These five American giants made $100bn profit: buy, hold or sell?

8th February 2023 10:01

by Rodney Hobson from interactive investor

Everyone will know this handful of famous names which are affected to a greater or lesser degree by oil prices. Each made big profits in 2022. Our overseas investing expert gives his view on each one.

Higher output, rising profits, more investment and bigger returns to shareholders from companies awash with cash. It all sounds wonderful for oil majors as they gain from the effects of the Russian invasion of Ukraine, but this year could be a lot tougher than the past 12 months, with wholesale oil and gas prices already tailing off.

Chevron Corp (NYSE:CVX) reported revenue up 17.3% to $56.5 billion in the three months to 31 December, while net profit rose 25.6% to $6.4 billion compared with the same quarter a year earlier. These rises, handsome as they are, do mark a slowdown though.

Across 2022, revenue was up more than 50% to $246 billion while net income more than doubled to a record $35.6 billion.

- Invest with ii: Trade US Stocks & Shares | US Earnings Season | Open a Trading Account

It was a similar story at Exxon Mobil Corp (NYSE:XOM), which saw revenue rise 12% to $95.4 billion in the quarter while net income soared 44% to just over $13 billion. However, that again marked a slowdown to end a remarkably good year in which net income more than doubled to $57.6 billion and revenue was up 45% to $413.7 billion.

Investors can enjoy the good times while they roll. Chevron raised its quarterly dividend by an easily affordable 6.3% to $1.51 and replaced its $25 billion share buyback programme with one totalling $75 billion, starting in April. This comes after the company doubled investments paid out of net cash to $12.1 billion during 2022 while still reducing debt, a good move given that interest rates are rising aggressively. Exxon lifted its fourth quarter dividend by 3.4% to 88 cents. It had already boosted its share buyback programme in December.

Investors should not worry too much about the political posturing of US President Joe Biden, who has demanded that extra cash should be poured into producing more oil and gas rather than rewarding shareholders. Chevron and Exxon are doing both.

In fact, Exxon produced record amounts of oil and gas last year thanks to extra output from the Permian Basin in Texas. The company increased US production by 3.7%, which more than offset a fall in production elsewhere. Americans should hardly be worried about that state of affairs.

- Stocks could be headed for a new bull market

- From global recession to global divergence

- Why oil prices could be heading lower again

The much-improved circumstances for oil companies is naturally reflected in their share prices, with Chevron trebling from $60 at the bottom in 2020 to $180 last November and Exxon scoring an even more spectacular gain from $33 to $113.

Source: interactive investor. Past performance is not a guide to future performance.

Chevron is just off its best at $174 where the price/earnings (PE) ratio is an undemanding 9.3 while the yield is attractive at 3.3%. Exxon stands at $115 with a PE of 8.4 and a slightly lower yield of 3.2%.

Source: interactive investor. Past performance is not a guide to future performance.

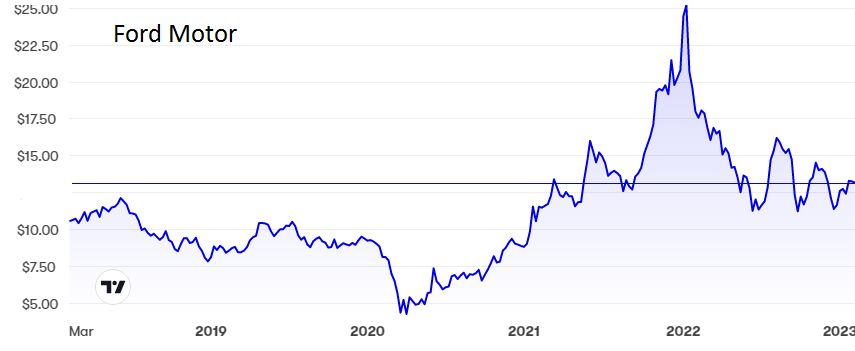

Higher fuel prices are naturally having an adverse impact at the other end of the chain, but US car manufacturers are not doing too badly in the circumstances despite continuing problems with supplies and shortages of workers. See Keith Bowman’s expert analysis of results from Ford Motor Co (NYSE:F)here.

Source: interactive investor. Past performance is not a guide to future performance.

