Stockwatch: a major turning point for UK economy and stock market?

An old City adage tells investors to sell in May and buy again in September. That tactic is less relevant in modern times and couldn’t be more wrong so far this year. Analyst Edmond Jackson analyses the market and updates his tips on BT and Vodafone.

17th May 2024 11:19

by Edmond Jackson from interactive investor

“Sell in May” is being turned on its head by an outbreak of stock re-ratings, companies upgrading guidance and takeover bids.

Even Royal Mail may be on the cusp of being finally sorted out, with a possible offer for owner International Distributions Services (LSE:IDS) from a Czech billionaire.

In a long-term financial context, this is all pretty standard. The stock market anticipates economic recoveries as well as recessions, hence, over recent months various stock prices have risen. It started with financials - which do tend to move first - especially low valuation/high yield banks such as NatWest Group (LSE:NWG) and Barclays (LSE:BARC) when their numbers proved better than expected. This is now spreading to various consumer, cyclical and small-cap stocks.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

In the FTSE 100, there have been re-ratings such as Diploma (LSE:DPLM) (which I examined last Tuesday), BT Group (LSE:BT.A) with yesterday’s annual results and Anglo American (LSE:AAL) subject to a takeover bid

Some of these stock price jumps seem highly anticipatory: for example, Marshalls MSLH building products is up 23% to 315p since mid-April despite a 10% like-for-like revenue fall in the first four months, as the market anticipates a second-half-year recovery as interest rates fall.

Yet Ultimate Products (LSE:ULTP) in household items such as Salter scales, joined the party with a jump from 145p to 180p, retracing this after a 10 May update cautioned of a “broader slowdown in sales to consumers” with revenue down 7% over February to April. This small-cap did however affirm a sense of better times to come, saying the order book for the July 2025 financial year “is significantly ahead of the 2024 year as retailers increase forward orders as the overstocking issues brought about by the pandemic subside and consumer confidence builds as we see a return to real wage growth.”

That is a very good example of the dynamics involved, although you might question how with inflation possibly sticky above 3%, interest rates are going to fall usefully if wages are heading up. A similar dilemma applies in the US.

Watches of Switzerland capitalises on buoyant US

Yesterday, the mid-cap shares in luxury watch and jewellery retailer Watches of Switzerland Group (LSE:WOSG) jumped 20% to 405p in response to an update for the February to April quarter that cited sales 4% softer in the UK and Europe but 14% ahead in the US where “sales remained strong across all regions.”

I believe this affirms a point I made in a recent macro piece, about how soaring asset prices there (since the Federal Reserve hinted at lowering interest rates before inflation is licked to 2%) has meant quite a boom in leisure spending. Affluent people have splashed out on the luxury lifestyle.

US shares enjoyed another fillip last Wednesday after April’s US consumer price inflation came in slightly lower than expectations at 3.4%, a tad down on 3.5% in March. It affirmed the current sense for a “Goldilocks” scenario where inflation is neither too hot nor growth too cold, which should be bullish for stocks.

If you believe central banks now regard “3% as the new 2%” inflation target before they start cutting rates then, yes, now represents a key turning point and various stocks are justifiably soaring. We will just have to live with this level of inflation.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- 10 hottest ISA shares, funds and trusts: week ended 10 May 2024

- IPO alert: Boots, Shein and Raspberry Pi mull London float

Some US economists have still cautioned that the lag-effect of having raised rates can be so long it will not be until the second half of this year when a real economic slowdown will materialise (historic data suggests).

Obviously, you can go round in circles reading economic views and miss the action in equity markets.

Telecoms re-ratings underway

It is a moot point whether BT and Vodafone Group (LSE:VOD) soaring this last week in part reflects being caught up in exuberance – or has something fundamentally changed about the sector?

As with the banks two months ago, I believe the key trigger with both stocks is perception of radically improved cash flow translating into shareholder returns. Whether or not investors currently wear rose-tinted glasses, they now see BT’s circa 6% yield as generous versus the group's underlying risks. Vodafone will yield more like 5% due to re-basing the dividend yet disposals are enabling a buyback programme that should support the stock.

A circa 35% surge in BT from recent lows has caught out short-sellers who until this week had bet on fierce competition remaining in telecoms, and also high borrowings checking returns.

The new story on BT is quite speculative given it hinges on the CEO having proclaimed “a path to more than double our normalised free cash flow over the next five years.” In an equities bear market, no way would that command attention. Investors would await proof. The 2023 operating results show the business muddling along, and the latest dividend is being raised 4% to 8.0p per share despite net debt including leases at 1.1x annual revenue.

Source: TradingView. Past performance is not a guide to future performance.

Yet a 6% yield around 134p per share is perceived as supportive enough now expenditure for full fibre and 5G roll-out looks like it is peaking. Many investors sense that despite telecoms being highly competitive, a lot of people cannot be bothered with the hassle of switching. Instead, they remain in contracts rising annually at near 4% plus the inflation rate. Yes, I am one of them.

I have rated BT “buy” at 102p in October 2020 and 124p last November. It has been a volatile ride, albeit a 7.7p dividend since the March 2022 year provided a decent return. I retain a “buy” stance, although mind that the stock has just had a big surprise on the upside and shorts are cornered. It might pay in the short term to let this unwind and sentiment to settle down.

