tracking business highly.

15th May 2020 15:36

by Richard Beddard from interactive investor

The shares are not cheap, but our companies analyst rates this vehicle tracking business highly.

As we gradually come out of lockdown, I am remembering the day before we went into it. It was the last time I took a passenger in my car. In fact, it was the last time I drove.

I was on my way home, heading up the hill that separates the village I live in from a neighbouring one, when I saw a van in the road ablaze.

There was no way I could drive past, so I headed back the way I had come when I noticed a friend who works at the school in the neighbouring village.

She was stranded, her husband on his way to pick her up was parked the other side of the van fire, pondering whether to take a five-mile detour like I was about to. So I gave her a lift home and, as we speculated about the drama, we realised it might be an insurance job - a symbol of the pain lots of small businesses must have been feeling.

All that remains of the van.

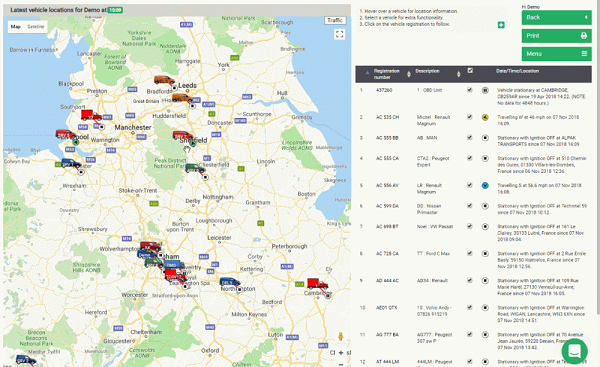

Coincidentally, I had just passed the road Quartix Holdings (LSE:QTX) uses in demonstrations of its vehicle tracking system. Quartix’s system is designed for and sold to many thousands of small businesses - since they are feeling pain, it must be too.

A growth business within

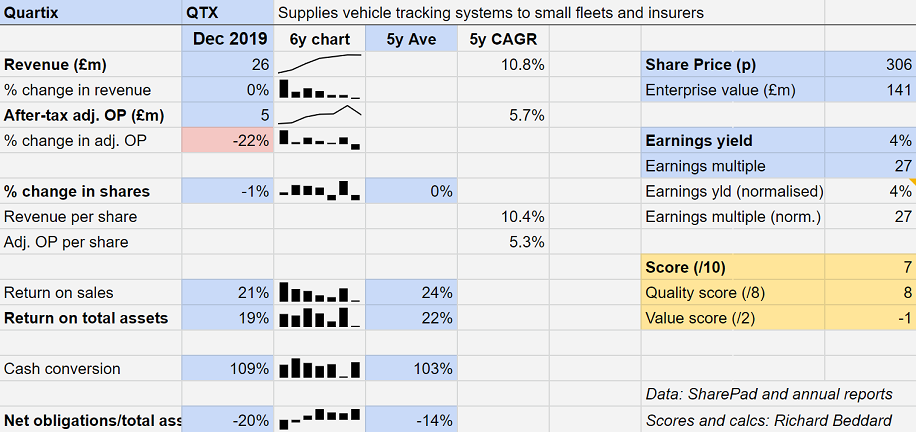

A quick look at the stats tells us Quartix has contracted regardless of the pandemic. Revenue in the year to December 2019 was flat, and adjusted profit fell 22%. A surge in profit in 2018 was mostly the result of a new accounting standard. I do not think Quartix has grown profit unambiguously for three or four years.

Quartix supplies vehicle tracking systems. Source: www.quartix.com

The company supplies vehicle tracking systems (telematics), principally for small fleet owners, often local businesses who want to keep tabs on their vehicles and how well they are being driven. The devices are simple, generic, supplied at no upfront cost and rented along with the tracking service for a minimum of 12 months. When the contract ends customers pay as they go.

When the economy is not locked down, customers are loyal. Just under 12% of units are returned each year and Quartix is installed in 150,000 vehicles in the UK, so it seems the company has hit something of a sweet spot in terms of price and service.

It has focused only on features demanded by a high proportion of customers and developed internal systems around the most efficient ways of marketing it, direct telesales and online sales, and through price comparison sites.

The imperative, to keep the cost of the device low, permeates the whole business, including product development. Traditionally, Quartix trackers are fitted by self-employed installers, but sales of new customer installed versions of the device had grown to 40% of new subscriptions by the end of the financial year.

Quartix also supplies insurance companies with telematics systems installed in the cars of newly-qualified drivers. This business is less profitable, probably because the tracking device is usually installed only for a year, insurers are big customers with more pricing power, and almost all of Quartix’s sales are to Wunelli, a reseller. Quartix has a policy of only supplying insurers when it can earn a reasonable return, hence this part of the business has contracted to 19% of revenue and 6% of profit.

The financial highlights in the annual report, the numbers the company most wants us to read, tell the story. Although the net result of Quartix’s hard work has been unremarkable in terms of growth in recent years, the company wants us to look past the declining insurance business (31% decline in revenue and a 51% decline in profit in the year to 2019) to the sunny uplands of the fleet business (revenue up 11%, profit flat).

