Three stocks I wouldn’t sell

This group of companies have been excellent tips for overseas investing expert Rodney Hobson and he’s not about to give up on them now.

28th February 2024 08:54

by Rodney Hobson from interactive investor

America’s retail market is more than ten times the size of the UK’s and there are some big beasts selling a wide spread of goods in the mix. Big is, though, not necessarily better for investors looking to buy into the sector.

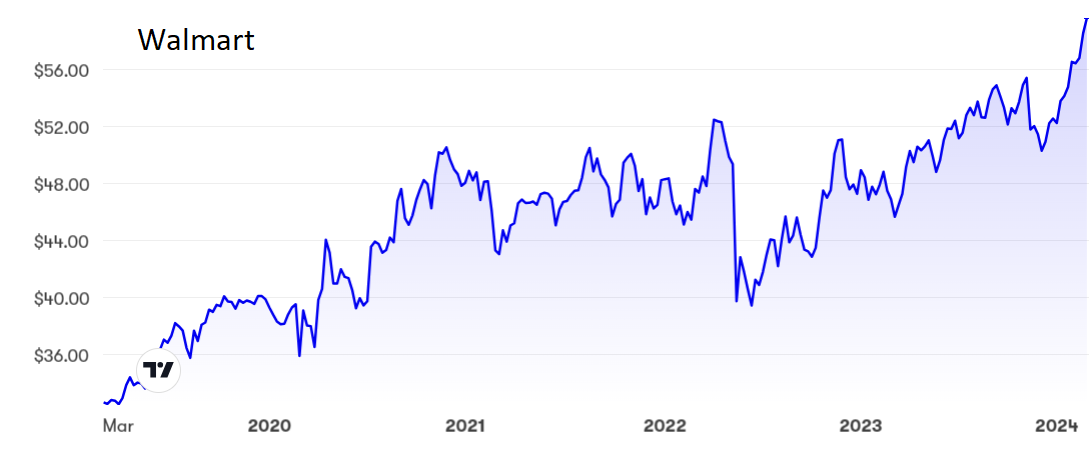

There is admittedly no disputing that Walmart Inc (NYSE:WMT), the biggest of all with total annual revenue at $650 billion, is a star. This one US retailer is as big as the entire UK retail sector. Walmart is one of many retailers in North America and Europe to discover the hard way that what works in retailing on one side of the Atlantic does not transfer readily to the other side. Walmart has now got out of Europe, including selling Asda, and will be all the better for that strategic retreat going forward.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The fourth quarter to 31 January saw revenue rise 5.7% year on year to $173.4 billion, better than experts had expected, but rather disappointingly net income fell 2.3% to $5.7 billion thanks to a sharp fall in one-off gains. ii’s Graeme Evans provided a full expert analysis of Walmart’s latest figures.

The problem with Walmart is that despite a boost in sales during the pandemic, profits have improved little in more than a decade, and increases in earnings per share have come mainly from share buybacks. Although dividends have increased, the share price has almost doubled over the past five years to around $60, so the yield is only 1.28% while the price/earnings (PE) ratio is a chunky 31.

Source: interactive investor. Past performance is not a guide to future performance.

