Stockwatch: a high conviction bearish view that divides opinion

18th July 2023 11:31

by Edmond Jackson from interactive investor

Is there justification for selling down a portfolio of equities amid recession fears? Analyst Edmond Jackson examines the current predicament and gives his view on this defensive firm.

Kicking off this week is a June financial year-end review from Ruffer Investment Company (LSE:RICA) – managed by Ruffer LLP, a professed “all-weather” specialist.

This £1 billion fund is positioned ultra-defensively – with less than 14% of assets allocated to equities versus 53% to bonds, and “illiquid strategies and options” (to hedge against market falls) at a chunky 15%. Gold-related assets comprise 5% and cash another 5%.

- Invest with ii: Trade Investment Trusts | Cashback Offers | Open a Trading Account

Long-dated US inflation-linked bonds have recently been added, partly to build exposure to the dollar given it and the yen are expected to appreciate during market stress. Gold and copper have been reduced.

The team for this near £27 billion (overall) asset manager appears to heed the strategic views of founder-chairman Jonathan Ruffer, with RICA achieving an annualised net asset value performance just over 7%, in line with UK equities albeit with lower volatility.

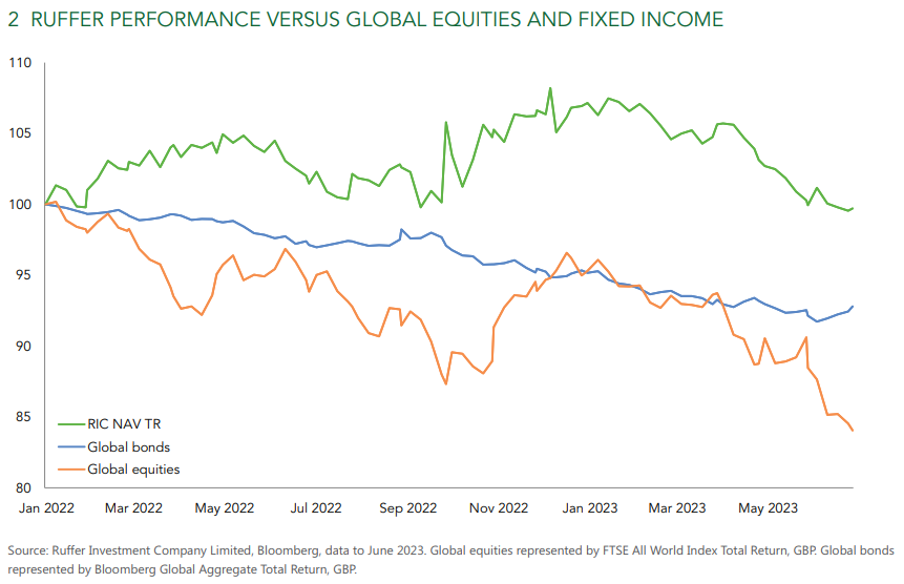

Currently at 277p, Ruffer’s stock fell 7% over 12 months to 30 June, albeit net asset value declined by less than 2%. This still beat global bonds and equities over the period as interest rates rose but has under-performed this year as risk appetite increased.

Past performance is not a guide to future performance.

By end of June, the stock had slipped to a 3.4% discount to net asset value (NAV) versus a 1.7% like-for-like premium. Buying it at a discount to assets has a high hit rate, say the managers: “On each of four significant occasions, the three-year share price invariably bounced back handsomely.”

I would mind that investment companies do tend to trade at an NAV discount, especially when sentiment is cautious. It is a macro trait rather than a verdict on fund managers.

Going against the latest bullish consensus

I think this is mainly reflected in the S&P 500 index up 17% in the first half-year, as US investors gain confidence that inflation will fall and a soft-landing for the economy be achieved without financial instability. The FTSE All-Share index barely managed 3%.

Yet the US rally has been narrowly based on technology stocks amid hopes that artificial intelligence can drive productivity improvements. UK financial and cyclical stocks – that would traditionally power a market recovery – remain under the cosh.

Ruffer argues it would be highly unusual to slay inflation while household net worth is rising, unemployment remains at record lows and there is no recession.

- Beyond wealth preservation trusts, nine other defensive options

- Funds and trusts four professionals are buying and selling: Q3 2023

I believe Covid’s disruption has been an exceptional factor, creating a tighter labour market, while exceptional monetary stimulus from 2020 means house prices are only now adjusting back.

But I respect Ruffer’s case that higher interest rates can have long and variable lags: “their inevitable bite on economic activity and asset prices is coming...the recession will arrive with a sudden thud.”

