Some great bellwether stocks and a 'best buy'

30th January 2019 10:28

by Rodney Hobson from interactive investor

Our bullish leading industry commentator, author and columnist accuses the market of undue pessimism.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stockmarket. He is qualified as a representative under the Financial Services Act.

It's quite reasonable to regard recruitment companies as bellwether stocks. After all, if companies around the world are taking on staff then presumably the global economy is not yet seizing up.

Much has been made in the UK of the Brexit shambles, and figures for UK-based recruitment specialists show that the uncertainty has undoubtedly held back their earnings in Britain and Ireland. But that is comparatively small beer in global terms, even if the UK is one of the largest economies in the world.

- Invest with ii: Most-traded US Stocks | Buy International Shares | Top UK Shares

Of greater concern is a slowdown across the eurozone, with even Germany in danger of recession, a slippage in growth in China from nearly 10% to nearer 6%, and worries that trade wars will have an impact in the United States.

Yet the US recorded a new low in jobless claims last week despite the prolonged government shutdown and a significant rise in employment, while even the UK is showing a similar pattern. Recruitment companies based on both sides of the Atlantic are thriving and there is no sign that the picture will change for the worse any time soon.

Many commentators fear that 10 years of recovery from the 2007-8 financial crash is quite long enough, and a correction must come soon. That is unduly pessimistic. Downturns tend to be short and sharp; upward trends are more gradual but they run until there is a major crisis – there is no specific time limit that says the cut-off has arrived.

As the US is still the largest economy in the world, it makes sense to look there for investment prospects in the sector.

- Analyst has a nibble at these four funds

- Stockwatch: The tech share I want to own

- Is Microsoft stock a buy ahead of results?

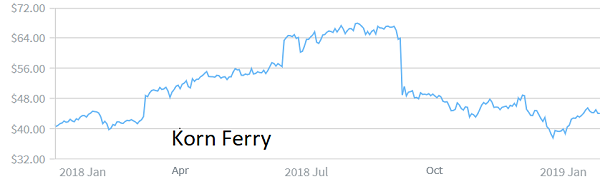

Korn Ferry (NYSE:KFY) is possibly the best known American recruitment firm and it also offers advisory services covering business organisation, development and motivation. It employs 7,500 staff serving clients in 50 countries.

It has the size and geographic spread to withstand a turndown in any part of the globe. However, its range of services, though a boon in good times, is a potential hazard, for if there is a downturn it will be magnified across the full gamut.

A two-year bull run took the shares up to $68 last summer but they slipped back to $38 at Christmas. They have now clearly bottomed out but it is not too late to buy in at around $44, where the yield is an admittedly miserly 0.9%. They could well top $50 soon.

Source: interactive investor (*) Past performance is not a guide to future performance

Manpower (NYSE:MAN) shares peaked earlier, at $135 a year ago, and the slide has been longer and more pronounced: half the value had disappeared by Christmas. Here again, though, there has been a recent pick-up to around $74 as the view grows that the sell-off was overdone. Barring any unexpected bad news, the recovery should continue.

The price/earnings (PE) ratio is actually in single figures, which looks quite unjustified, and the yield at 2.7% puts Korn to shame. Manpower is the third-largest staffing company in the world and has the muscle power to withstand any downturn better than most.

Source: interactive investor (*) Past performance is not a guide to future performance

However, the largest companies in the sector, and arguably the two best investment prospects, can be found in Europe.

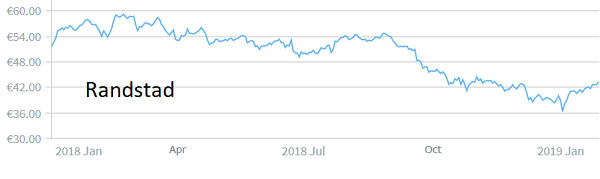

Randstad (EURONEXT:RAND) is based in the Netherlands. Like its American counterparts, it has seen its shares slide, from €60 last February to €36 in December before a modest pick-up to €43. It's PE of 11.3 and yield of 4.8% are the most attractive combination among the largest recruitment groups.

Source: interactive investor (*) Past performance is not a guide to future performance

Adecco (XETRA:ADI1) (and SWX:ADEN) is a Swiss company whose shares have traced the same path. Its yield is 4.9% and PE only 9.8.

Both European companies have seen turnover, profits and earnings per share rise in recent years.

Hobson's Choice: Adecco looks the best buy on fundamentals, closely followed by Randstad. Both US companies are possible buys as long as you take profits when the opportunity arises.

*Horizontal lines on charts represent levels of previous technical support and resistance. Trendlines are marked in red.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.