Stockwatch: a FTSE 100 bid target about to capitulate?

It’s been a busy summer of takeovers and bid approaches as overseas buyers swoop on undervalued UK companies. Analyst Edmond Jackson reveals what he’d do with this blue-chip takeover situation.

24th September 2024 11:54

by Edmond Jackson from interactive investor

A possible offer for FTSE 100-listed online property marketing group Rightmove (LSE:RMV) is the latest in a bumper year for takeover activity. Official data shows seven bid approaches materialised in June alone.

Yet a number have fallen apart including those industry-based where you might think a more determined logic might prevail. In the consulting engineering sector, Sidara came in for John Wood Group (LSE:WG.), while in housebuilding Bellway (LSE:BWY) went for Crest Nicholson Holdings (LSE:CRST).

- Invest with ii: Top UK Shares | Free Regular Investing | What is a Managed ISA?

It continues to mark UK equities as undervalued in a global context and perhaps reflects a cleaner approach to disclosure nowadays rather than speculative approaches being dealt with privately.

Shareholders need a disciplined mindset to cope. Are you just going to bury head in the sand and ignore the action with faith that “all shall be well” in the long run? Or do you consider an aspect of trading, taking a view on possible outcomes?

Realities are that Wood is down 38% to 130p having traded up to 210p for much of the summer; and Crest Nicholson is down 27% at 194p from its summer peak. These have not been whip-saw actions that were tricky to decipher; rather there were months when the stocks were elevated by “possible” offers.

Rightmove is a live and relevant example

Starting on 5 September, REA Group Ltd (ASX:REA), the Australian-listed and (ultimately) Murdoch-controlled group of property websites, made a possible cash-and-shares offer equivalent to 705p a share, raising this to 749p as of 18 September. These were rebuffed, but this week has started with a third possible offer equating to a 760p range (as REA shares turn volatile) albeit only a 1.7% increase.

Pitching at around a 40% premium to the share price at end-August, REA proclaims this would be a good offer against a share price that has lacked upward momentum for the last two years.

