Stockwatch: How to play Ocado shares now

22nd May 2018 10:04

by Edmond Jackson from interactive investor

How high for ? Last January, and despite the mid-cap shares soaring two-thirds to 525p in response to technology/warehousing deals with major food retailers in France and Canada, I suggested, "on a 2-3 year view, unless Ocado makes mistakes with the technology roll-out, then its stock is likely to go higher still".

I added: "There's big potential to roll out what Ocado has achieved, with online supermarkets a relatively new concept abroad."

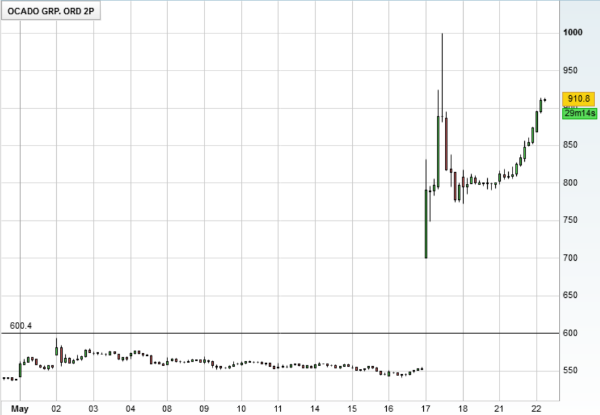

The stock carried on up to test 600p then consolidated, but May has seen another major boost: deals to develop a Swedish supermarket's online business and now with Kroger Co, a leading global grocer that aims to redefine the US retail experience by adopting Ocado's centralised automated model.

• Stockwatch: The mother of all short squeezes?

• This is the big one for Ocado!

• Ocado shares put Thomas Cook in the shade

Given it is currently impossible to ascribe positive earnings per share (EPS) based on the 2017 results (reflecting online deliveries than the emerging technology business model), the stock is all over the place on speculation.

It jumped initially to 1,000p, settling currently around 800p, capitalising Ocado at just over £5 billion versus total 2017 revenue shy of £1.5 billion and pre-tax profit of only £1 million. The technology solutions side achieved operating profit of just £2.5 million versus £81 million for retail, albeit said "primed for growth".

Source: interactive investor Past performance is not a guide to future performance

Projections are plucked from the air

A current projection from analysts at UBS (making an about-turn on their 'sell' stance) reckons the Kroger deal is worth £1.5 billion net present value or 230p per share, i.e. if 550p market price was fair value beforehand then 800p currently factors in a bit anticipation of further deals.

But this all assumes the market is reading Ocado fairly, while as yet the 2017 revenues from the technology solutions side show a 16.2% advance to £115 million based on a range of service fees from Morrison. There are also upfront fees for international partnerships signed, although operating profit halved to £2.7 million. Capital expenditure on technology rose 24.8% to £42.8 million, or 26.7% of the total, another sign of potential, but it's very early to assert £1.5 billion value from one deal alone.

As the partnerships extend then their costs should fall relative to the likes of Morrisons, although the terms of the service agreement with Kroger are yet even to be defined, if likely similar to previous deals with food retailers.

There will be "monthly exclusivity and consultancy fees" and Kroger/Ocado are now working to identify an initial three sites in the US for development of automated warehouse facilities, with a further 20 over the first three years.

Kroger is to contribute £183 million equity finance by way of 33.15 million shares, implying a price of 552p, although that would simply have been benchmarked from prevailing market price. It shows Kroger willing to pay that kind of market value to progress the deal, but don't confuse this with proof of intrinsic value like much punditry is doing. That will take years.

