A solid, low-risk investment to hold for the long term

This company is one of the world’s biggest and certainly the largest of its kind. While it might not be shooting the lights out currently, overseas investing expert Rodney Hobson thinks it’s one to buy.

27th March 2024 08:42

by Rodney Hobson from interactive investor

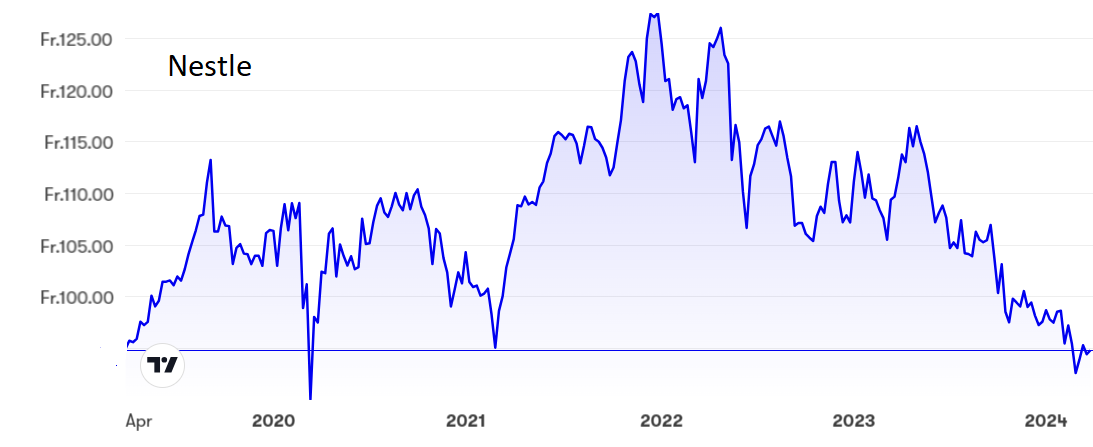

The price consumers are prepared to pay for coffee defies gravity. Unfortunately the same cannot be said for shares in Nespresso owner Nestle SA (SIX:NESN), which have dropped back to the level they were at five years ago. The fall since the end of 2021 is beginning to look a bit overdone.

Swiss-based Nestle is the world’s largest food company with iconic brands including Nescafe, Perrier. KitKat and Purina selling in nearly 190 countries. Its wide spread of products and markets offer stability of earnings and profits.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Its latest wheeze is to venture into the expanding world of coffee shops, leveraging its high-profile Nespresso coffee capsules brand made familiar to the public by film star George Clooney and former soccer international David Beckham.

Now the move is out of machines for the home into Nespresso coffee bars, starting near the busy Liverpool Street railway station in London. If successful, this could be the start of a Europe-wide chain. Given the prices charged by Costa Coffee and Starbucks, this could be a real money spinner.

On the negative side, Nestle has come under growing attacks to reduce the number of its products with high levels of salt, sugar and fats as shareholder activists demand an improvement in the health rating of the group’s range. Activists claim that less than half the products have a sufficiently high health rating. Coffee is one of the targets.

Meanwhile, it is inflation rather than health targets that is holding Nestle back. Sales fell 1.5% to 93 billion Swiss francs (SFr), or £81.5 billion last year as price increases averaging 7.5% took their toll on consumers, who presumably need to preserve cash to pay for overpriced coffee. There was also some disruption to supplies of vitamins, minerals and supplements.

Net profits did improve by a superficially impressive 21% to SFr11.2 billion but that was still well below the near SFr17 billion earned in 2021.

- US shares to put in your ISA in 2024

- How to build a £1 million pension and ISA portfolio

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Perhaps it is indicative of consumer spending choices that pet care is the fastest growing part of the business, followed by infant formula foods. We also seem to be eating more chocolate, perhaps as a comfort food as we struggle to cope with inflation.

The shares peaked at SFr127 on Christmas Eve some 30 months ago but have been on a downward trajectory since then. At SFr95 the price/earnings ratio is a little on the high side but not too demanding at 22, while the yield is a decent 3.1%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: The fundamentals are not overwhelming but this is a good investment for anyone wanting a solid, low-risk investment to hold for the long term. Buy.

Update: All too often the directors who preside over disaster walk away unscathed, leaving the shareholders to pick up the pieces, but heads have rightly rolled at aerospace group Boeing Co (NYSE:BA).

Boing! Chief operating officer Stan Deal goes immediately. Boing! Chief executive Dave Calhoun, who was brought in to rescue Boeing’s reputation after two crashes, will resign at the end of this year. Boing! Chairman Larry Kellner will not stand for re-election at the next AGM. Good luck to their successors.

- Nvidia stock tipped to smash through $1,000 barrier

- 10 hottest ISA shares, funds and trusts: week ended 22 March 2024

The shares fell only 2%, or $4, in the immediate aftermath of news of the high-level clearout, perhaps because they had already fallen from $280 in December to around $190 now. There does seem to be a solid floor at $180 but I would not bank on it holding, especially if the new leaders throw the kitchen sink out through the boltless doorway.

I rated Boeing a sell in mid-February when the shares were $204. At that stage there looked to be a floor at $200. All the same arguments apply now at a slightly lower level.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.