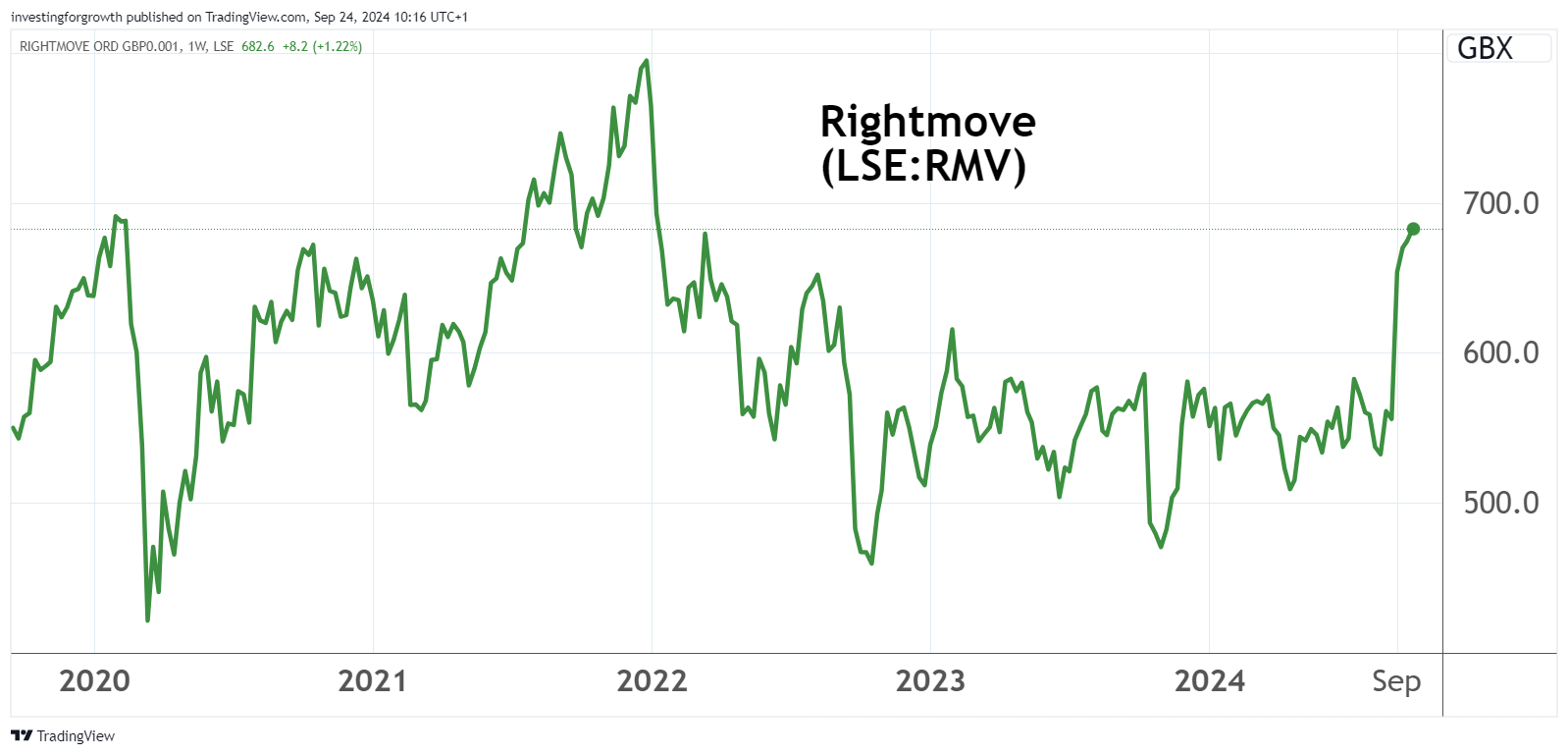

In fact, I would describe a volatile-sideways move going back five years after Rightmove – in due respect – had an excellent run from 20p in 2008 to 550p:

Source: TradingView. Past performance is not a guide to future performance.

A dilemma for Rightmove equity has been that it previously gained a rich growth rating of up to 50x earnings, although this included people’s fleeting rush to buy countryside properties during the pandemic. Such a rating also reflected operating margins around 70% and very low capital expenditure needs, hence strong free cash flow (see table) and clean earnings with no adjustments at all.

Even so, the dividend yield has not been great, partly due to share buybacks but also a nominally high market price, meaning the circa 10p per share expected for this year equates to only 1.5%. If REA backs off, there is no yield support, hence there’s a risk that the market price drops around 20% back to 550p as before.

Rightmove - financial summary

Year-end 31 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 268 | 289 | 206 | 305 | 333 | 364 |

| Operating margin (%) | 74.2 | 73.9 | 65.7 | 74.2 | 72.6 | 70.8 |

| Operating profit (£m) | 199 | 214 | 135 | 226 | 241 | 258 |

| Net profit (£m) | 160 | 173 | 110 | 183 | 196 | 199 |

| Reported EPS (p) | 17.7 | 19.5 | 12.6 | 21.3 | 23.4 | 24.7 |

| Normalised EPS (p) | 17.7 | 19.5 | 12.6 | 21.3 | 23.4 | 24.7 |

| Return on total capital (%) | 799 | 384 | 98.5 | 283 | 317 | 343 |

| Operating cashflow/share (p) | 18.5 | 20.7 | 11.0 | 22.7 | 23.7 | 25.4 |

| Capex/share (p) | 0.2 | 0.1 | 0.4 | 0.1 | 0.3 | 0.4 |

| Free cashflow/share (p) | 18.3 | 20.6 | 10.6 | 22.6 | 23.4 | 25.0 |

| Dividend per share (p) | 6.5 | 2.8 | 4.5 | 7.8 | 8.5 | 9.3 |

| Covered by earnings (x) | 2.7 | 7.0 | 2.8 | 2.7 | 2.8 | 2.6 |

| Cash (£m) | 19.9 | 36.3 | 96.7 | 48.0 | 40.1 | 38.9 |

| Net debt (£m) | -6.9 | -24.0 | -84.4 | -37.0 | -30.6 | -31.5 |

| Net assets/share (p) | 1.4 | 4.7 | 14.1 | 8.3 | 8.3 | 8.7 |

Source: company accounts

Settling back to a price representing nearer 20x earnings per share, this growth is expected to be in mid-single digit per cent until double digits again in 2025.

