Stockwatch: the dial just shifted in favour of this FTSE 250 stock

Up a third since he recommended hanging on following a bounce from record lows, analyst Edmond Jackson updates his view after an acquisition and ahead of half-year results.

11th July 2025 12:17

by Edmond Jackson from interactive investor

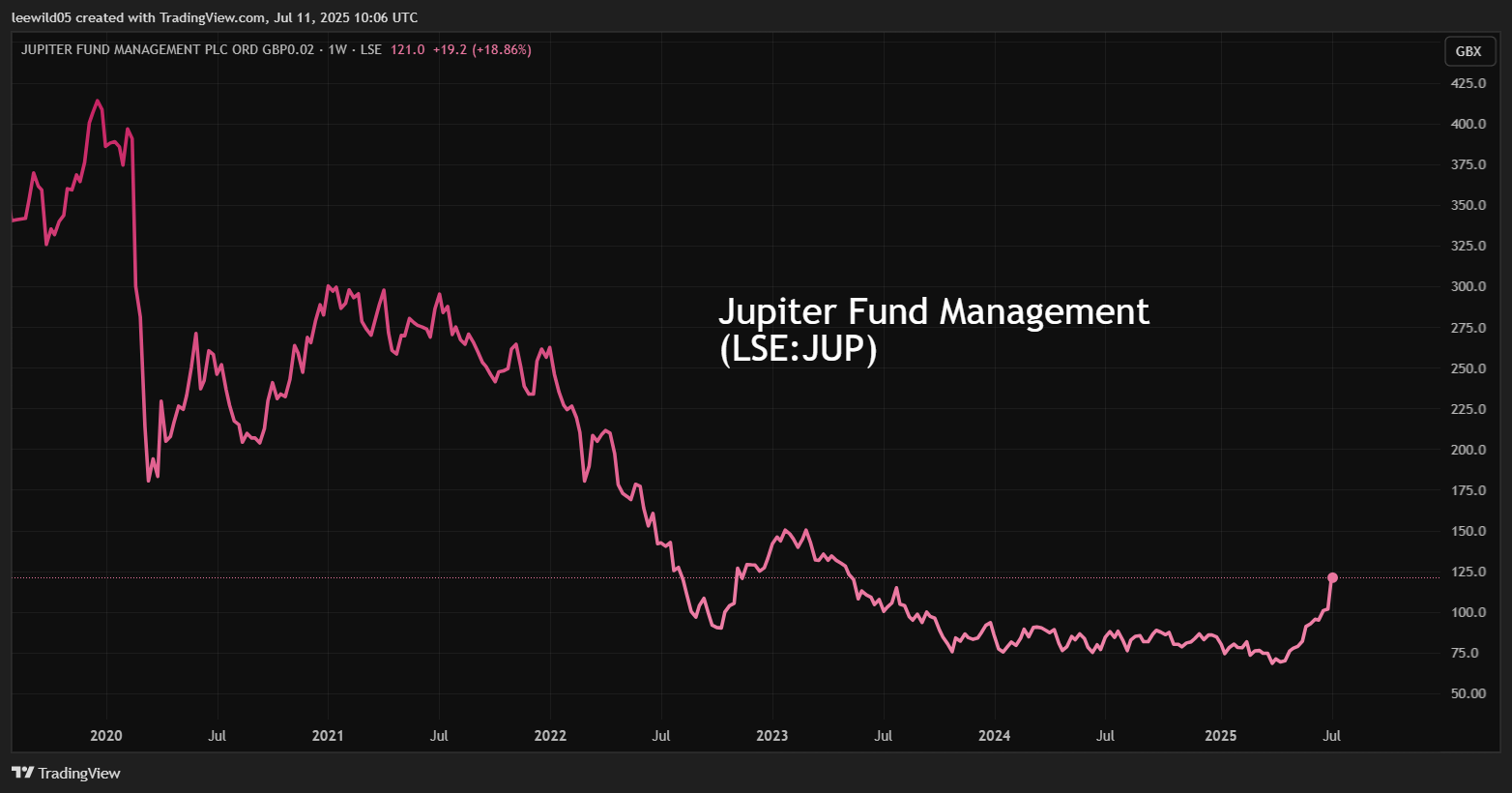

Shares in mid-cap firm Jupiter Fund Management (LSE:JUP) spiked 11% yesterday to 120p, building on a rally from under 70p late April. The latest rally followed news that it is acquiring CCLA, the UK’s largest asset manager serving charities, local authorities and other non–profit organisations, with over £15 billion managed.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

It looks a very attractive deal – almost too good to be true? – in the sense of marking a 35% boost to Jupiter’s £44.3 billion assets under management (AuM) as of 31 March. Yet for £100 million consideration, Jupiter will get control of £150 AuM for each £1 spent – a keener valuation than around £115 AuM for each £1 invested when Jupiter shares traded at that sub-70p all-time low three months ago:

Source: TradingView. Past performance is not a guide to future performance.

