Tide about to turn for shares in this global powerhouse

We all either use or know well some of this company’s famous brands, and a shock downturn has left the stock looking good value, believes analyst Rodney Hobson who thinks the bottom has been reached.

11th September 2024 08:21

by Rodney Hobson from interactive investor

Life has been really tough for Nestle SA (SIX:NESN) since the end of 2021 but there are hopes that a new chief executive will turn the Swiss food giant round. This is admittedly taking a lot on trust, but the long slide in the share price could at last signal a buying opportunity.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

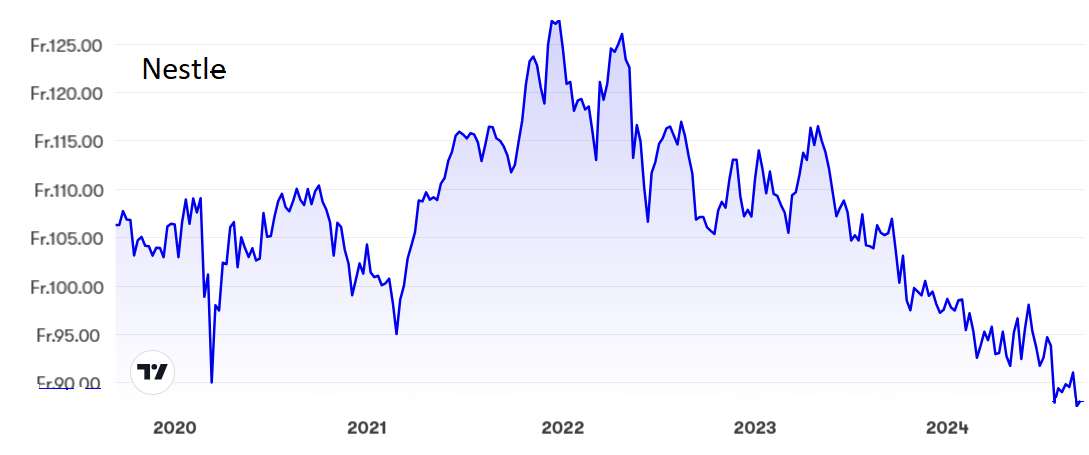

Nestle announced towards the end of August that chief executive Mark Schneider would be stepping down. In little over a week he had been replaced, so there is no doubt that he was ousted with hardly a thank you for his eight years at the helm. His fellow directors had clearly had enough after seeing the share price slump by more than 30% from a peak of SFr127 (£115) to below SFr90, so they decided not to wait until his replacement can be approved by shareholders at the AGM next April.

Source: interactive investor. Past performance is not a guide to future performance.

That replacement is Laurent Freixe, an insider who at least guarantees some degree of continuity and stability rather than disruption at a critical junction. Freixe joined Nestle’s French arm nearly 40 years ago and served as head of the Europe zone for six years before taking over in the Americas. After the zones were restructured, he became chief operating officer for Latin America. He probably knows more about Nestle than anyone else. In contrast, Schneider had been the first outsider in nearly 100 years.

The clock started ticking a month before Schneider was ousted when Nestle lowered its guidance for 2024 after reporting disappointing sales and profits for the first half. Profits were stagnant at SFr5.78 billion while sales slipped 2.7% to SFr45.05 billion. Prices had come under pressure despite the group having a range of iconic brands such as KitKat chocolate, Purina pet foods and the coffee that bears the company’s name.

Nestle has in the past been able to push through price increases to drive growth in the top line. For much of this year it has been relying on promotions that may well continue for the foreseeable future.

The group lowered its guidance for full-year organic sales growth, although it still expects to achieve 3% after a modest improvement in the second quarter. This is the second downgrade this year.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Stockwatch: time to worry over Warren Buffett’s rapid sales?

- What the Wall Street cheat sheet says about stocks now

At least Freixe will be able to put some recent misfortunes behind him. The disastrous 2020 acquisition of peanut allergy drug maker Palforzia, a doubtful fit from the start, was sold last year after incurring a $2.1 billion impairment charge. There was a water purification scandal in France, while disruption to the IT system in the health science business caused supply shortages for several months.

The hope now is that a shock downturn in the first quarter has already been reversed. That is far from guaranteed. The United States is Nestle’s biggest market and some major competitors there are reporting that less well-off consumers are starting to struggle.

The price/earnings ratio is 20, not excessive for a company of this quality and lower than it has been in recent years. The yield is quite attractive at 3.4%. The dividend was raised again last year and if that is repeated, as is likely, that will make 30 years of rising payouts.

Hobson’s choice: With sales spread across nearly 200 countries,this is a company selling some of the best brands in the world across one of the widest geographic spreads. I gave a cautious buy recommendation at SFr95 in March but now feel even more confident that the bottom has been reached and that the tide will turn. Catching falling knives is a dangerous game but now is surely time to grasp the handle rather than the blade.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.