Flat profit for the fleet business may seem unimpressive, but the company also wants us to understand this is a result of the mounting cost of expansion in the UK, where Quartix is well established, and the US and Europe, markets it is still relatively new to.

This cost is described by the company as “fleet customer acquisition investment”, a euphemism for marketing, which is 24% of revenue. If it had not been straining to grow so fast, Quartix would be more profitable because it would have lower costs. The thing is though, the company is extraordinarily profitable any way, which makes me think ‘investing’ in acquiring new customers is the right thing to do.

Impressive numbers

I cannot calculate Quartix’s return on capital the way I do it for other companies because the denominator, capital, evaluates to a negative number. For the time being, I have resorted to return on total assets, which is a remarkable 20%, and certainly understates Quartix’s profitability. The company is even more profitable in cash terms than accounting profit:

A 22% rise in the number of units under subscription, the result of steady increases in the UK and rapid growth overseas, and a modest unit attrition rate of 12%, indicate that on the eve of the pandemic continued growth could be expected.

That impression was confirmed in the first three months of the new financial year (to 31 March), although new installations had started to slow during March itself and some businesses were taking vehicles off the road.

In April, Quartix estimates new orders were 60% below the previous April, and new insurance installations almost came to a halt, although there should be more in May.

The contraction in new orders means Quartix’s costs are lower because it is not installing as many units, so even though revenue will fall, in the short-term at least, profit and cash flow will hold up.

Meanwhile, the board has conducted what it considers to be a pessimistic risk assessment, assuming continued investment in marketing and product development, much reduced installations and unit attrition rates rising to 30% by the year-end, moderating to 20% in 2021.

Reassuringly, under this scenario, the company does not believe it will have to draw on its cash surplus of £8.5 million, a surplus it intends to maintain or increase. Although the company proposed a dividend at the AGM, it recommended shareholders vote against it, thus stopping about £4.8 million flowing out of the company earlier this month.

I believe Quartix is a meticulously managed business. Its scenario planning reminds me of Next’s, which is the gold standard, although Quartix is in a stronger financial position.

The company’s culture fosters meaningful relationships, simplicity, treating everybody the same, sharing knowledge, and doing the right thing.

Despite appearances, and immediate prospects, I rate Quartix highly but its valuation less so:

Does the business make good money? [2]

+ High return on total assets understates profitability

+ High return on sales despite lower-margin insurance business

+ 100%-plus cash conversion

What could stop it growing profitably? [2]

+ Lower cost alternatives (unlikely, strategy addresses this)

? Large installed base in the UK means growth could slow

? Mobile networks will shut down 2G this decade requiring installed devices to be upgraded, perhaps at a cost to Quartix

? Autonomous vehicles may be a threat in the distant future.

How does its strategy address the risks? [2]

+ Dedication to standardisation and simplicity keeps costs down

+ International expansion provides new growth markets

? Quartix is seeking to minimise the cost of upgrading devices through "various technological and commercial means"

? Quartix is committed to adapting the service to new technologies

Will we all benefit? [2]

+ The company is still run by founder Andy Walters

+ Walters owns 38% of the shares

+ Three executive directors are modestly remunerated

+ Customer focused corporate culture

+ Employees get free shares options, exercisable after 18 months

Are the shares cheap? [-1]

No. A share price of 306p values the enterprise at £140 million, about 27 times adjusted profit. The earnings yield is just 4%.

At this kind of valuation, you have to believe! I do. It scores 7/10 and is ranked 17th of 31 companies I follow. I think it’s likely to be a good long-term investment.

Cimpre$$

Not one, not two, but three readers contacted me after reading my profile of 4imprint (LSE:FOUR), a direct marketer of promotional paraphernalia: tee-shirts, mugs and so on. One reminded me of the enormous size and fragmented nature of the market. 4imprint says it is the largest distributor in the US promotional products industry yet its share of the $27.3 billion US and Canadian market is just 3%, so it has plenty of room to grow.

The other two readers wrote in to warn of a threat posed by Cimpress (NASDAQ:CMPR), which is headquartered in Ireland and listed on the NASDAQ exchange. Cimpress’s biggest brand is Vistaprint, an online supplier of business cards, flyers, brochures that has acquired a substantial number of promotional goods suppliers and developed a promotional products brand, Promotique by Vistaprint.

The two companies have something in common: visionary chief executives. But in almost every other way they are different. Cimpress has grown by acquisition, its businesses customise products rather than outsourcing the work, and it is heavily in debt. It is trying to do a lot more than 4imprint, which is barely involved in the production or shipping of products, and Cimpress has operations in many more countries. Judging by its stretched balance sheet, it may be taking on too much, but I hope it isn’t.

In any case, given the fragmented market, both companies could flourish, once businesses are back in business.

Richard owns shares in Quartix.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.