At 92p in May, I noted how Jupiter had regained October 2023 levels after a long fall from over 500p, as if the chart had put in quite a “double bottom” reversal despite persistent asset outflows that have bugged the sector. At least institutional flows had turned positive despite retail remaining fearful amid the US tariff chaos.

Sector analysts targeted 90-95p, and I concluded with a “hold” stance, while expressing scope for a more positive view if earnings per share (EPS) can recover somewhere to median levels above 20p where they were before 2022. That compared with the sub-7p outcome analysts have been predicting.

“Trough earnings” forecasts are liable to be extra-cautious but those have already ticked up to 7.4p and 7.7p in respect of 2025-26. What makes this deal doubly interesting is it being satisfied from £549 million cash that Jupiter had at year-end, versus only £91 million debt, hence no dilution involved.

- The Income Investor: a cyclical FTSE 250 stock with dividend appeal

- UK results preview 2025: reason for optimism

The announcement cites an annualised run rate of £11.4 million underlying operating earnings for CCLA, which compares with £95.6 million operating profit before exceptionals for Jupiter in 2024. This disparity relative to the two companies’ AuM hints at the apparent bargain purchase price, but Jupiter has an initial target for run-rate cost synergies of at least £16 million annually by end-2027.

This reflects my regular point on asset manager shares – if timing and price/value are right – how this kind of business can be operationally geared. If assets expand while costs remain relatively constant (assuming boards do not let bonuses soar in good years) then earnings rise more than revenue from management fees. Similarly if AuM are acquired and there is scope to take out costs rather than have dual roles.

Although it is not organic growth, consolidation is a logical strategy while net outflows weigh on the asset management industry, and Jupiter looks to have identified and executed on a well-regarded business of size.

Future earnings quality

CCLA has generated net inflows into long-term funds in each of the last 15 years, with cumulative net inflows of £4.3 billion since 2015. It looks like non-profit organisation clients are stickier than individuals spooked by market moves. The announcement says: “CCLA benefits from a loyal and stable client base. Client turnover has consistently been lower than its comparable peer group and a number of clients have been with CCLA since inception in 1958.”

That sale terms include downside protection, say if some trustees decide to move funds due to the change of ownership, and shows Jupiter has been mindful of this. The purchase price includes an adjustment linked to changes in CCLA’s run-rate revenues, between signing and completing the deal. Conversely, it appears that an improvement would not require a higher price.

Admittedly, it is quite hard to reconcile AuM of the two groups with revenues generated, as if CCLA is notionally lower margin. Yet in its financial year to 31 March 2025, CCLA generated £13 million underlying operating earnings on £66 million revenue, a 20% margin versus Jupiter’s reported operating margin of 21.5%. That is no real disparity despite an £11.4 million run-rate for CCLA anticipated. As Jupiter’s historic table shows, its operating margins/profit have varied radically over time, so at least the two groups have been roughly on par in the last year.

Jupiter Fund Management - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 402 | 460 | 461 | 419 | 501 | 618 | 444 | 406 | 403 |

| Operating margin (%) | 42.6 | 41.9 | 38.9 | 36.5 | 27.5 | 30.8 | 14.5 | 2.4 | 21.5 |

| Operating profit (£m) | 171 | 193 | 179 | 153 | 138 | 191 | 64.3 | 9.8 | 86.3 |

| Net profit (£m) | 136 | 155 | 143 | 123 | 105 | 150 | 47.9 | -12.9 | 65 |

| Reported EPS (p) | 29.6 | 33.7 | 31.1 | 26.8 | 20.8 | 26.9 | 8.9 | -2.5 | 12.2 |

| Normalised EPS (p) | 29.7 | 33.8 | 31.5 | 28.9 | 23.5 | 29.0 | 9.5 | 7.4 | 12.7 |

| Earnings per share growth (%) | 3.9 | 14.1 | -6.9 | -8.3 | -18.7 | 23.5 | -67.2 | -22.1 | 71.3 |