| Ocado - financial summary | ||||||

|---|---|---|---|---|---|---|

| year ended 3 Dec | ||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Turnover (£ million) | 792 | 949 | 1,108 | 1,271 | 1,464 | |

| IFRS3 pre-tax profit (£m) | -12.5 | 7.2 | 11.9 | 12.1 | 1.0 | -4.8 |

| Normalised pre-tax profit (£m) | -3.9 | 10.1 | 13.7 | 15.2 | ||

| Operating margin (%) | 0.3 | 1.8 | 0.6 | 0.7 | ||

| IFRS3 earnings/share (p) | -2.2 | 1.2 | 1.9 | 2.0 | 0.2 | -2.1 |

| Normalised earnings/share (p) | -0.7 | 1.7 | 2.2 | 2.5 | ||

| Earnings per share growth (%) | 33.3 | 12.3 | ||||

| Price/earnings multiple (x) | 4,000 | |||||

| Historic annual average P/E (x) | 187 | 222 | 126 | 111 | ||

| Cash flow/share (p) | 7.0 | 10.5 | 13.0 | 15.5 | 17.7 | |

| Capex/share (p) | 19.3 | 13.2 | 13.5 | 16.8 | 20.8 | |

| Net tangible assets per share (p) | 28.4 | 29.0 | 30.2 | 29.0 | 25.1 |

Source: Company REFS Past performance is not a guide to future performance

Short traders seriously wounded in 2018

Scope for radically diverging views is therefore likely to persist as to whether the current market value is justified or over-speculative, and whether Ocado merits rating somewhere between a British answer to and a technology licensing model that sustained ARM Holdings in its listed years.

Punditry is saying the rise to 1,000p/800p a share "proves" shorters wrong, but all it does is give maybe a dozen well-capitalised/diversified hedge funds wounds to stem in the near term.

Early in 2018, Ocado had been one of the largest short trades on the London market with 13.5% of stock out on loan. I suggested this implied an inflection point for price because, if these shorts were squeezed by ongoing news of technology partnerships, it would produce "the mother of all short squeezes" - a fair-enough remark on what we've just seen.

Disclosed short positions had however reduced to 7.2% before the Kroger news versus 20.8% nearly two years ago, so hedge funds have anyway been re-positioning, and some could have done well from Ocado's plunge from 617p to 208p over 2014-16.

Such traders are flexible pragmatists who probably recognise the de-rating they seek is unlikely now that Ocado is in a habit of declaring technology deals; Kroger being a huge endorsement, although the financial statements must eventually support expectations or shorting will resume.

Where does all this leave private investors?

On objective financial criteria Ocado is grossly overvalued, but like Amazon it will probably remain so while its story grips imaginations. So, decide whether you want to take a long-term view (as I posited in January) and ride out volatility, or lock in some gains to manage risk - given this kind of stock would probably suffer in market turmoil.

That said, the institutional "long" side of the shareholder base would probably be content to ride out swings, given they are believers. When 31.4 million shares were issued last February at 455p, only a 1.5% discount to the prevailing price was needed. So, despite a possibility, fresh short sellers may try their luck, if you can stomach a risky valuation then tuck in behind the institutions and see where Ocado's emerging prosperity leads.

Its established online deliveries are also enjoying quite a halo in the UK: market research suggests the 12 weeks to 22 April saw it gain the strongest sales growth of 12.7% versus even the "discounters" Aldi and Lidl with 7.3% and 9.1% respectively. This adds to the sense of Ocado being a commercial "disrupter", the kind of business investors prioritise.

This implies further to go also in terms of where equilibrium lies in food retail, between the convenience of online shopping (for busy people and families) and browsing stores (for the freshest items). Perishable food doesn't offer the same flexibility as household goods though, e.g. to be left at a local collection point or "safe space" at home, you have to be in to accept deliveries.

With fresh money, the best tactic is probably to wait and see if excitement over Kroger cools, and the market price falls back once any spike in short-closing passes.

All considered, Ocado is showing it has genuine potential as a British answer to Amazon and a technology licensing success story to boot. I think it's way over-valued on proven financials, but Amazon's example has shown this can persist for plenty of years.

Thus, it is impossible to define a trading range in the short to medium term, with much resting on sentiment. Ocado's credentials have just received a major boost though, so the appropriate stance is: buy on weakness.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.