- Three tax breaks you can carry forward and three you can’t

- 10 mid-cap shares investors should own in 2024

Meanwhile, at Vodafone, a declared €500 million (£430 million) buyback programme has been initiated from 15 May in context of plans to buy back €2 billion worth over the next 12 months now that the sale of its Spanish subsidiary is raising over €4 billion. The stock immediately started to rise when this was announced after annual results to 31 March.

I asserted “buy” at around 67p last March after the chief financial officer bought heavily. Often this is a very good sign for a stock, and the CEO now asserts: “we are fundamentally transforming Vodafone for growth.” At 78p, I retain this stance, though like BT be aware of patience needed to see the results.

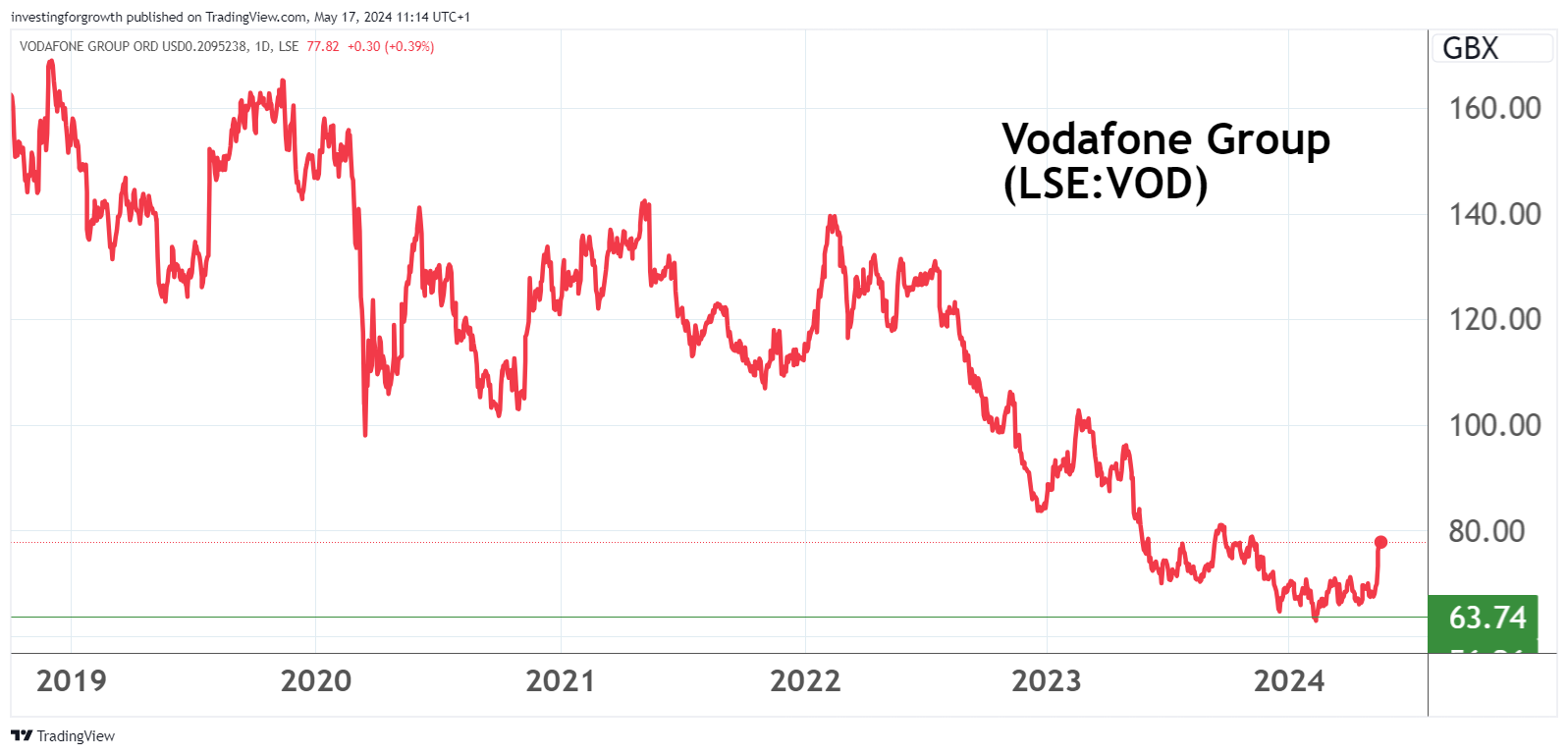

Vodafone’s latest chart pattern starts to look like a “reverse head and shoulders” signalling a major turning point.

Source: TradingView. Past performance is not a guide to future performance

Cyclical type stocks affirm improvement in business

Redde Northgate (LSE:REDD), a mid-cap vehicle provider whose stock has been on a tear since mid-February, is also worth a mention.

An update last Wednesday cited strong trading in the Spanish operation, helping full-year results to 30 April to the top end of expectations.

And Norcros (LSE:NXR), the bathrooms supplier whose stock is a terrific rollercoaster, is back rising also.

As a long-term follower of Norcros, this small-cap joining the action affirms to me a wider bull market.

How odd this is all happening in May.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.