This share is a magnet for income investors with a long-term view

This company has been shunned by many investors, and for good reason. But overseas investing expert Rodney Hobson believes performance is reliable enough for those seeking diversification and a regular source of dividend income.

27th September 2023 08:01

by Rodney Hobson from interactive investor

Plans by tobacco company Philip Morris International Inc (NYSE:PM) to diversify into a more ethical image seem to be unravelling. However, less queasy investors may wish to consider a company that is seen as a pariah by some and as a solid dividend payer by others.

Morris shocked both the investing and medical worlds two years ago when it bought Wiltshire-based Vectura, a maker of inhalers and medicines for smoking-related conditions, for £1 billion. There were accusations that Morris was trying to make money from treating the very illnesses that it and other tobacco companies had caused in the first place.

Critics suggested that the deal was “greenwashing,” and that Vectura would be hampered in its ability to “continue operating as a viable research-oriented business,” while Morris claimed the deal was central to its diversification into healthcare.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The critics seem to have been proved right, with several senior figures quitting Vectura. In July this year, Morris wrote $680 million off the value of Vectura, blaming unsuccessful clinical trials for its inhalable aspirin product, contract delays and increased costs. Yet Morris is committed to spending £58 million on an inhalation centre in Bristol and Bath Science Park that is due to open next year.

The attempts by the tobacco industry to diversify in the face of increased regulation and taxation in various countries goes way beyond Philip Morris, and includes food, alcohol, financial services and retailing with generally disappointing results. That leaves smokers to continue to provide the lion’s share of revenue and profits.

Morris said when it announced its half-year results in July that it was exploring the possibility of bringing in partners to help Vectura. Now it is reported to be considering other options, including selling a stake in the healthcare business.

The latest results were a mixed bag. While net revenue rose 15% year-on-year to nearly $9 billion in the second quarter, marketing, administration and research costs increased by 37% to $5.4 billion, and cost of sales rose 22% to $3.2 billion, putting a squeeze on margins.

It was a similar story for the first half as a whole, with net revenue up 9% but operating income down 16%. However, the second quarter was at least an improvement on the first.

Another positive from the company’s point of view is that people continue to smoke despite price rises. Morris sold slightly fewer cigarettes, but sales of heated tobacco products jumped 27% in the second quarter, taking total units sold up 3.3%. Again, the figures were more positive than in the first quarter.

Inflationary pressures are already easing in the second half, allowing Morris to raise its full-year forecast for net revenue growth to around 8% and for earnings per share to 8-9.5%.

- Goldman Sachs says to buy these six stocks to ride out the global doldrums

- Seven investing pitfalls to avoid

Morris is far from done with its journey towards a smoke-free future. It has just appointed to its board Victoria Marker, whose top-level experience is in media and digital communications and in energy. Even so, she is based in Virginia, the home of tobacco.

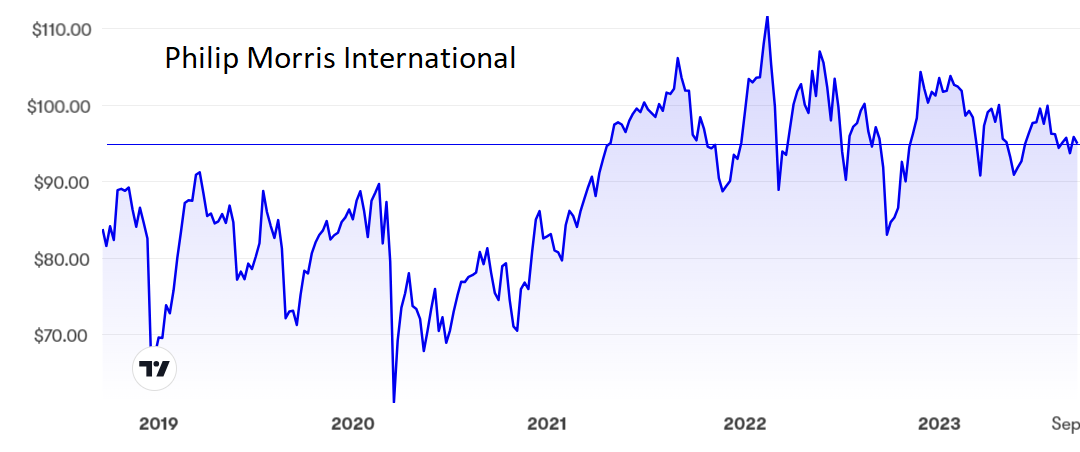

The shares have oscillated around $95 for the past two-and-a half years now, after breaking upwards from the previous range between $70 and $90. The price/earnings ratio is not too demanding at 18 and the yield is a quite attractive 5.35%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: This is obviously not a share for ethical investors, nor is it one for traders looking for quick substantial share price gains, but it remains a magnet for those investing for income with a long-term view. The widespread hostility towards the sector remains remarkably slow to affect revenue and earnings.

The downside on the shares is probably limited to $90 and the upside to $105. Based purely on investment criterion, the shares are a buy for income under $100.

For the record, I have never smoked.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.