That is still fundamentally a high rating unless earnings can re-accelerate, or a buyer is willing to pay a large premium for an alleged 85% share of UK residential property online marketing. (I question such a per cent given Rightmove’s listings are hardly exclusive and there is overlap for example with OnTheMarket.)

- Rolls-Royce among UK stocks benefiting from big US rate cut

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Higher interest rates have cooled housing market activity but are expected to fall, yet this space is becoming more competitive.

Last October, CoStar Group Inc (NASDAQ:CSGP) acquired the London-listed OnTheMarket property portal which, by March 2024, was reporting unique monthly visitors up 81% year-on-year, and total monthly leads to estate agents up 81% since acquisition.

Rightmove’s increased fees to estate agents are said to have led some to abandon the website. From an apparent peak of 218 million monthly visits, Rightmove’s recent claim is around 140 million (this may also, however, relate to weaker house purchasing activity).

The best days for Rightmove’s UK dominance may therefore be in twilight.

Can the stock maintain current shares price on its own?

While the Rightmove board is “confident in the company’s short and long-term prospects and sees a long runway for continued shareholder value creation”, REA’s latest offer terms look fair and pretty full to me – representing an exit price/earnings (PE) ratio around 27x.

If the end-game of a company’s stock market listing is likely to be a trade sale, holders have to recognise that something needs to be left on the table as an incentive for the buyer.

REA has not said this week’s third possible offer is its final terms, and let us remember that Sidara’s final possible offer for Wood Group was fourth-time hopeful.

I expect REA’s ploy is to get Rightmove to at least negotiate, and there may be scope to raise a genuine offer to around 800p a share. Yet synergies are not obvious, and this would essentially be another plank in REA’s global expansion.

Rightmove is acting a bit odd, rebuffing REA’s terms as “uncertain, highly opportunistic and unattractive” until responding to this latest 1.7% increase with “will carefully consider”, which comes across as if institutional shareholders have urged engagement.

Analysts in support of independence cite Rightmove’s objective to raise operating profit 55% between 2024 and 2028, as the company diversifies into mortgage broking and commercial property. Perhaps they are too young to appreciate the hard lessons of value destruction that came from “diworsification” as it became branded some 30 years ago, begetting a push for strategic “focus”.

Aussie shares are not a great pitch for UK funds or individuals

REA makes the reasonable contention that it has tripled revenue and EBITDA over 10 years (but does not say to what extent by acquisitions) and its stock has risen more than 300% over 10 years and 75% in the last two years.

Furthermore, its offer would provide “a combination of immediate value certainty in cash plus opportunity to benefit from future value creation of the combined business.” This would involve 341p cash per Rightmove share plus 0.0422 new REA shares, hence a 760p valuation range for Rightmove currently.

But who among UK equity funds, FTSE 100 trackers and British individuals, seriously wants – or is even able – to own Australian-listed paper? Logistically, I would expect most Rightmove holders to sell in the market in the event an offer consummates.

Selling half near term could be reasonable compromise

Each holder should take their view, which involves their risk preference.

But I think something has to be awry in the communications so far if Rightmove capitulates effectively at 760p to 770p. The prize for holders could be final agreement in the region of 800p, but even this would not square with the board’s expressed confidence in a standalone strategy.

Meanwhile, and given REA is also a listed company, it would meet with criticism of over-paying – as already seems manifest by way of a dip in its own share price.

My conclusion is that lessons from 2024 show shareholders should not push their luck with these “possible” offers. The market does overall respect this in terms of pricing in event probability - around 685p for Rightmove representing over a 10% discount to the third possible offer.

It is no ploy to avoid takeover rules - by 5pm on 30 September, REA must still declare whether it has a firm intention to make an offer (albeit with scope for an extension if agreed by the Takeover Panel). Rightmove has said it will “respond to the most recent proposal in due course”. As yet no one else is declaring their hand.

I therefore think Rightmove holders might respect an extent of selling looks justified. Even if you think REA backs off and Rightmove has a good long-term future, a case exists to lock in some profit perhaps.

Notwithstanding the chance of higher terms being agreed, my stance therefore tilts to: Sell.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.