Is this stock the new Tesla?

Tesla is a star in the world of electric vehicles. This company wants to do the same, but with trucks.

28th October 2020 10:57

by Rodney Hobson from interactive investor

Tesla is a star in the world of electric vehicles. This company wants to do the same, but with trucks.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

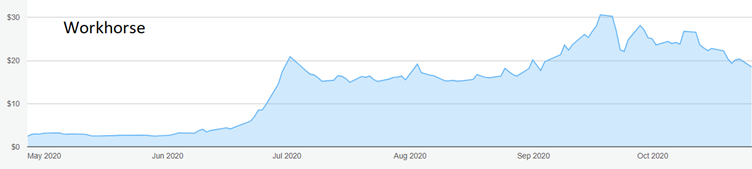

While Tesla (NASDAQ:TSLA) has captured the headlines in the move towards electric vehicles, investors with an appetite for risk and an eye for the next potential success story have been piling into Workhorse (NASDAQ:WKHS). It has been one of the most popular buys among interactive investor customers in recent months.

Workhorse designs and makes battery-driven medium duty trucks and, crucially, HorseFly delivery drones that could add a lot of value as the company seeks sales to distribution companies. It also offers monitoring systems that help fleet owners organise their vehicles to reduce fuel consumption and make best use of routes.

It was founded as AMP in 2007, based in Ohio, but changed to its present name in 2015. It originally took over the production of chassis for General Motors vans and motorhomes, but its ambitions far outstrip its humble beginnings.

- Use our helpful calendar to find out when the America's largest companies are reporting results

- Want to buy and sell international shares? It’s easy to do. Here’s how

A lot of faith is required when investing in this technology. The potential is enormous but the costs of developing this type of vehicle are a drain on resources and success is far from guaranteed.

Even Tesla lost money for years and Workhorse is still some way from breaking even. In the financial year to last December it lost $37 million; in the latest quarter it lost $131 million on revenue of $92 million.

A further loss is expected in 2021 but forecasts suggest a modest profit in 2022. That will depend on hefty growth over the next two years, so this forecast may prove optimistic. Nonetheless, next year should at least mark a step in the right direction.

Workhorse already has bagged a contract with United Parcel Service (NYSE:UPS) for up to 950 vehicles. Now much depends on whether the company wins the $6 billion contract to provide electric delivery vehicles for the US Postal Service, which is phasing out 163,000 existing petrol and diesel trucks. The race has been whittled down from 15 contenders to just three, and Workhorse has the advantage of being the only one that makes only electric vehicles. Its drones could be highly useful for parcel deliveries in remote areas when operated out of the mail vans.

Winning this contract would secure Workhorse’s future. Losing will be a bad setback but not the end of the company. However, investors should bear this in mind when assessing the upward trend of analysts’ expectations. It is a little uncomfortable to rely so heavily on winning one huge contract.

Source: interactive investor. Past performance is not a guide to future performance.

In any event it will be a long time before Workhorse pays a dividend. Its accumulated losses, which will get worse before they get better, mean the balance sheet shows negative equity, which will have to be cleared before any payout can be considered. In any case, all available cash will be needed to fund production and technological research.

However, the company has had no difficulty in raising cash to keep going until the tide turns. It has recently sold $200 million worth of bonds that can be converted into shares at $36.14, way above the current share price. The money will be used to boost production, develop new products and refinance existing debt on more favourable terms.

- Baillie Gifford American: owning Tesla and more top stocks

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Investors can probably not be too disconcerted by a bear raid on the shares this summer. Short seller Fuzzy Panda Research published a report claiming that Workhouse was misleading investors over its chances of winning the post service contract, alleging that vehicle prototypes were plagued with problems and cost overruns. The impact was quickly dismissed by institutional investors.

Hobson’s choice: The shares have slipped back from $30 in September 2019 to below $18. While a correction was overdue, the shares are reasonably priced given the company’s prospects. The downside looks limited to $15. Buy up to $21.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.