| Return on capital (%) | 27.7 | 29.7 | 28.0 | 22.2 | 13.3 | 17.9 | 6.5 | 1.1 | 9.1 |

| Operating cashflow/share (p) | 32.0 | 42.3 | 37.1 | 32.7 | 20.7 | 34.0 | 30.1 | 16.9 | 13.8 |

| Capex/share (p) | 0.8 | 1.1 | 0.7 | 0.8 | 0.5 | 0.6 | 1.0 | 0.7 | 1.4 |

| Free cashflow/share (p) | 31.2 | 41.2 | 36.4 | 31.9 | 20.2 | 33.4 | 29.1 | 16.2 | 12.4 |

| Dividend per share (p) | 14.7 | 17.1 | 17.1 | 17.1 | 17.1 | 17.1 | 8.4 | 6.9 | 5.4 |

| Covered by earnings (x) | 2.0 | 2.0 | 1.8 | 1.6 | 1.2 | 1.6 | 1.1 | -0.4 | 2.3 |

| Cash (£m) | 331 | 368 | 390 | 391 | 441 | 497 | 445 | 499 | 549 |

| Net debt (£m) | -317 | -332 | -316 | -333 | -337 | -397 | -349 | -405 | -458 |

| Net assets (£m) | 610 | 640 | 624 | 612 | 886 | 901 | 843 | 790 | 834 |

| Net assets/share (p) | 133 | 140 | 136 | 134 | 160 | 163 | 154 | 145 | 153 |

Source: historic company REFS and company accounts.

A potential boost to capital distribution

Jupiter shares are also likely responding to the prospect of greater returns. The deal helps enable “a further capital distribution planned in respect of 50% of performance fee-related revenue generated in 2025”. Additional to the ordinary dividend, this could be via a special dividend and/or additional buybacks. Potentially it implies an improvement on the circa 3% ordinary yield, covered twice by earnings. This is lower than the near-10% uncovered yield offered by Polar Capital Holdings (LSE:POLR), while Liontrust Asset Management (LSE:LIO) offers 7.5% with 1.5x cover, according to forecasts.

This does, however, make Jupiter shares more competitive than some other asset managers on notionally attractive yields.

Before the CCLA deal was announced, consensus anticipated plunges of more than 40% in Jupiter’s net profit and earnings per share this year, to £39.5 million and 7.4p respectively, then only a modest recovery to £42.6 million and 7.7p in 2026. Similarly, the dividend was projected to fall 35% to 3.5p then 3.8p in 2026. Hence, the 12-month forward price/earnings (PE) ratio was around 16x and yield around 3% with the shares currently at 121p. In PE terms, certainly, it’s as if the market senses upgrades given growth is being acquired without dilution, plus synergies.

- Why dollar collapse is opportunity for UK investors

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Group EPS ought to be more like 9p, equating to a 13.5x PE, and possibly a dividend more like 4.7p, hence a near 4% yield on the ordinaries. Both metrics could be squeezed a bit more positively according to how extra capital distributions pan out.

Mind, this is a relatively near-term snapshot and the fortunes both of asset prices and investor sentiment could generate radically different outcomes on a three- to five-year view. Despite this uncertainty, Jupiter is doing just the right thing by way of industry consolidation at this stage in the cycle – it’s a good time to buy another asset manager.

Institutional and director stakebuilding

While overall quite modest, buying among directors and professional investors cumulatively implies support despite this year’s all-time low for the shares.

Silchester, a US investment group, added 2.1 million shares at end-April, to own 101.7 million, or 19.2% of the company. To be increasing at all implies a conviction holding. Fidelity has also added 9.4 million to own 27.4 million or 5.2%. That institutional selling has been relatively modest, which implies the share weakness has been primarily retail selling, reflected in fund redemptions.

Apart from part-sales last year following share option exercising, likely to meet taxation, the recent trend has been all cash-buying: two directors each around £25,000 worth at 83p last December and 75p last March, then the chair in a well-timed substantive purchase of £74,000 worth at 74p.

As of this morning, the offer price has edged up to 122p on decent volume, as if investors are recognising merits of the deal. Half-year results are due on 25 July, and the latest data on fund flows could affect sentiment either way.

Yet notwithstanding the classic risk of how asset manager shares are a geared play on stock markets, this deal to me shifts Jupiter’s dial more towards “reward”, therefore I upgrade my essential stance to “buy”. If you are hesitant to chase the spike, then note Jupiter as one to buy amid future market jitters.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.