Why dollar collapse is opportunity for UK investors

President Trump’s wish for a weaker dollar has come true, and multi-year lows versus the pound are giving Brits the chance to snap up cheap assets. Analyst John Ficenec explains.

8th July 2025 09:06

by John Ficenec from interactive investor

The dollar has suffered its worse collapse in the first six months of the year since Richard Nixon was President of America 52 years ago. The steep decline in the world’s reserve currency has sent ripples throughout the financial markets, creating interesting opportunities for investors to profit in the coming months.

Dollar down

The dollar’s position as the world’s reserve currency is being sorely tested by political turmoil and economic fallout under the Trump presidency. A toxic combination of combative global tariff policy while at the same time attacking the independence of the Federal Reserve chair Jerome Powell, has shaken the greenback’s role as a “safe haven” asset.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The dollar index, which measures the currency’s strength against a basket of six others, is down 10.8% in the first half of 2025.

Source: TradingView. Past performance is not a guide to future performance.

“We think dollar weakness is likely to extend – in large part because US policy shifts including tariffs, have raised uncertainty and are likely to weigh on US economic growth, corporate earnings, and consumer sentiment,” said Kamakshya Trivedi, head of global foreign exchange, interest rates and emerging market strategy research at Goldman Sachs Research.

Goldman expects the euro to be worth $1.20 and the pound $1.39 in 12 months, from $1.18 and $1.37 currently. They are not alone. Morgan Stanley, Deutsche Bank and the International Monetary Fund (IMF) among others see the dollar weakening against the Japanese yen, euro and sterling into the end of the year and beyond.

How low can you go?

The big question is how much further does the dollar have to fall? The answer it seems is quite a lot further. The main issue here is that the American economy is running on a huge current account deficit, or to put it another way it is the world’s biggest consumer, importing huge quantities of goods while not making enough products to balance things out through exports. This was all exacerbated by the strength in the dollar, which hit a 30-year high in April 2024, making imports relatively cheap compared to homegrown products.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Five ways to invest in US outside of traditional tracker funds

Trump has a vast problem on his hands, with the US current account deficit ballooning to the largest of the G7 countries at $450.2 billion, or 6.0% of GDP, at the end of the first quarter of 2025, up from a revised third-quarter deficit of $310.3 billion, or 4.1% of GDP. Putting that in perspective, the UK had a current account deficit of £23.5 billion ($32.2 billion), or 3.2% of GDP, at the end of the first quarter of 2025, up from £21 billion, or 2.9% of GDP. So, the US deficit is around twice that of the UK in terms of the size of the economy, but more than ten times larger in absolute dollar terms.

Big, beautiful and going for broke

Trump has approached this problem in typically bombastic style. By slapping tariffs on imports, he instantly raises their price, making them less attractive than US-made goods, while simultaneously raising tax income to balance the books. At the same time, he has launched attacks against the US Federal Reserve chair to cut interest rates, which has spooked investors who are concerned about the stability of the US economy and caused a sharp fall in the dollar. If exported American-made goods are suddenly cheaper in dollar terms, the thinking goes that more people should buy them.

Then there is the “big, beautiful bill” which is designed to boost the economy through cutting taxes and increasing spending on borders and defence, the upshot of which is the Congressional Budget Office estimates the bill could add $3.3 trillion to federal deficits over the next 10 years.

The US had no problems running this budget deficit in previous years because of its exceptionalism; it was the largest and one of the fastest growing economies in the world. Investors were more than happy to fund it through buying as many US Treasuries as could be printed.

This is no longer the case. Investors abhor uncertainty, and if your main attraction is one of a safe haven asset, then it becomes a problem when you become not very safe at all. This all came to a head after “Liberation Day” when the tariffs were announced and, as asset prices slumped, US Treasuries and equities underperformed the rest of the world because they were no longer the safest haven, period.

This has shown itself clearly in the flow of investment funds this year. The most recent research shows fund flows into US fixed income and equities grinding to halt. “Looking for evidence of dollar asset liquidation misses the point however: foreigners don't need to sell US assets to weaken the dollar but merely to say ‘no thank you’ to buying more, said George Saravelos, head of FX research at Deutsche Bank.

Mr Saravelos shows that the direction of travel is clear as the US dollar has always weakened when the current account deficit is over 4% of GDP. The tariffs have made little impact in adjusting trade balances so far, and that if foreign investment alone was to right the current account deficit, the dollar would have to fall a further 30 to 40%. Now nobody is predicting a dollar fall that large, not even Mr Saravelos, but illustrate the kind of pressure the dollar is under.

The latest figures from the Investment Association (IA), which tracks the £9.1 trillion managed in the UK, backs up this trend showing £660 million leaving US equity funds in May, with some of the big winners being inflows to UK Gilt and UK equity funds.

