Share Sleuth: TV’s Dexter Morgan lends a hand and new firms for Decision Engine

Richard Beddard pulls more companies into the stock selection funnel.

28th May 2020 09:13

by Richard Beddard from interactive investor

Richard Beddard pulls more companies into the stock selection funnel.

When I was reaching for a pithy way to sum up the latest month in the life of the Share Sleuth portfolio, the phrase “There’s nothing like a crisis” came to mind, but none of the endings that followed really fitted. I was thinking of “to focus the mind”, but it didn’t hit the mark so I typed the first half of the phrase into Google. The search returned a quote from Dexter Morgan, a fictional anti-hero. It was perfect.

Morgan said: “There is nothing like a crisis to define who you are.” I don’t know what his fictional circumstances were, but the pandemic feels like a crisis, and investing-wise I responded with denial, then acceptance, and subsequently by defining who I am.

However, I did not deliberately choose this path when I set out to revamp my Decision Engine, the spreadsheets that wrangle all the information I use to score and rank shares. I wanted to release a bottleneck in my investing process.

- Read more content about shares

Comparison process

For me, investing is a process of comparison. I want to own the best companies as long as they are reasonably priced, and this means comparing the shares I own with the shares I might prefer to own. It takes time to know a business well, and to make the system work I need to compare lots of businesses. Balancing these two imperatives, knowing each company well and knowing lots of shares, is perhaps my biggest challenge.

For some time, I have felt that there needs to be more competition for places in the Share Sleuth portfolio, which means scoring and ranking more shares. The bottleneck was the many years of financial data I collect from annual reports, which use up a lot of time.

So, while I still need to collect some of the more esoteric numbers myself to make adjustments, I have restructured my Decision Engine spreadsheets to incorporate many of the financial numbers I require from a third party, SharePad, the software service I already use to track the portfolio’s performance.

Only one of the five criteria I use to score a share is calculated directly using these numbers (the Value score). The other four criteria are judgements about the business, which I have defined more clearly as follows:

1) Profitability: Has the business made good money? Judges whether the company has been profitable in cash and accounting terms.

2) Risks: What could stop the company growing profitably? Examines debt, the variability of earnings, and competition.

3) Strategy: How will the company make more money? Considers whether the company’s strategy addresses the risks.

4) Fairness: Will shareholders, staff and customers benefit? Assesses executive pay and share ownership, company policies and reputation

Having sucked in the numbers and judgements and made calculations, the Decision Engine ranks the shares and recommends trades to me. The higher the score, and the smaller any existing holding, the more it will suggest I invest. I do not, though, have to take its advice.

Today ,the Decision Engine is offering me five shares to buy: They are RM (ranked 4), Dart (5), Anpario (7), Next (9) and Howden Joinery (10). These are quite contrarian recommendations. Dart and RM’s high rankings are, in part, because their share prices have fallen quite a way. Anpario (see Share Watch) is a more comforting prospect; I have yet to pull the trigger, but may have done by the time you read this.

More recommendations in the pipeline

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 4,892 | ||||

| Shares | 124,202 | ||||

| Since 9 September 2009 | 30,000 | 129,094 | 330 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 937 | 3,168 | 3,467 | 9 |

| ALU | Alumasc | 938 | 999 | 732 | -27 |

| AVON | Avon Rubber | 192 | 2,510 | 5,069 | 102 |

| BMY | Bloomsbury | 1,256 | 3,274 | 2,531 | -23 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 2,641 | -27 |

| CGS | Castings | 1,109 | 3,110 | 3,660 | 18 |

| CHH | Churchill China | 341 | 3,751 | 4,945 | 32 |

| CHRT | Cohort | 1,600 | 3,747 | 9,120 | 143 |

| DTG | Dart | 456 | 250 | 2,779 | 1,012 |

| DWHT | Dewhurst | 735 | 2,244 | 6,064 | 170 |

| GAW | Games Workshop | 113 | 324 | 6,746 | 1,981 |

| GDWN | Goodwin | 266 | 6,646 | 5,958 | -10 |

| HWDN | Howden Joinery | 748 | 3,228 | 3,964 | 23 |

| JDG | Judges Scientific | 159 | 3,825 | 7,632 | 100 |

| NXT | Next | 45 | 2,199 | 2,143 | -3 |

| PMP | Portmeirion | 349 | 3,212 | 1,557 | -52 |

| PZC | PZ Cussons | 1,870 | 3,878 | 3,478 | -10 |

| QTX | Quartix | 1,085 | 2,798 | 3,157 | 13 |

| RM. | RM | 1,275 | 3,038 | 2,652 | -13 |

| RSW | Renishaw | 92 | 1,739 | 3,176 | 83 |

| SOLI | Solid State | 1,546 | 4,523 | 7,266 | 61 |

| TET | Treatt | 1,222 | 1,734 | 5,737 | 231 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,400 | 190 |

| TRI | Trifast | 2,261 | 3,357 | 2,691 | -20 |

| TSTL | Tristel | 750 | 268 | 3,900 | 1,354 |

| VCT | Victrex | 323 | 6,254 | 6,331 | 1 |

| XPP | XP Power | 339 | 6,287 | 10,407 | 66 |

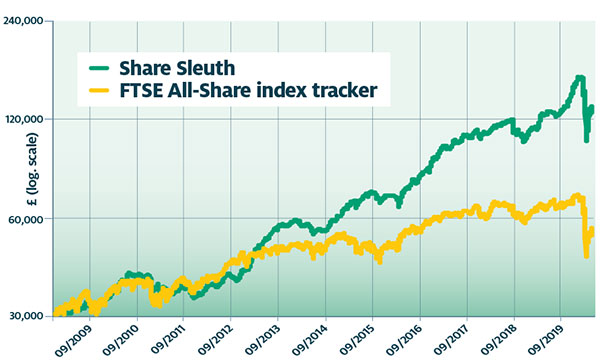

Notes: No transactions. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £129,094 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £55,869 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 1 May 2020

Bouncing back from the bottom

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.