Stockwatch: I’d buy this FTSE 250 share with 6% yield

Despite a previous lack of organic growth, this company looks attractive and its rating has scope to improve. Analyst Edmond Jackson explains why he thinks this business will do well.

14th June 2024 12:36

by Edmond Jackson from interactive investor

In growth stock investing, revenue tends to be perceived as the holy grail, with investors willing to postpone expectations of profit delivery, sometimes for years. But for investors whose chief objective is income with capital protection, does it matter if corporate revenues are sluggish – or in decline even?

A virtue is sometimes made of “mature businesses that throw off cash” albeit with the risk that if perception suddenly jolts towards a fundamentally declining business, then the stock de-rates, even to what seem a ridiculously low price/earnings (PE) multiple.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Reach and PayPoint as prime examples

An outstanding example has been small-cap publishing group Reach (LSE:RCH) (previously Trinity Mirror) which plunged from over 600p following the 2008 financial crisis and amid a sense that its newspapers had become old hat. It was left bumping along in a circa 25p to 100p range, on a low-single figure PE and high yield (given strength of cash flow even from declining print newspapers).

With due respect to various managements, Reach has weathered the storm, achieving a considerable switch to digital. And, at around 85p, it is up from 66p last January – offering a near 9% dividend yield thrice covered by earnings if forecasts are fair.

The first three months of 2024 did however see both digital and print revenue in decline, near 7% at the group level, with investor confidence propped up by reassurance on cost control and management’s expectation that “the reduction in referral traffic from the major platforms will lessen as we progress through the year.”

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- How to become an ISA millionaire

Yesterday, PayPoint (LSE:PAY) made a very similar pitch on the outlook. Amid reassurances on cost control, the chief executive of this mid-cap payment services group said:

“In the current year, consumer behaviour across a number of our businesses remains subdued, reflecting continued tighter family budgets and a generally flat economy. Our expectation is that the consumer outlook will improve during the course of the year.”

We can expect managers naturally to be optimistic like this and, indeed, despite the UK economy flat-lining in April after 0.4% growth in March, the risk of a consumer recession seems unlikely.

Revenue growth has needed a major acquisition

PayPoint has impressive headline numbers for its latest year to 31 March - underlying pre-tax profit up 22% to near £62 million on revenue up 83% to £306 million. But this is chiefly due to a £51 million full-year contribution (versus £3 million last year) from the February 2023 acquisition of Appreciate, re-named Love2shop, which proclaims itself as the UK’s leading gift voucher company.

Otherwise, net revenue is up just over 3% in the existing PayPoint businesses and, despite a 21.5% rise in underlying group pre-tax profit, organically it is just 0.4% up which does not even pace inflation.

The seven-year table shows revenue and profit essentially bumping along, albeit on strong operating margins which contribute also to strong operational cash flow, modest capital expenditure needs leaving free cash flow amply ahead of earnings per share.

| PayPoint - financial summary | |||||||

| year to end-Mar | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Turnover (£ million) | 214 | 212 | 144 | 128 | 145 | 168 | 306 |

| Operating margin (%) | 25.0 | 25.9 | 35.0 | 17.1 | 34.8 | 27.0 | 18.4 |

| Operating profit (£m) | 53.5 | 54.9 | 50.5 | 21.8 | 50.5 | 45.5 | 56.3 |

| Net profit (£m) | 42.9 | 44.4 | 45.7 | 22.3 | 69.5 | 34.7 | 35.7 |

| EPS - reported (p) | 62.7 | 64.8 | 58.1 | 23.1 | 57.0 | 49.6 | 48.8 |

| EPS - normalised (p) | 63.3 | 63.9 | 58.6 | 27.2 | 53.7 | 57.4 | 66.0 |

| Operating cashflow/share (p) | 92.0 | 86.8 | 74.8 | 79.3 | 32.5 | 39.5 | 74.3 |

| Capital expenditure/share (p) | 19.5 | 16.0 | 12.2 | 16.3 | 15.6 | 18.1 | 22.3 |