So, how do we square the circle of record highs on US markets with these flows? Well it’s a foreign buyers strike not a widespread rout and US securities are still majority, or around 80% according to the US Treasury, owned by domestic investors. Foreign buyers leaving is being offset by mom and pop betting the farm, and sending markets to record levels after job creation in June beat expectations and hope remains over trade deals.

Discount tech shopping

What if I offered you a brand-new iPhone at almost half price? You’d snap my hand off most likely, and that’s what investors should look for in the coming months. Apple Inc (NASDAQ:AAPL) shares are down around 15% so far this year, but in the depths of the April tariff tantrum they were down 30%, but that’s just in dollar terms, add in another 10% fall in the dollar against the pound and you could have bought Apple shares 40% cheaper.

The same sort of price falls and discounts were true of AI chip maker NVIDIA Corp (NASDAQ:NVDA), software giant Microsoft Corp (NASDAQ:MSFT), and tech leviathan Alphabet Inc Class A (NASDAQ:GOOGL), owner of Google. Keeping a watchful eye through any sell-offs could bag you bargain.

Tariff deadline fast approaching

The recovery in US markets has been driven by a pause in tariffs and tweets about progress in talks, but there’s no less uncertainty now whatever happens by the 9 July deadline, or by 1 August when higher tariffs are now said to kick in.

There will be more deals done, it’s inevitable, but with most of the good news seemingly priced in, it leaves little margin for policy error.

Paid to wait

With the US dollar looking set to weaken for the next six to 12 months, and the buying power of UK investors increasing, you are effectively being paid to wait.

A clear option then is for investors who have missed out on US tech gains to wait for any market wobbles in the coming months and stock up. The US still leads the world in cutting-edge technology, and that will take some time to be overhauled.

