These funds are the last to sell and first to buy

As he redeploys his cash pile, Saltydog analyst is buying funds that have served him well in the past.

11th May 2020 14:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As he redeploys his cash pile, Saltydog analyst is buying funds that have served him well in the past.

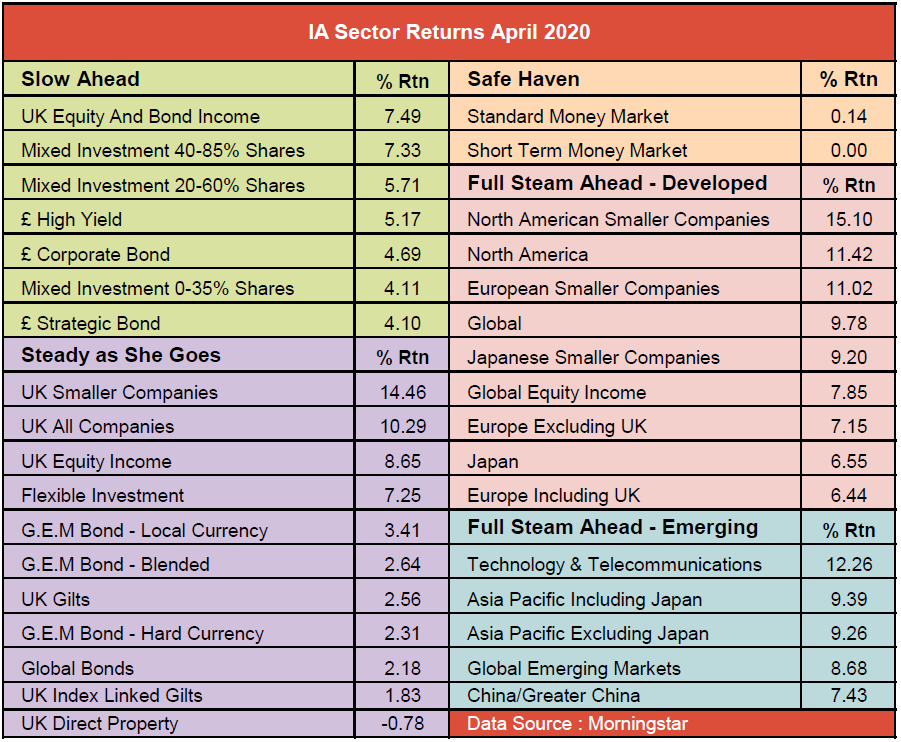

Investment Association sectors bounce back in April

After the first three months of the year, most of the Investment Association sectors were showing losses. The exceptions were the two ‘Money Market’ sectors, ‘UK Gilts’, and ‘UK Index-Linked Gilts’.

The UK equity sectors were hit particularly hard. ‘UK All Companies’ and ‘UK Equity Income’ had both dropped by 28% since the beginning of the year, and ‘UK Smaller Companies’ was down over 30%.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

The European sectors had fallen by around 20%. The ‘North American’, ‘Global’ and ‘Japan’ sectors had done better, but were still down about 15%.

The ‘Technology & Telecommunications’ and ‘China & Greater China’ sectors had weathered the storm better than most and were down less than 7%.

In April, there was a strong rally and nearly all sectors made gains. Only the ‘UK Direct Property’ sector was showing a loss, down 0.8%.

At Saltydog Investor we review the performance of the most readily available UK domiciled Unit Trusts and OEICs on a regular basis.

We split them into their Investment Association sectors, so that we can track the individual sector performance, and then combine them to form our own proprietary Saltydog Groups.

The Saltydog Groups are:

Safe Haven

These are the least volatile funds and can be found in the two money market sectors. The returns are dependent on bank interest rates and so have been low for many years. In 2019, the sector returns were 0.7% for the Standard Money Market and 0.6% for the Short Term Money Market. In April the Standard Money Market went up 0.14% while the Short-Term Money Market was flat.

Slow Ahead

This Group is made up of sectors that either invest in bonds, or a combination of bonds and equities. They can go down, as well as up, but tend to be less volatile than the funds which focus just on equities. The leading sectors last month, ‘UK Equity & Bond Income’ and ‘Mixed Investment 40-85% Shares’, both went up by over 7%.

Steady as She Goes

The sectors in this Group have been more volatile in the past, but not as volatile as sectors in the ‘Full Steam Ahead’ Groups.

The sectors that had gone down the most in the first quarter of the year, had the strongest recovery in April. ‘UK Smaller Companies’ was at the top of the group having gone up 14% during the month.

Full Steam Ahead

These are the most volatile sectors which we split into two groups, Developed Markets and Emerging Markets.

Four sectors from these groups made double-digit gains in April. ‘European Smaller Companies’ and ‘North America’ were up 11%, ‘Technology & Telecommunications’ made 12%, and ‘North American Smaller Companies’ beat them all, gaining 15%.

Portfolio Update

In our demonstration portfolios we usually hold a mix of funds from each of the Groups.

At the end of February, we started heading for safety and in early March took the decision to go almost 100% cash. During April we started to reinvest and are currently holding funds from the ‘Mixed Investment 40-85% Shares’, ‘£ High Yield’, ‘UK Smaller Companies’, ‘UK All Companies’, ‘North America’, ‘Technology & Telecommunications’, and ‘Specialist’ sectors.

The last funds that we sold were from the ‘Mixed Investment 40-85% Shares’ sector and these were the first ones that we went back into. In 2019, the Royal London Sustainable World fund went up 30%, and the Janus Henderson Global Responsible Managed and Liontrust Sustainable Future Managed funds both went up by 25%.

At the beginning of April, we went back into the Royal London Sustainable World fund and soon added the Janus Henderson Global Responsible Managed fund. We have been happy with their progress so far.

Last week we invested in the Liontrust Sustainable Future Managed fund.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.