| Free cashflow/share (p) | 72.5 | 70.8 | 62.6 | 63.0 | 16.9 | 21.4 | 52.0 |

| Dividends per share (p) | 82.6 | 48.8 | 78.6 | 32.2 | 26.0 | 36.7 | 38.2 |

| Covered by earnings (x) | 0.8 | 1.3 | 0.7 | 2.2 | 1.4 | 1.6 | 1.7 |

| Return on total capital (%) | 86.6 | 109 | 129 | 34.2 | 51.1 | 27.4 | 16.6 |

| Cash (£m) | 46.0 | 37.5 | 73.7 | 10.5 | 7.7 | 160 | 165 |

| Net debt (£m) | -46.0 | -37.5 | -2.7 | 76.5 | 44.1 | -60.0 | -71.1 |

| Net assets (£m) | 61.3 | 50.2 | 38.3 | 33.3 | 83.3 | 112 | 121 |

| Net assets per share (p) | 89.9 | 73.5 | 56.1 | 48.5 | 121 | 154 | 167 |

| Source: company accounts | |||||||

So despite a lack of organic growth (lately addressed by acquisition) the business model is certainly conducive to shareholder returns.

Share buyback programme will enhance the numbers

Notable from PayPoint’s release yesterday – and additional to dividend growth – is the intent to buy back at least £20 million worth of shares over the next 12 months, with potential to increase that in a second and third year.

The implied £60 million plus cancellation of shares represents around 15% of the current near £450 million market cap at 607p, hence a significant enhancing of per share numbers.

A 2% slip in the group’s 2023 diluted earnings per share (EPS) - partly because 3.6 million shares were issued to help buy Appreciate - means re-balancing is justified, although on an underlying profits basis it crept up nearly 4% to 62.6p. Buybacks should help this mid-single digit sense of EPS where growth otherwise seems lacking, hence a trailing PE multiple just below 10 times.

Net finance costs up 169% to £7.0 million are odd considering net debt has reduced from £72 million to below £68 million. Another aspect impacting net profit was a hike in the tax charge from 18% to 26%.

The total dividend is up 4% to 38.2p, implying a trailing yield above 6% and assuming recent consensus for 39.3p in respect of the current financial year, then even after the market price jumped 8% yesterday the prospective yield of 6.4% is covered 1.8 times by expected earnings and possibly more like three times by free cash flow.

Merely on income consideration, PayPoint looks attractive at 610p to buy, yet helped by the buybacks, both EPS and its rating have scope to rise unless UK consumers reign back spending.

Sluggish revenue at four key divisions

Such is the “wall of worry” PayPoint shares have to climb.

Shopping related annual revenues are up 4% to near £65 million, although the next-biggest side - payments & banking - is down nearly 5% to £53.5 million, implying decline given the macro context has been reasonably supporting and shopping is up. As ever with a company’s growing digital operations, such growth is rapid – up nearly 62% - helped by a low base at £12 million.

The Love2shop business comes across as challenged in revenue terms also. Its Park Christmas Savings business saw billings up 1.2%, behind inflation, although Christmas 2024 has started up 5%. The Love2shop gift vouchers business saw weaker business in the second-half financial year, slipping over 4% - especially in employee rewards, as businesses turned cautious in the challenged macro situation. More positively, management cites “a strong pipeline of new business building into the current financial year” and MBL gift card technology operation saw 2023 revenue up 37% - hence an overall mixed than declining profile.

- Has Scottish Mortgage turned a corner? Analysts consider what’s next

- Brace your income for the self-assessment tax raid

Synergy is being achieved by way of supplying Love2shop gift cards to retailers on PayPoint’s shopping side, and Love2shop adding the likes of B&Q and Currys to its clientele.

In broad revenue terms, however, PayPoint remains exposed to the vagaries of discretionary consumer spending – hence its shares are liable always to be rated modestly for earnings while market pricing also exacts a useful yield as compensation for risks.