The US Federal Funds Rate has risen 500 basis points, or 5%, with more like 6% of effective tightening, a substantial drag on growth. Ruffer considers there will be more hikes and the market is yet to price in a “higher for longer” rates scenario.

Yield curves are deeply inverted, “a reliable predictor of recession”, although I say they reflect market expectations rather than economic reality. Mind the adage how “the market has predicted nine out of the past five recessions!”

Ruffer notes, the US personal savings rate has slumped to its lowest level since 2013 and excess savings from during Covid are running out. A recent loan officers survey shows a significant tightening of credit only seen in recessions.

Reed Recruitment implicitly backs Ruffer’s caution

News from one of Britain’s largest private firms is pertinent. April to June saw a 24% like-for-like fall in UK jobs listed, down nearly 27% on the same period in 2019 pre-Covid.

Reed said: “The alarm bell is sounding a lot louder now than it was, as the labour market begins to loosen. This continued contraction in job postings, which have been falling since this time last year, therefore suggests a recession may well be imminent.”

It is happening just as two mitigating factors for UK households start to unwind. Fixed-rate mortgages will begin to need re-financing, and lockdown savings will continue to expire as a cushion against higher inflation and interest rates.

- UK household costs rocket to highest in 30 years

- Investors expecting to make returns comfortably ahead of inflation in 2023

Meanwhile, the US labour market shows a fall in temporary employment.

Political factors will compromise inflation fight

Ruffer argues that even if central banks are belatedly tackling inflation, “there is simply not the political or popular appetite for the sustained restrictive monetary policy needed to properly deal with these new inflationary forces. The consequence is an ameliorated recession, stickier inflation and ever-growing debts and deficits.”

UK and US elections beckon in 2024, and political operators know the track record of victory in recessions is poor. They will likely offer financial support measures: witness the Tories reportedly exploring a political bung of abolishing inheritance tax. Meanwhile, Labour says they will “invest” to “grow the economy” despite UK public debt at over 100% of GDP and such action conflicting with higher interest rates – purposely intended to slow the economy.

It raises the odds that central banks will need to compensate for political actions by keeping interest rates higher for longer.

How relevant is all this to British private investors?

Ruffer’s central message is to keep a portfolio “highly liquid and defensive as we wait for better opportunities to emerge.”

Yet legendary investor Benjamin Graham tackled such an “anticipatory approach” in The Intelligent Investor, arguing it was not long-term reliable; it being far sounder to practise a value-based approach and trade when stocks look particularly cheap or expensive.

That in itself has flaws, especially the price/earnings (PE) multiple and potentially dividend yield also, as you are taking a view on the future which is easily compromised by macro change.

- The Income Investor: dividend stocks still beat bonds and two shares I like

- Insider: captain of AIM’s biggest business starts buying again

It is why I recently made an exception for two UK housebuilding stocks trading at a discount to net asset value; arguably they enjoy firmer support unless a tough recession undermines land values.

Yes, cyclical stocks as such could go lower, but there is also a dilemma with hesitancy; that a worse-case scenario does not materialise, or just one takeover approach re-rates the sector involved. My compromise is to entertain averaging-in.

Fund manager tools are less easy to adapt by individuals

UK gilts, indeed international bond funds, are in easy reach. Experienced private investors even use equity ‘put’ options or the FTSE 100 Vix Index VFTSE, which amounts to a bet on overall volatility.

But it is easy to take out such “portfolio insurance” that expires worthless. You have to renew it, then may throw in the towel just when markets capitulate.

If steeled professionals such as Ruffer find option trading a net cost (recently) than benefit, is there hope for individuals getting this more right than wrong?

Similarly, gold, to which Ruffer has reduced exposure. My lesson was the 1987 crash, when gold slumped with pretty much everything and I subsequently never regarded it as a genuine hedge.

Should you put faith in a conviction view?

Ruffer is doubling down on a recession ahead, though I feel sure that Warren Buffett would say it cannot dependably be predicted. Ultimately, this gets philosophical and what genuine scope is there for forecasting?

I respect why Ruffer challenges a more optimistic consensus in the US, but do not see it justifies selling down a portfolio if you already own equities. Aspects of yield offer support and, for example, housebuilder balance sheets are vastly stronger than in past downturns.

Agreeing we are likely to see harder times ahead, I would let them manifest in investment company ratings, and see from RICA’s updates if hedging starts to work, rather than buy the stock now. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.