These four stocks are worth buying again

13th April 2022 10:58

by Rodney Hobson from interactive investor

Our overseas investing expert is already sitting on a big profit after backing these stocks post-pandemic, but they’re off their highs and looking attractive.

Sometimes memories are too short and investors rush into the same mistakes; sometimes memories are too long and investors are reluctant to accept that circumstances have changed and sectors that were poor investments in the past offer great opportunities now.

It is 15 years since the US housing market started to fall apart, leading to the financial crash in 2008, yet suspicions towards the sector still linger. The age of subprime mortgages and lending to homebuyers with no hope of repaying their mortgages is in the past. While the propensity for banks to make rash investments has not gone away, at present they are still recovering from the effects of the pandemic shutdowns. American housing is on firm footings and, although dividends in the sector tend to be ungenerous, there is scope for capital gains.

It was in fact housebuilding that drove spending in a buoyant construction sector last year thanks to surging demand from buyers encouraged by the resilience of the US economy.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Top 10 things you need to know about investing in the US

- How high could US interest rates really go?

Total spending on construction projects rose 1.6% year-on-year in January and, despite some cutbacks in the public sector, were still 0.5% ahead in February, indicating that the US economy continues to thrive. Again, housebuilding led the way with a 1.1% increase.

Admittedly, investors should not ignore warning signs that the housing sector is likely to slow down as this year progresses. The Federal Reserve Bank has made clear its intentions to raise interest rates aggressively from their unnaturally low level, which will inevitably make mortgages more expensive. The average cost of a 30-year mortgage is already creeping up towards 5% and will break that ceiling soon, possibly by the end of this month.

At the same time the impact of high levels of inflation will push up the prices of building materials and the cost of labour, which will squeeze the margins of house builders. Input prices in the construction sector were estimated to be nearly 25% higher in February than in the same month last year. It could well become harder to raise selling prices as more expensive borrowing chokes off demand.

The pandemic has helped to fuel the housing market by encouraging people in more crowded areas to seek the comparative safety of wide-open spaces. Significantly, the demand for family homes as opposed to apartment blocks has been notable throughout 2021. That pressure is already easing and will probably continue to do so.

- Why these two US-listed electric vehicle wannabes are a high-risk punt

- Q1 US earnings season preview: banks to set downbeat tone

However, the US housing market is underpinned by continuing high demand and a shortage of stock, with unsold existing homes equal to less than two months of current sales and new homes only enough to meet demand for about half a year. Wages are rising, which will give home seekers some confidence in buying what is, for most people, the biggest purchase they will ever make.

Even if the market does slow down, that does not justify the miserly ratings typically given to the sector at this stage, with price/earnings (PE) ratios in single figures and sometimes as low as 5.

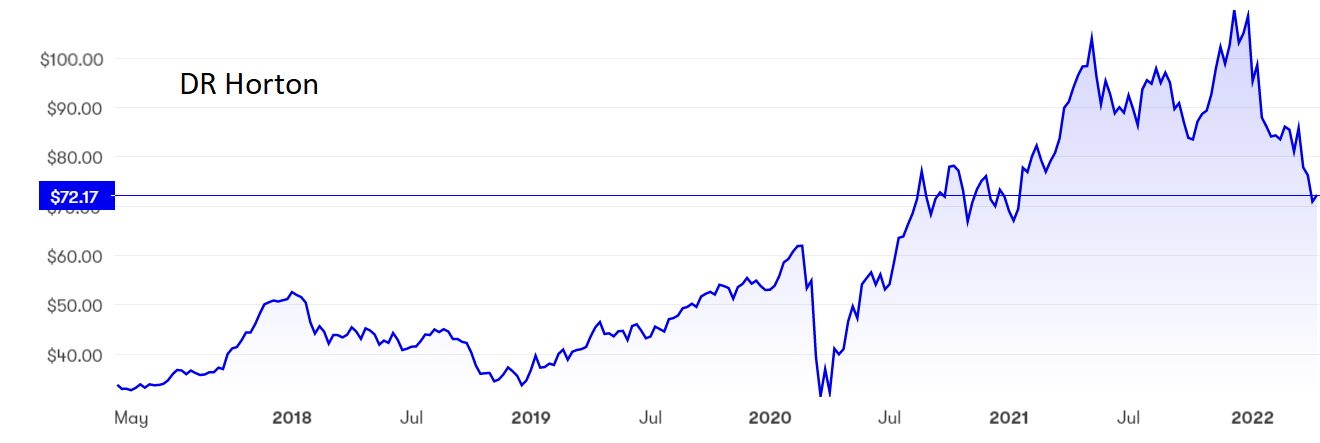

D.R. Horton (NYSE:DHI) is a leading house builder in the US and it has been a major beneficiary of the trend towards single-family homes, earning 90% of its revenue from a wide range of detached houses from first homes to the luxury end of the market. Yet it’s PE is only 5.8 and it does pay a dividend, although the yield is only 1.18%.

The shares, at $71.50, are down 10% over the past month and 20% over the past year, which seems quite enough of a correction from a high of $110 in December.

Source: interactive investor. Past performance is not a guide to future performance.

Another large US house builder Taylor Morrison Home (NYSE:TMHC) also has a good mix of developments. Yet the shares, at $26.50, are stagnating at the level they reached four years ago and strong growth in earnings per share over the past few years has pushed the PE ratio down to 5.1%. There is no dividend, so the possibility of capital gains is particularly important.

Source: interactive investor. Past performance is not a guide to future performance.

KB Home (NYSE:KBH) stands at $32, well below recent peaks, to give a PE of only 4.9% and Lennar (NYSE:LEN) has also slipped back to a rating of 6 times earnings with the shares at $76.70. The yields are 1.9% and 1.5% respectively.

Source: interactive investor. Past performance is not a guide to future performance.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s Choice: I tipped all four as buys in April 2020, just after the Covid-19 crash, and all are still well ahead of their levels two years ago. Recent dips have provided another buying opportunity.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.