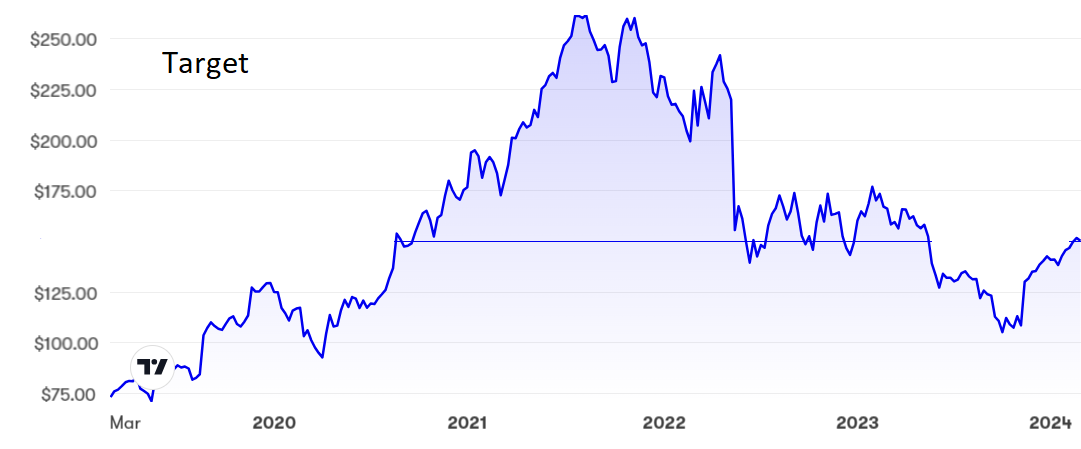

Much smaller rival Target Corp (NYSE:TGT) reports its figures next week and could provide a pleasant surprise after a disastrous two years in which it overexpanded and made an ill-fated move upmarket. Its attempt to expand in city centres did not work out well either.

Target’s fortunes turned for the better last year and, although investors have to trust that management has learned from its earlier mistakes, the shares have recovered strongly from $107 in November to over $150 now.

The PE is less demanding at 19 and the dividend more attractive at 2.9%.

Source: interactive investor. Past performance is not a guide to future performance.

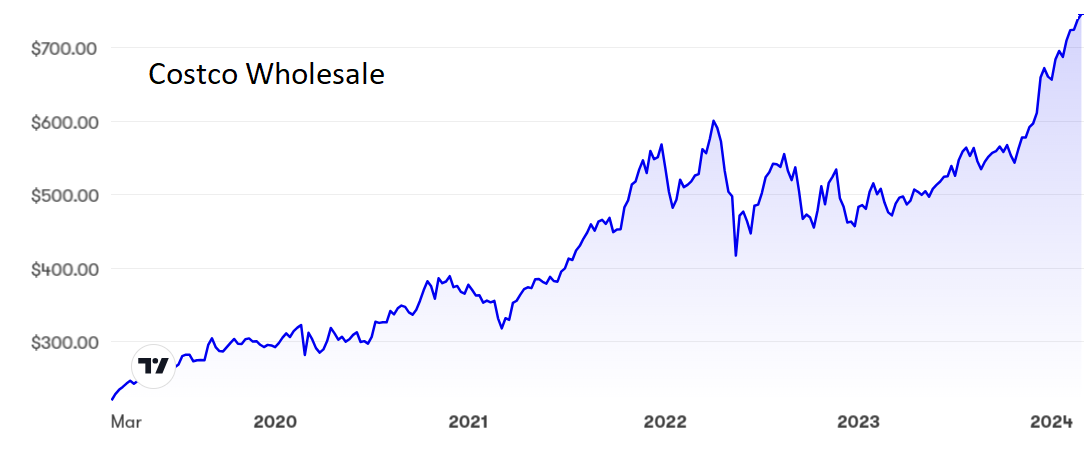

Costco Wholesale Corp (NASDAQ:COST) is a retailer pretending to be a wholesaler. Its 129 million members pay an annual fee and Costco bulk buys on their behalf. With membership growing strongly since the start of the pandemic, it has developed a happy knack of beating analysts’ estimates and the latest quarter to the end of January could continue that trend.

It had a good Christmas, with sales in the five weeks ending 31 December up 9.9%, although admittedly there was a 3% boost from the period having an extra trading day. Sales should continue to grow as free cash is ploughed into expanding the business.

- How to buy the right stocks when markets are high

- 10 hottest ISA shares, funds and trusts: week ended 23 February 2024

The shares have more than trebled in the past five years to stand at $744, a full reflection of the success of a business that has doubled sales and quadrupled profits in the past decade. However, the PE is 50 while the yield is only 0.55%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I first recommended Target shares at $86.50 and again in December last year at around $140. It would be risky to buy ahead of results but those who bought on my recommendation should hold on. There is unlikely to be a disaster about to unfold.

I have previously rated Walmart a buy but expressed some caution that, in the event, was overstated. Hold for now or look to buy if the shares slip back below $57.

I first drew attention to Costco in October 2022, saying buy below $480, and urged shareholders to hang on in December at $680. The shares are so expensive that it is hard to make out a case for buying now, but there is surely no reason to sell while the good times roll. I just worry that there could be a sharp correction at some point.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.