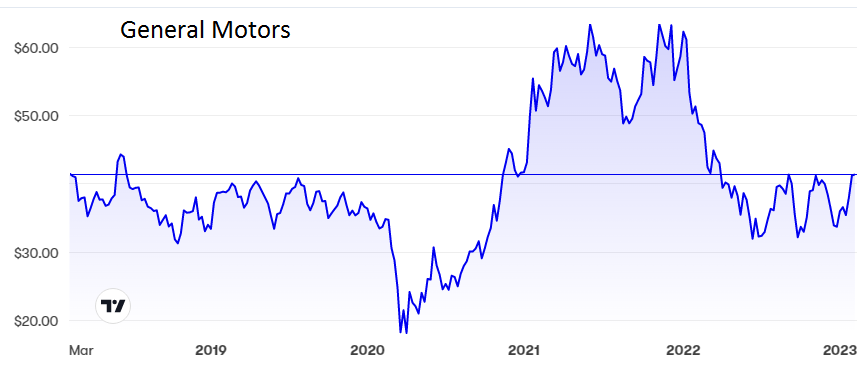

General Motors Co (NYSE:GM) reported higher revenue and profits in the fourth quarter after a mixed year. Revenue was up 28% to $43.1 billion and net income increased 15% to $2 billion. This was a great way to end a difficult year in which net income was down slightly over the full 12 months, despite a substantial rise in revenue as GM gained market share.

The company believes, with good reason, that momentum will carry over into 2023. Supply chain issues have eased, drivers who have put off replacing their vehicles will find a purchase more pressing, and the resilience of the USA economy will help commercial vehicle sales.

Source: interactive investor. Past performance is not a guide to future performance.

Greater acceptance of electric vehicles is another potential plus. GM has reached an agreement with Lithium Americas to mine lithium, an essential component of batteries, to support the annual production of 1 million electric vehicles.

GM shares have been below $20 and above $60 in the past three years and now sit around the middle of that range just above $40.

The PE at a mere 6.7 suggests that the market is far from convinced of better times to come, and that mood is compounded by a poor yield of 0.44%. The yield at Ford is 3.8%.

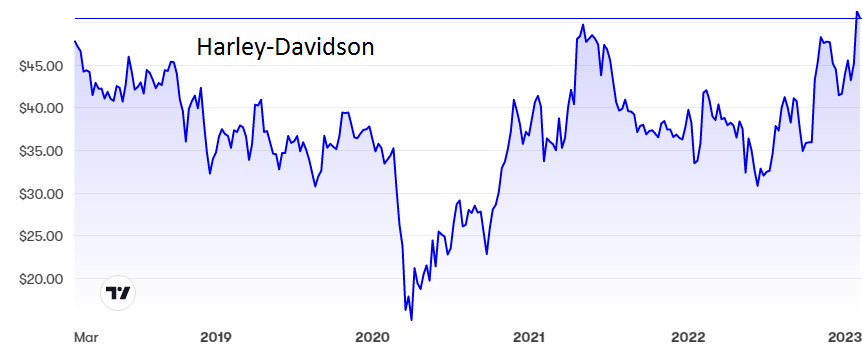

Harley-Davidson Inc (NYSE:HOG) is adored by motorcyclists and avoided by investors. Now could be a good time to be riding pillion. The strong brand name means that price rises have been passed on to customers, boosting revenue by 12% to $1.14 billion and net income by a whopping 94% to $42 million in the final quarter of 2022. Higher petrol and diesel prices have made two wheels more attractive.

The improved figures are reflected in a share price that has revved up from $30 to $50 and, although the PE is reasonable at 10.2, the yield is only 1.2%.

Source: interactive investor. Past performance is not a guide to future performance.

Going electric may be the fashion in car manufacturing but Harley seems to have pulled off a masterstroke by spinning out its electric division Livewire last year. Livewire saw sales fall 28% to $9 million while operating losses rose 45% to $29 million.

Hobson’s choice: I upgraded Chevron to ‘buy’ when the shares were below $140 and Exxon below $80 last February, and that rating still stands. Certainly, those who are already in should hold on. I believe both will return to their recent peaks but even if they do not, the quarterly dividends are worth having.

It is hard to choose between Ford and General Motors. The former has the better yield but the latter ended last year on a much more positive note. Both companies just about rate a ‘hold’, but GM looks marginally the better pick at the moment.

Well done if you bought Harley-Davidson when the shares were cheaper. They are still worth hanging on to, otherwise it could be best to see if a better buying opportunity comes along.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.