Prospects hinge on macro outlook

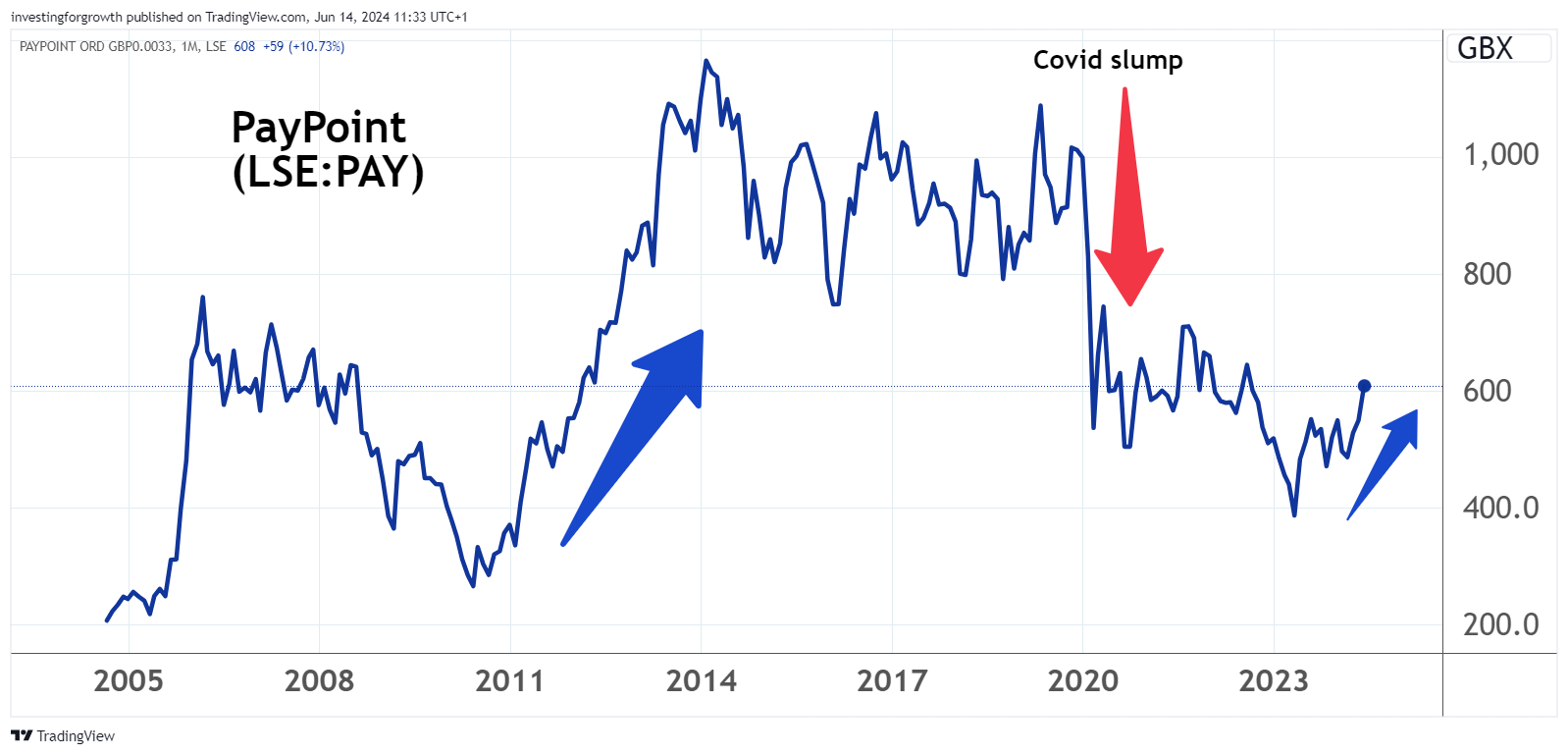

The chart below, especially the past five years, reflects what you would expect from the economic fundamentals - a big dent from Covid then a sideways-volatile trend amid a cost-of-living crisis hit due to inflation.

Effectively, a near double-digit rebound in the stock on these results is mean reversion to the level it has trended since the Covid hit, you must go back to 2011 to see the same.

This kind of volatile-sideways trend is similar to other classic yield stocks, even in different sectors – for example Legal & General Group (LSE:LGEN) – where overall shareholder return depends quite significantly on timing your entry well (or at least not badly).

I therefore find PayPoint a close call. A “hold” most certainly for income, and the stock should benefit from a material buyback programme.

I tilt to “buy” on grounds that a majority Labour government would preserve low to moderate income people’s spending power – putting the bulk of taxes on wealthier individuals – which should be supportive for the kind of purchasing behind PayPoint transactions.

Mind that if pollsters are wrong and anything like a hung parliament results in July, then fresh uncertainty would disrupt confidence generally.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.