Shares in this iconic brand are the real thing

This stock tip delivered a 24% profit, and the market crash offers a chance to replicate the trade.

25th March 2020 11:05

by Rodney Hobson from interactive investor

This stock tip delivered a 24% profit, and the market crash offers a chance to replicate the trade.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Things were going so well for soft drinks maker Coca-Cola (NYSE:KO) at the end of last year. Then came the coronavirus pandemic and the fizz evaporated. When we eventually come out of the crisis, the shares could be the real thing.

Coca-Cola is the largest non-alcoholic drinks maker in the world with brands that include Coke, Fanta and Sprite.

It also has some non-sparkling brands. Most of its efforts go into the early stage of the supply chain, making concentrates that are processed and distributed by a network of 100 bottlers. Revenue is generated around the world. It sells in 200 countries and makes nearly 70% of its sales outside the US.

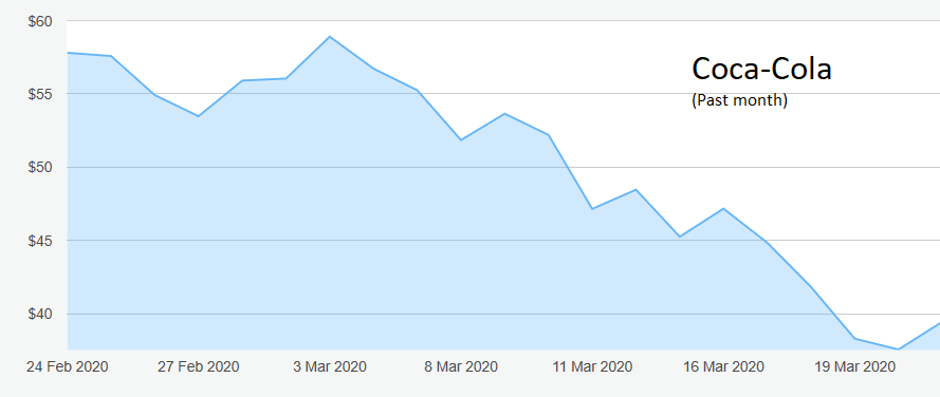

Source: interactive investor Past performance is not a guide to future performance

At the end of January, the Atlanta-based company reported a strong performance in the final three months of 2019, with earnings per share more than doubling from 20 cents to 47 cents.

Net earnings were similarly ahead, from $927 million in the previous fourth quarter to over $2 billion. Organic revenue grew 7% and total revenue was 16% higher, with group volumes ahead by 3%.

Around the globe, sales were patchy but with most regions ahead. Latin America was the best performer with 26% organic growth on volumes up 3%; Asia Pacific was up 8% and in North America revenue rose 4% even though volumes were flat.

The disappointment came in Europe, Middle East and Africa where organic revenue slipped 2%. But one of the big advantages of Coca-Cola is that its global reach means any setbacks can be more than compensated for elsewhere.

Over the whole year, revenue increased by 9% to $37.3 billion and net income soared by 39%. All regions were ahead over the year as a whole.

Chair and chief executive James Quincey claimed that Coca-Cola was growing in a more sustainable way and he was confident that organic revenue would rise 5% in 2020, with earnings per share of $2.11-2.25. At the top end, that would be 7% ahead.

Clearly the Covid-19 lockdowns in various countries will knock a hole in that assessment, but the impact should be lessened substantially by the fact that food stores need to be exempted from any enforced closures of retail outlets. Sales of soft drinks should hold up reasonably well.

Source: interactive investor Past performance is not a guide to future performance

More impact will be felt at the Costa Coffee shop chain bought from Whitbread (LSE:WTB) in January last year. Many commentators felt that the Americans had acquired a great business with enormous potential for expansion.

That acquisition of 2,700 outlets looks somewhat ill-timed now, especially as Coca-Cola is committed to paying 16,000 members of staff at closed stores their full average weekly pay over eight weeks. Cafes, where complete strangers congregate, are naturally seen as expendable in lockdowns, but we will one day get back to normal.

While figures from China are suspect, the tailing off of cases and deaths reported there are being replicated in places such as South Korea and Singapore and possibly in Italy. Coca-Cola has the financial clout to hang on until we turn the corner.

I last looked at Coca-Cola on 1 May when it reported quarterly profits beating analysts’ forecasts and the shares looked unfairly subdued, having fallen back from a peak at $51.

The stock closed that day at $48.39 and I suggested buying below $50. It looked a good call as shares rose steadily to a peak above $60 in February. They have since slumped to $38 but have come off the bottom to approach $40.

Hobson’s choice: The advice to buy up to $50 still stands although investors can easily beat that at the moment and will probably be able to do so for some time.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.