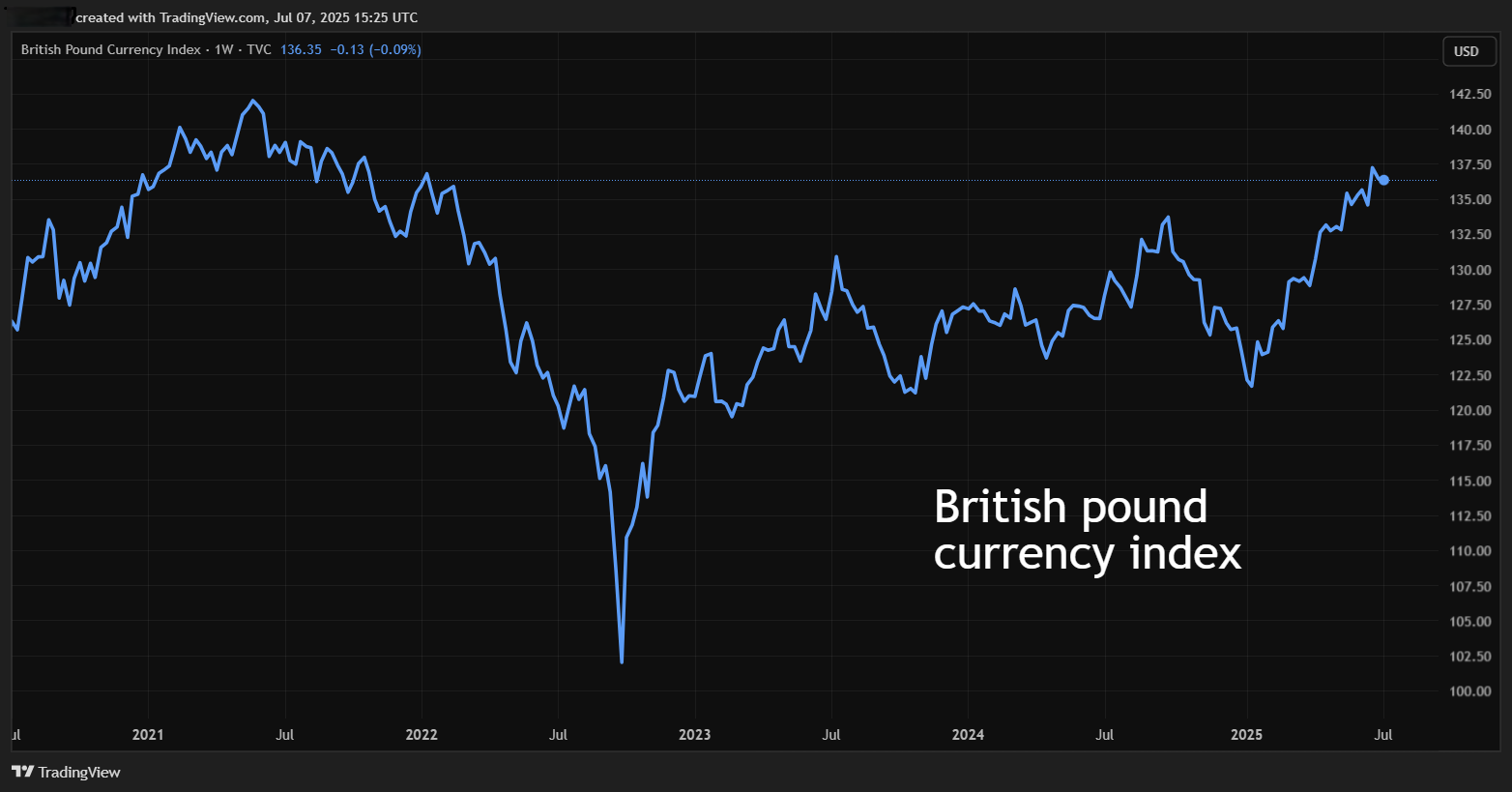

The return of the mighty pound

The pound almost became a joke after the brief foray into Trussonomics during the so-called mini-budget of September 2022, sinking to an all-time low of $1.03 against the dollar, its lowest level since decimalisation in 1971.

The cost of borrowing also shot up as foreign investors balked at the spending plans, with yields on 5-, 10- and 30-year gilts soaring.

So, let’s just say this recovery in the pound is coming off a low base. Against the dollar the pound is now around $1.36, a long way from the lows but only marginally above the long-run average of $1.30, and it has stubbornly failed to convincingly break the $1.40 level since the Brexit vote in 2016.

Source: TradingView. Past performance is not a guide to future performance.

Against the euro, the pound has been steadily recovering since early 2023 to a peak of €1.21 in March, but more recently it has stumbled as questions swirl around the chancellor and the near £5 billion hole in finances from the botched welfare bill. The pound has slipped back to €1.17 in recent trading.

That said, the UK was the fastest-growing of the G7 economies in the first three months of 2025, and was one of the best-performing regions in the world for investors in the first half of 2025. UK gilts have also performed better as safe havens for global investors than US Treasuries after the tariff tantrum.

Small is beautiful

The recovery in the pound also creates an interesting dynamic to profit from. The FTSE 100 generates around 80% of its earnings overseas as it is dominated by oil and gas, miners, pharma, and consumer goods companies. If the pound strengthens further, it will eat into those earnings, distributable profits and shareholder returns. The FTSE 250 by comparison earns around 50% of its revenue overseas, so if the pound strengthens it will relatively outperform.

In the past month alone the FTSE 250 has easily outperformed, delivering gains of 3.3% against its big brother the FTSE 100 largely flat at just 0.4%.

- Fund managers’ favourite UK smaller companies

- Five things for investors to watch in the second half of 2025

With the buyers strike on US assets showing no signs of easing, the money will have to flow somewhere and it is already showing signs of going into UK gilts and UK equities given the attractive valuations in the UK.

There are several other ways into this trade in terms of UK focused exchange-traded funds (ETFs). Vanguard FTSE 250 UCITS ETF (LSE:VMID), iShares FTSE 250 ETF GBP Dist (LSE:MIDD), iShares MSCI UK Small Cap ETF GBP Acc GBP (LSE:CUKS) are all popular.

In interactive investor’s Super 60 investment ideas’ list, WS Amati UK Listed Smaller Coms B Acc is highlighted. Investment trust duo Fidelity Special Values Ord (LSE:FSV) and Diverse Income Trust Ord (LSE:DIVI), which invest across the UK market, have a bias to UK mid-caps and small-caps. At FSV, the allocation to small and mid-cap stocks currently is just over two-thirds of the portfolio.

Other options often flagged by external experts include BlackRock UK Smaller Companies D Acc), JPMorgan UK Small Cap Growth & Income (LSE:JUGI) and Aberforth UK Small Companies Acc, with the latter investing in ‘deep value’ stocks.

Eurovision

Hopes are rising that Germany, the business engine of Europe, will be kickstarted after years of underperformance. The debt brake is off and a huge spending plan to rebuild infrastructure, accelerate defence obligations and spark growth have sent the DAX index soaring by over 20% so far this year.

European markets have also been the key beneficiaries of concerns about American stability, and the move away from the dollar should continue to the end of the year.

One way to benefit from this is through broad exposure to eurozone blue-chips. The Xtrackers Euro Stoxx 50 ETF 1C GBP (LSE:XESC) is an option, or if you want to look at smaller companies there’s Montanaro European Smaller Ord (LSE:MTE) or Fidelity European and its investment trust sister fund Fidelity European Trust Ord (LSE:FEV).

As for interactive investor’s Super 60 list of investment ideas, there is BlackRock Continental Eurpopean Income.

Outlook for the second half of 2025

It looks to be characterised by more dollar weakness and a return of uncertainty around US policy, which should create opportunities, be it buying US tech on the cheap, taking another look at good value UK small-caps or even holding your nose and buying European exposure.

Movements in foreign currency markets are always wild and driven by many factors, but there are some solid fundamentals making the weather at the moment, and that should allow for positive returns in a balanced portfolio.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.